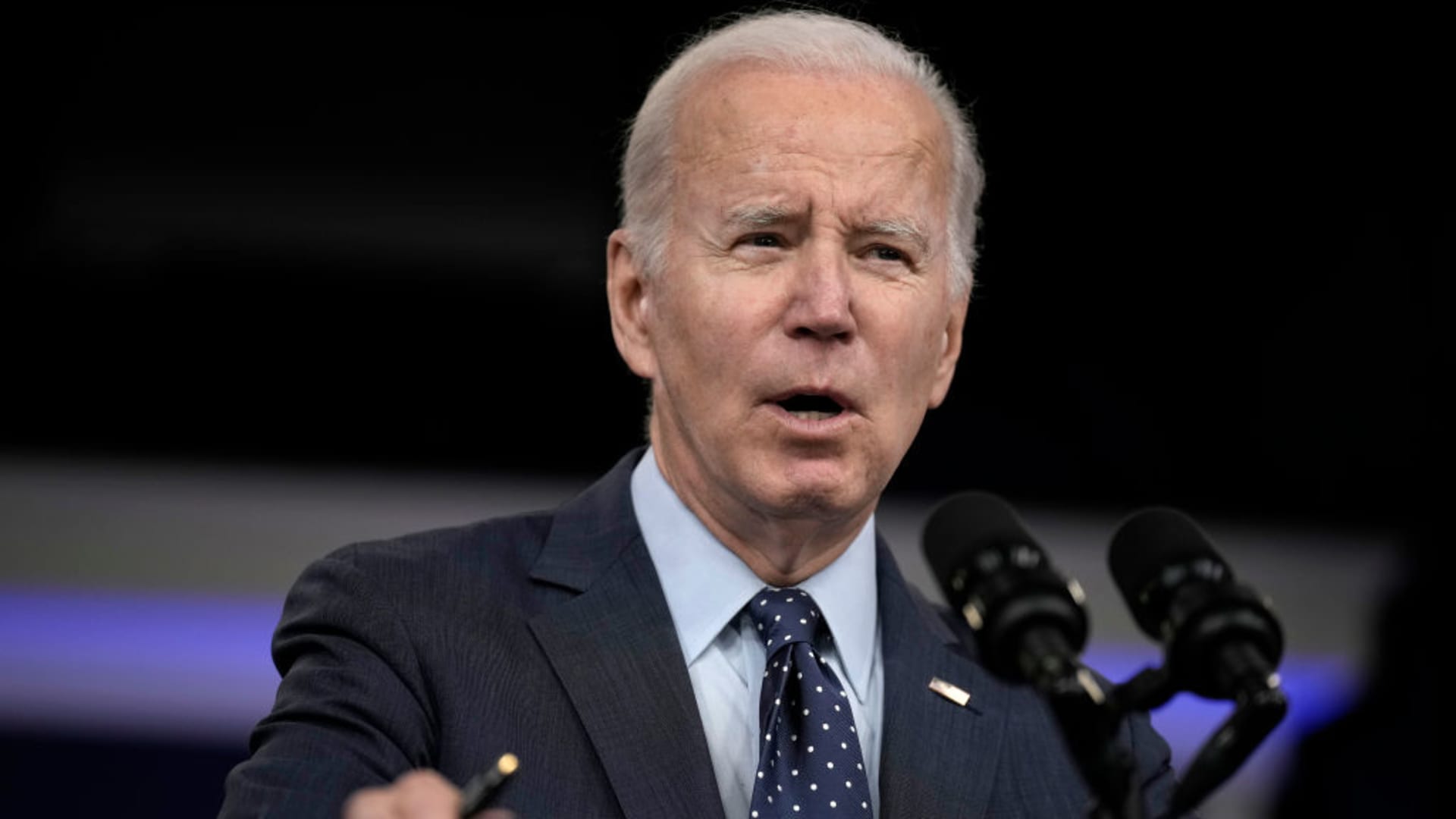

President Joe Biden speaks about the U.S. response to the significant-altitude Chinese balloon at the White Property complex Feb. 16, 2023 in Washington, DC.

Drew Angerer | Getty Illustrations or photos Information | Getty Photos

President Joe Biden is proposing better taxes on rich People in america to assist protect priorities like Medicare and Social Security in his 2024 finances.

The strategy calls for a top rated marginal earnings tax rate of 39.6%, up from 37%, which was diminished as component of former President Donald Trump’s signature tax laws. The repeal would apply to one filers generating more than $400,000 and married partners with income exceeding $450,000 for each year.

The spending plan also aims to tax funds gains at the exact rate as typical revenue for those earning far more than $1 million and near the so-termed carried curiosity loophole, which permits wealthy expense fund administrators to pay a reduce tax amount than day-to-day staff.

Biden’s system aims to reform the tax code to “reward get the job done, not wealth,” White Property Office environment of Management and Funds Director Shalanda Young advised reporters on a get in touch with.

Although the proposed tax boosts are not possible to move in the Republican-managed Household of Associates, the prepare highlights Biden’s priorities and will grow to be a setting up point for potential negotiations.

Minimal 25% tax on prosperity in excess of $100 million

Biden also renewed his phone for a minimum tax on the wealthiest People in america, which he revisited through the 2023 Condition of the Union address in February.

The system contains a 25% bare minimum tax on Us residents with prosperity exceeding $100 million, and would “assure that no billionaire pays a decreased tax rate than a trainer or firefighter,” Younger stated.

Biden’s 2023 federal spending budget prepare proposed a 20% levy on households with the very same degree of wealth, applying to “overall earnings,” such as common earnings and so-referred to as unrealized gains.

Senate Democrats pushed for a comparable tax in Oct 2021 to assistance fork out for their domestic paying agenda. Nevertheless, the two plans have not attained wide assistance in the Democratic Party.

Tax costs will maximize in 2026

For 2023, the major marginal revenue tax amount of 37% kicks in at $578,126 for single filers and $693,751 for married partners, which is approximately 7% larger than in 2022 owing to annually inflation changes from the IRS.

With out extra modifications by Congress, several provisions from the Tax Cuts and Work opportunities Act will sunset in 2026, bumping the major revenue tax charge again to 39.6%.

The change will also raise the other tax fees, which Biden stated in the price range, indicating he options to “function with Congress to deal with the 2025 expirations.”