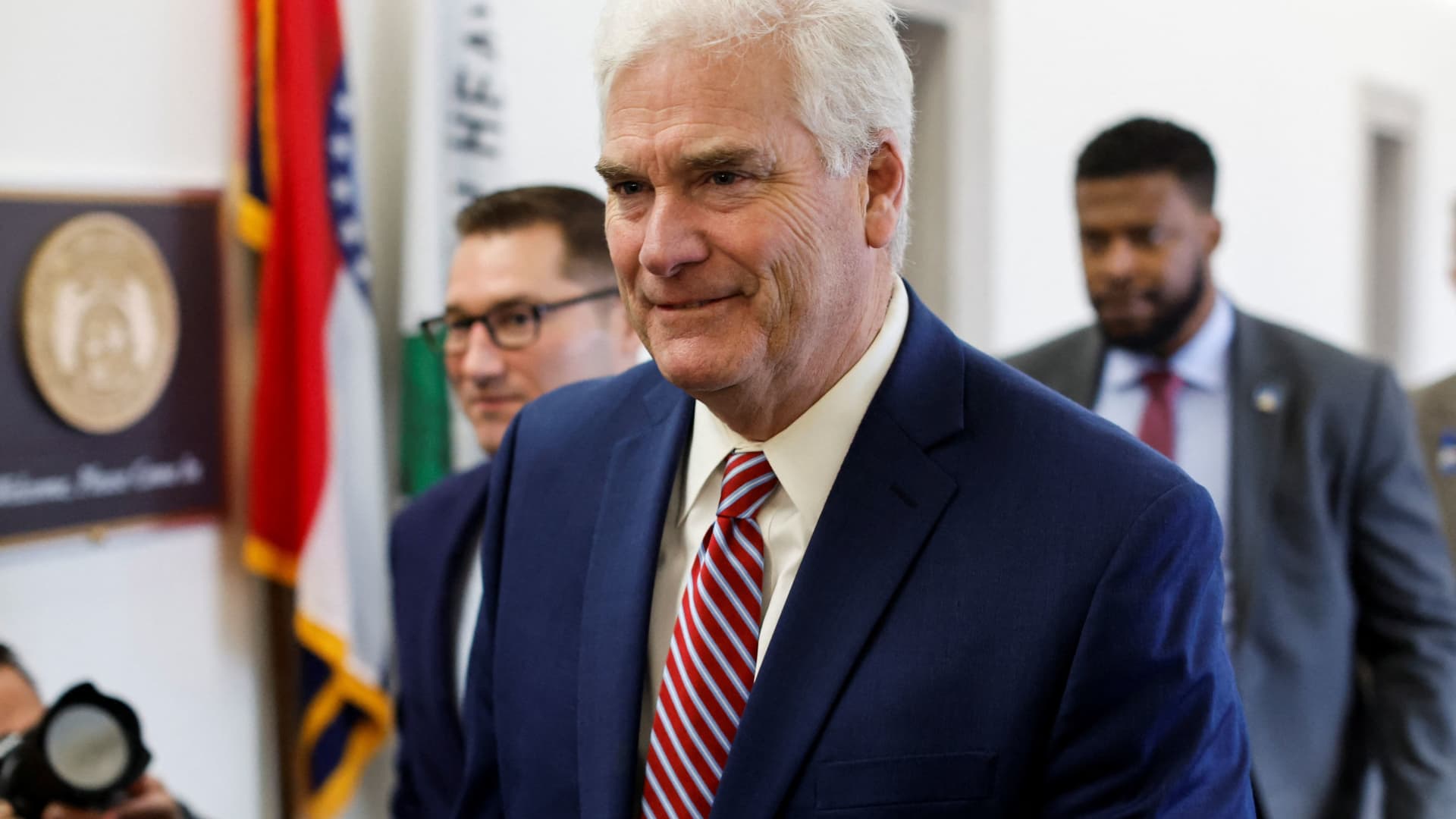

Steve Huffman, co-founder and CEO of Reddit, speaks during WSJ Tech Live conference hosted by the Wall Street Journal at the Montage Laguna Beach in Laguna Beach, California, on October 21, 2024.

Frederic J. Brown | Afp | Getty Images

Reddit shares fell more than 15% on Wednesday after the company reported weaker-than-expected user numbers in its fourth-quarter earnings.

Here’s how the company did compared with LSEG estimates:

- Earnings per share: 36 cents vs. 25 cents expected

- Revenue: $428 million vs. $405 million expected

Global daily active uniques, or DAUq, rose 39% from a year earlier to an average of 101.7 million for the fourth quarter. That trailed Wall Street estimates of 103.1 million.

A Google search algorithm change caused some “volatility” with user growth in fourth quarter, but the company’s search-related traffic has since recovered in the first quarter, Reddit CEO Steve Huffman said in a letter to shareholders.

“What happened wasn’t unusual — referrals from search fluctuate from time to time, and they primarily affect logged-out users,” Huffman wrote. “Our teams have navigated numerous algorithm updates and did an excellent job adapting to these latest changes effectively.”

Reddit has benefited from Google search updates and internal site improvements that have helped it gain a significant amount of new and returning users, which the social company refers to as logged-out users, over the past year and a half. Reddit has said it is working to convince logged-out users to create accounts as logged-in users, which are more lucrative for its business.

Global logged-in DAUq grew 27% year over year to 46.1 million in the quarter while global logged-out DAUq rose 51% to 55.6 million, the company said.

Despite missing on user number, the company otherwise reported a strong quarter and provided optimistic guidance.

Reddit’s sales jumped 71% in the quarter from $250 million a year earlier, the fastest rate of growth for any quarter since 2022.

The company said first-quarter sales will be between $360 million to $370 million, ahead of the average analyst estimate of $358 million.

Net income almost quadrupled to $71 million or 36 cents a share, from $18.5 million, or breakeven on a per-share basis, a year earlier. Reddit reported adjusted earnings of $154 million in the fourth quarter, topping analysts’ expectations of $128 million.

Reddit’s fourth-quarter earnings followed several other online advertising tech companies that recently reported their latest quarterly earnings.

Last week, Amazon reported fourth-quarter earnings, saying its online advertising business recorded $17.29 billion, up 18% from a year ago. In its fourth-quarter earnings, Pinterest said its sales in the period rose 18% year over year to $1.15 billion.

Also last week, Alphabet said its Google advertising sales grew 11% from a year prior to $72.46 billion while YouTube ad revenue jumped 14% to $10.47 billion in the fourth quarter. Snap, meanwhile, reported fourth-quarter revenue growth of 14% year over year to $1.56 billion.

In late January, Meta said its revenue for the fourth quarter came in at $48.39 billion, up 21% from the previous year. Microsoft also reported that its news advertising sales increased 21% year over year in its latest quarterly earnings. Microsoft does not disclose that unit’s specific quarterly sales figures.

Watch: I’d buy Amazon over Meta, says Hightower’s Stephanie Link