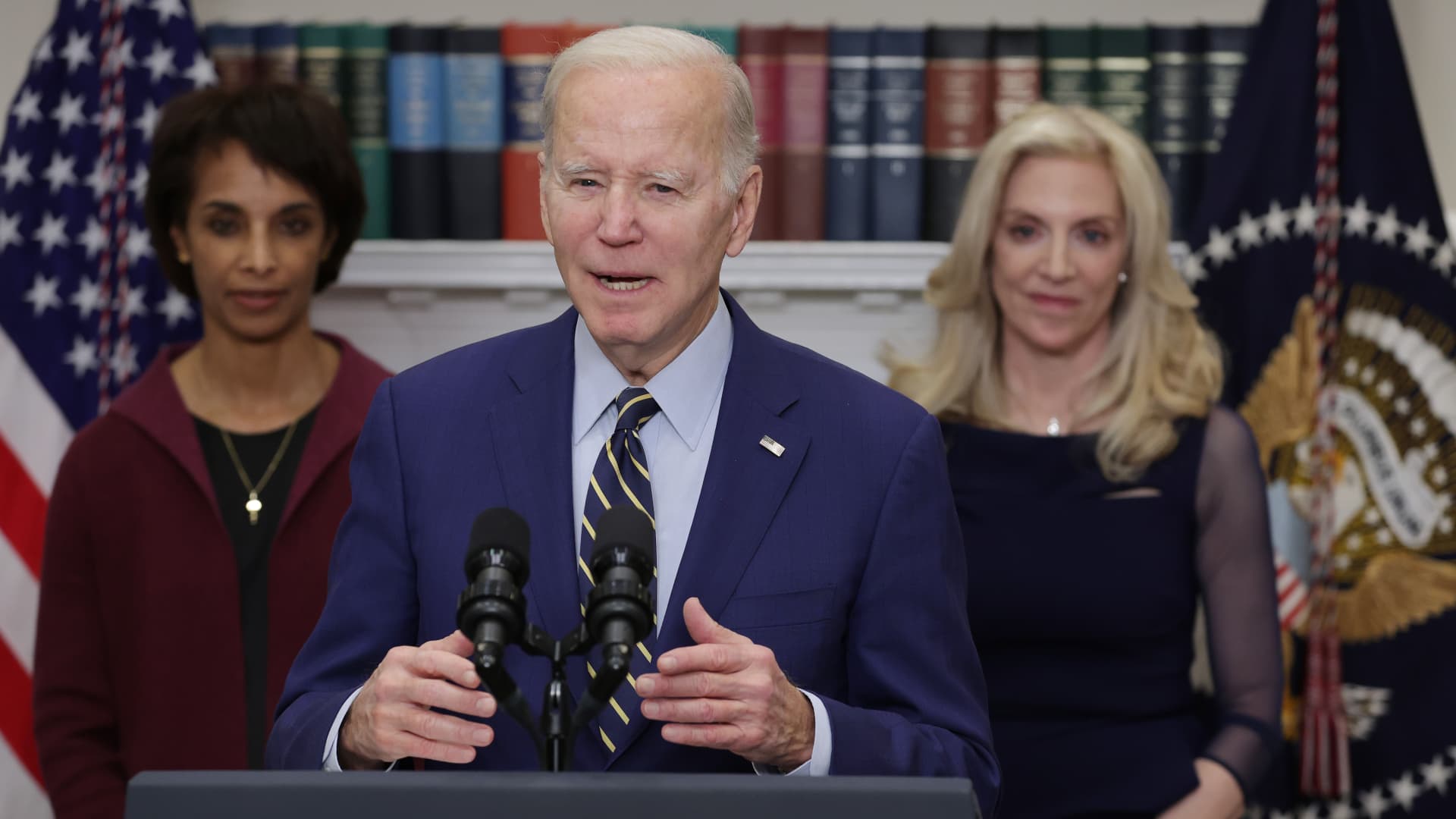

U.S. President Joe Biden (C) delivers remarks on the February positions report with Council of Financial Advisers Chair Cecilia Rouse (L) and National Economic Council Director Lael Brained in the Roosevelt Home at the White Residence on March 10, 2023 in Washington, DC.

Alex Wong | Getty Photographs Information | Getty Illustrations or photos

President Joe Biden produced his 2024 spending plan program Thursday that guarantees to cut the deficit by $3 trillion about the subsequent ten years thanks to a flurry of new and elevated taxes aimed at the richest Americans.

The proposal is just the to start with step in the federal government’s budgetary course of action and is unlikely to be enacted in its present-day form going through a divided Congress now that Republicans maintain the bulk in the House of Reps.

Quite a few of the proposed taxes are additional of messaging alerts as the president prepares to start a probable re-election bid and enter the 2024 campaign period.

Exactly where is the funds coming from? This is a search at the best revenue-earning taxes outlined in the approach.

All income figures are more than the span of the next 10 years.

Raise corporate tax price to 28%: $1.326 trillion

Biden’s budget phone calls for increasing the company income tax to 28% from the present-day 21%. The White Property argues the increase is nevertheless far below the 35% tax before former President Donald Trump slashed the tax in 2017.

Guaranteeing providers “pay their truthful share” has been a priority for Biden given that his marketing campaign and is likely to choose center phase on his system if he decides to run once more. The president’s financial platform is centered on creating the financial system “from the bottom up and middle out” a direct criticism of so-referred to as “trickle-down economics” theories. Expanding taxes on the highest earners, including large businesses, is central to its implementation.

Impose least revenue tax on .01%: $436.61 billion

Biden’s funds calls for a minimum 25% tax on American homes worthy of more than $100 million, which would far more than triple the 8% charge the wealthiest .01% presently shell out.

“No billionaire need to be spending a decrease tax rate than a school instructor or a firefighter,” Biden said in a speech Thursday in Philadelphia, Pa. immediately after his price range proposal was produced. He reported there are far more than a thousand billionaires in the United States presently, up from 600 when he took business two decades in the past. Individuals Us citizens, the White Residence argues, really should be contributing much more.

Read extra on Biden’s fiscal year 2024 spending budget plan:

Raise the wealthy’s ACA tax: $344.37 billion

Biden’s spending plan calls for growing the 3.8% Cost-effective Treatment Act tax to 5% on Individuals earning far more than $400,000. The maximize would go in direction of bolstering Medicare.

Shut ACA tax loopholes: $305.94 billion

This is a further reform that would support shore up Medicare. If enacted, it would near the loophole to assure the Obamacare tax is usually used to higher earners’ so-termed “move-via corporations” wherever money flows to unique returns.

Raise leading marginal revenue tax: $235.26 billion

Constructing off of the billionaires’ tax, Biden’s spending plan outlines bumping the top rated payroll tax price to 39.6%, up from 37%, on Us residents creating additional than $400,000 every year and married partners earning a lot more than $450,000 a 12 months. If enacted, the money tax hike would reverse cuts built by former President Donald Trump in his 2017 tax bill.

Quadruple the inventory buyback tax: $237.91 billion

The new levy putting a 1% tax on all inventory buybacks was handed beneath last year’s Inflation Reduction Act and went into impact on Jan.1. It is projected to garner $74 billion in excess of the following ten many years. The president even though argues it does not go much plenty of to control share repurchases and proposed in his finances rising the tax 4-fold to 4%. The move, the White Dwelling states, would motivate financial investment in businesses on their own alternatively than share repurchases and dividends.