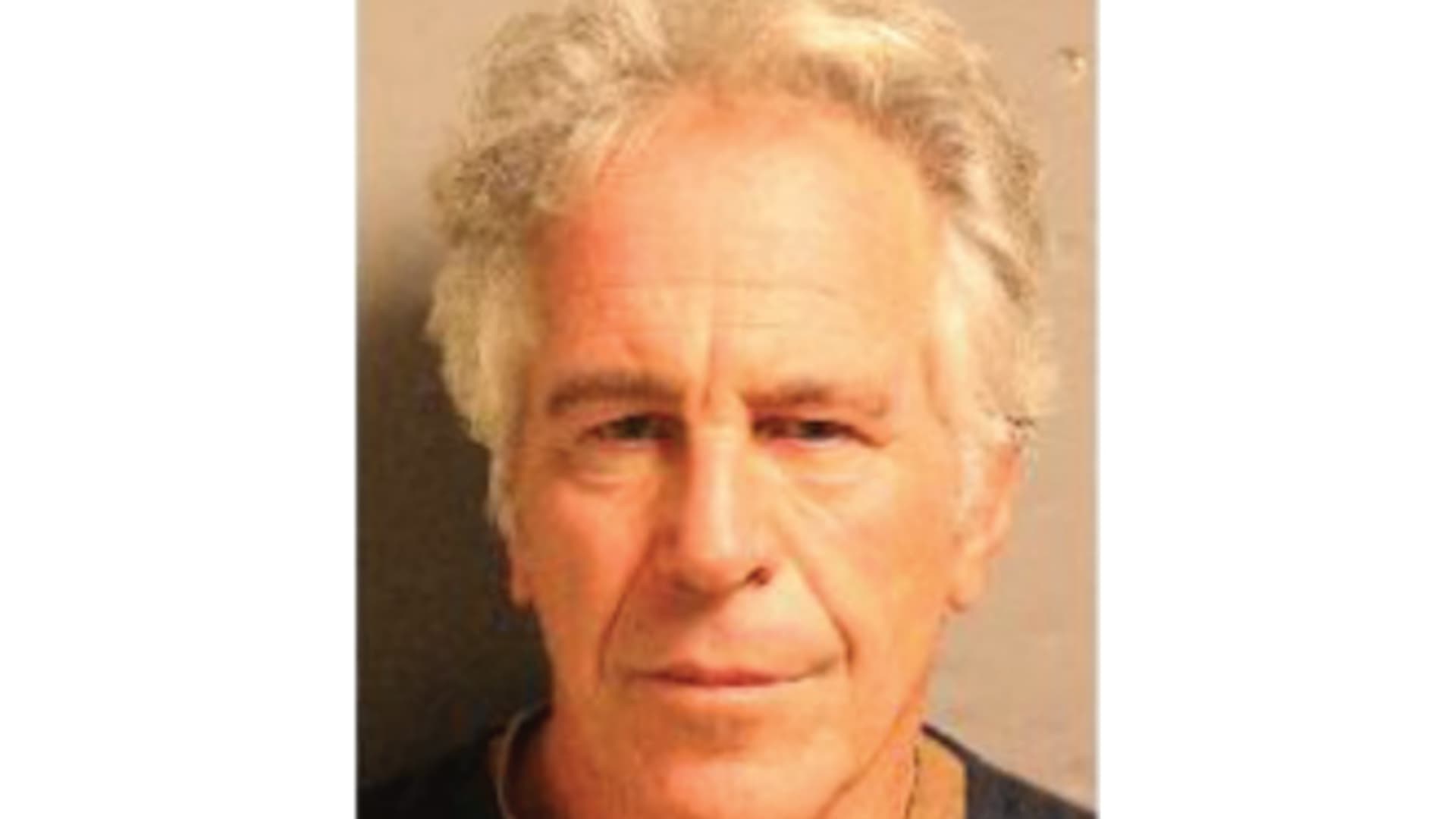

British Primary Minister Liz Truss announces her resignation, outside the house Quantity 10 Downing Street, London, Britain October 20, 2022.

Henry Nicholls | Reuters

LONDON — Previous U.K. Primary Minister Liz Truss is blaming a “effective financial establishment” for bringing her chaotic 44-working day tenure to an conclude final year.

Truss resigned in Oct, getting to be the shortest-serving key minister in British historical past, following her radical tax-slicing funds roiled economic marketplaces, sank the pound, took British pension strategies to the brink of collapse and led to a revolt in her own Conservative Bash.

In a 4,000-word essay published by the Sunday Telegraph, Truss argued that she was hardly ever supplied a “real looking possibility” to implement the £45 billion ($54 billion) tax-chopping agenda she and Finance Minister Kwasi Kwarteng set ahead.

In her very first public remarks since leaving office environment, Truss stood by her financial policies, proclaiming they would have enhanced growth and brought down community debt more than time, and blamed the two the country’s financial establishments and her possess occasion for her downfall.

“I am not proclaiming to be blameless in what took place, but essentially I was not given a realistic likelihood to enact my insurance policies by a pretty effective economic institution, coupled with a lack of political guidance,” she wrote.

She included that she experienced assumed her “mandate would be respected and acknowledged” and had “underestimated the extent” of resistance to her economic method.

