WASHINGTON — A former White Home economist on Tuesday said he thinks the Federal Reserve will hike desire costs yet again amid rising inflation quantities and electricity rates.

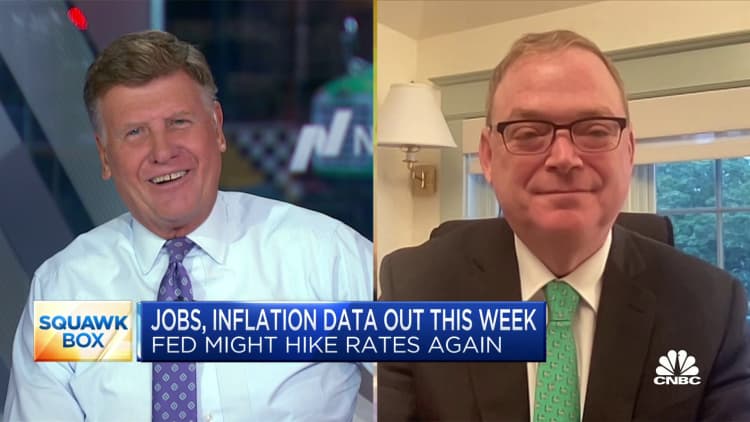

“The hiking is coming yet again,” Kevin Hassett, former chairman of the Council of Economic Advisers underneath then-President Donald Trump, informed CNBC’s “Squawk Box.”

“The inflation numbers are heading to shock on the upside because gasoline charges have absent up so much and … we are wanting probably for a best-line (buyer rate index) of .8 or so,” he included.

Hassett was referencing headline inflation, a measure of the full inflation inside the financial state which include commodities like foodstuff and energy. The CPI rose .2% for the month in July and 3.2% in contrast to the yr prior. Although the once-a-year fee of headline inflation arrived in down below anticipations, it marked an improve from 3% in June, according to the U.S. Bureau of Labor Data.

Fed Chair Jerome Powell warned previous 7 days that curiosity costs could be raised all over again to decrease inflation again to its 2% goal. The Fed’s Federal Open Marketplace Committee has raised curiosity fees 11 instances because March 2022.

“We’re going to see variety of a sawtooth inflation cycle,” Hassett claimed. “It is likely to be sort of like the Covid waves the place it feels like Covid’s below regulate and then you can find a new range.”