CSX coach at Seagirt Maritime Terminal, Port of Baltimore.

Baltimore Sunshine | Tribune News Services | Getty Photos

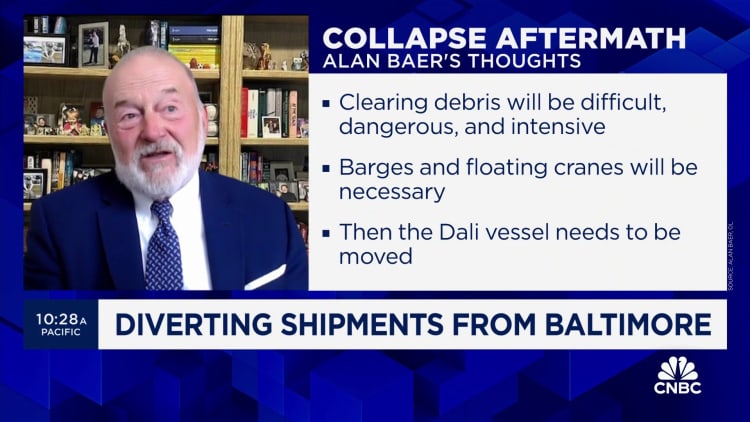

CSX is beginning a new dedicated freight rail provider among Baltimore and New York for its clientele on Tuesday to help mitigate the trade disruption as a outcome of the closure of the Port of Baltimore after the cargo vessel Dali collided with the Francis Scott Crucial Bridge leading to its collapse on March 26.

Baltimore-bound rail freight which was diverted to the Port of New York and New Jersey will use this new CSX assistance, the freight railroad tells CNBC. Freight destined for the Port of Baltimore as exports will also use this new services to get to the Port of New York. The sum of freight getting moved on the new line is not staying disclosed for now, a CSX spokeswoman stated. CSX is currently in an earnings silent time period.

The railroad defined in an email to CNBC that strategic partnerships with steamship lines allow it to transport freight in between New York and Baltimore, using its founded global product sales community.

The new company “will assist to deal with the targeted traffic circulation that would typically transit by way of the Port of Baltimore,” the CSX spokeswoman stated in a assertion to CNBC, though she pressured that the condition at the port is fluid. “While the timeline for resuming freight operations at the Port of Baltimore continues to be uncertain, we are in continuous communication with our consumers, providing well timed updates on the standing of their shipments. CSX is absolutely focused to conference our customers’ transportation demands all through this tough period.”

MSC, the world’s largest ocean provider, explained to transport clients past week “passage to and from Baltimore is at this time unachievable and will not be reestablished for many months if not months.”

Various major ocean carriers have informed their shipping clientele that when cargo reaches diversion ports, it will be the obligation of the specific consumers to make transportation preparations.

In addition to rail support for the Baltimore freight that is remaining diverted on recent vessels and now likely to the Port of New York/ New Jersey, there are 10 vessels not counting the Dali that are stuck at the Port of Baltimore — like three bulk carriers, a person car provider, three logistics naval vessels, two typical cargo ships and 1 oil chemical tanker — which may possibly eventually have to have choice freight options, which includes rail.

“The system is changing now and it is signaling it will last a although,” claimed Aaron Roth, retired Coast Guard captain and Chertoff Team principal. “The magnitude of the event is however staying assessed.”