Truss was elected leader of the Conservative Social gathering in September, defeating her eventual successor Rishi Sunak, soon after garnering 81,326 votes from party users following the ousting of Boris Johnson. The U.K. inhabitants exceeds 67 million.

“Massive sections of the media and the broader general public sphere experienced become unfamiliar with key arguments about tax and financial coverage and around time sentiment had shifted leftward,” she added.

Present Small business Secretary Grant Shapps, previously Home Secretary underneath Truss, told the BBC on Sunday that Truss’ solution “evidently was not the right one particular,” but gave credit history to her more time-term eyesight.

“I consider she makes a properly valid level that somebody has of course acquired to be agitating for and generating the great arguments for the explanations why a lower tax financial state in the long run can be a extremely productive financial system,” Shapps included.

Specter of ‘Trussonomics’

All through her leadership campaign previous summer time, Truss took goal at the Bank of England, promising radical reform of a central financial institution she alleged was failing in its mandate to control inflation, and threatening to critique its remit.

She also railed in opposition to what she dubbed “Treasury orthodoxy,” in specific projections that substantial unfunded tax cuts could exacerbate inflation and compress advancement in the lengthy run.

Upon getting business office and with a expense-of-residing disaster escalating, Truss immediately sacked the most senior civil servant in the Treasury, Tom Scholar.

As the Bank of England tried to overcome spiraling inflation by increasing fascination costs and introducing quantitative tightening in get to gradual the overall economy, Truss and Kwarteng’s fiscal ideas set out to spur growth by reducing taxes for the wealthiest parts of culture and jumpstarting expending. The governing administration and the central bank ended up effectively performing versus one a different.

Truss also broke from custom by slicing the impartial Business for Spending budget Obligation, which generally publishes economic forecasts on the probably impact of government policy along with price range statements, out of the course of action.

The economic markets, in particular the bond sector, recoiled on the announcements of big scale unfunded tax cuts with no obvious effect assessment, sending mortgage loan premiums skywards and forcing the Lender of England to intervene to protect against a collapse of several British pension funds.

Michael Saunders, a previous member of the Bank of England’s Monetary Plan Committee, instructed CNBC on Monday that Truss was brought down since the economical marketplaces did not deem her procedures credible, and this was “almost fully her own fault.”

“The concept that there is a kind of still left-wing establishment made up of everyone in Liz Truss’ universe — marketplaces, central financial institution, OBR, every person else — that is just not an plan to consider significantly,” he reported.

“She went out of her way to undermine her have believability, sacking Tom Scholar, disparaging opinions about the Financial institution of England, getting the OBR out of the forecast approach. She was performing as if winning a bulk of the Conservative Occasion membership gave her financial trustworthiness, and it most plainly would not.”

Recent Key Minister Rishi Sunak’s govt vowed to restore this credibility on having around in Oct, and swiftly reversed Truss’ overall financial agenda.

In November, Finance Minister Jeremy Hunt introduced a £55 billion program of tax rises and spending cuts as he seemed to plug a considerable gap in the country’s community funds.

However, Truss retains the guidance of a range of Conservative members of Parliament, such as superior-profile backbenchers this kind of as Jacob Rees-Mogg, a consistently outspoken critic of Sunak’s govt, and previous party chairman Jake Berry. Her financial agenda also observed her to a thorough victory around Sunak amongst get together customers only very last summer.

Saunders, now a senior policy advisor at Oxford Economics, explained reigniting the discussion inside the Conservative Bash after the marketplaces rejected Truss’ agenda could erode belief from possible buyers that the governing party is truly dedicated to financial security.

“The simple fact that the Conservative Party even now demands to have this debate by itself will fear buyers looking at the U.K., because it will guide them to dilemma how deep and sound is the Conservatives’ dedication to security-oriented procedures — the suggestion and the sense that this is what Conservative MPs and users, in their hearts, would actually like to do,” he stated.

“International buyers will glance at that and issue regardless of whether a authorities which signifies individuals passions can be trusted to adhere to balance-oriented insurance policies.”

Pension fund collapse

The central bank reported pension money were being hrs from collapse when it resolved to intervene in the U.K. long-dated bond industry in late September, just a 7 days after Truss’ funds announcement.

The plunge in bond values brought on worry in individual for Britain’s so-known as liability-pushed investment resources (LDIs), which maintain significant quantities of U.K. gilts and are owned predominantly by last income pension designs.

In her essay, Truss claimed that she was not warned about the risks to economical stability contained in the LDI market place.

In an post Sunday in the New Statesman, former Get the job done and Pensions Secretary David Gauke implied that Truss’ edition of occasions propose that the LDI market’s frailties caused the market place turmoil, when in reality, the surge in governing administration bond yields induced the LDI troubles.

“There may well be a discussion about the position and regulation of LDIs (whilst we need to not ignore the consequence of prohibiting LDIs would signify substantially higher pension contributions from employers and/or employees) but the fundamental challenge was that gilt yields surged since the bond market imagined the U.K. governing administration had taken leave of its senses,” Gauke wrote.

“Truss complains that she was not warned of the LDI risks. For argument’s sake, enable us acknowledge this as accurate. But she was definitely warned about the hazards of pursuing an aggressive tax-slicing Price range devoid of displaying how the community finances ended up likely to be put on a sustainable footing.”