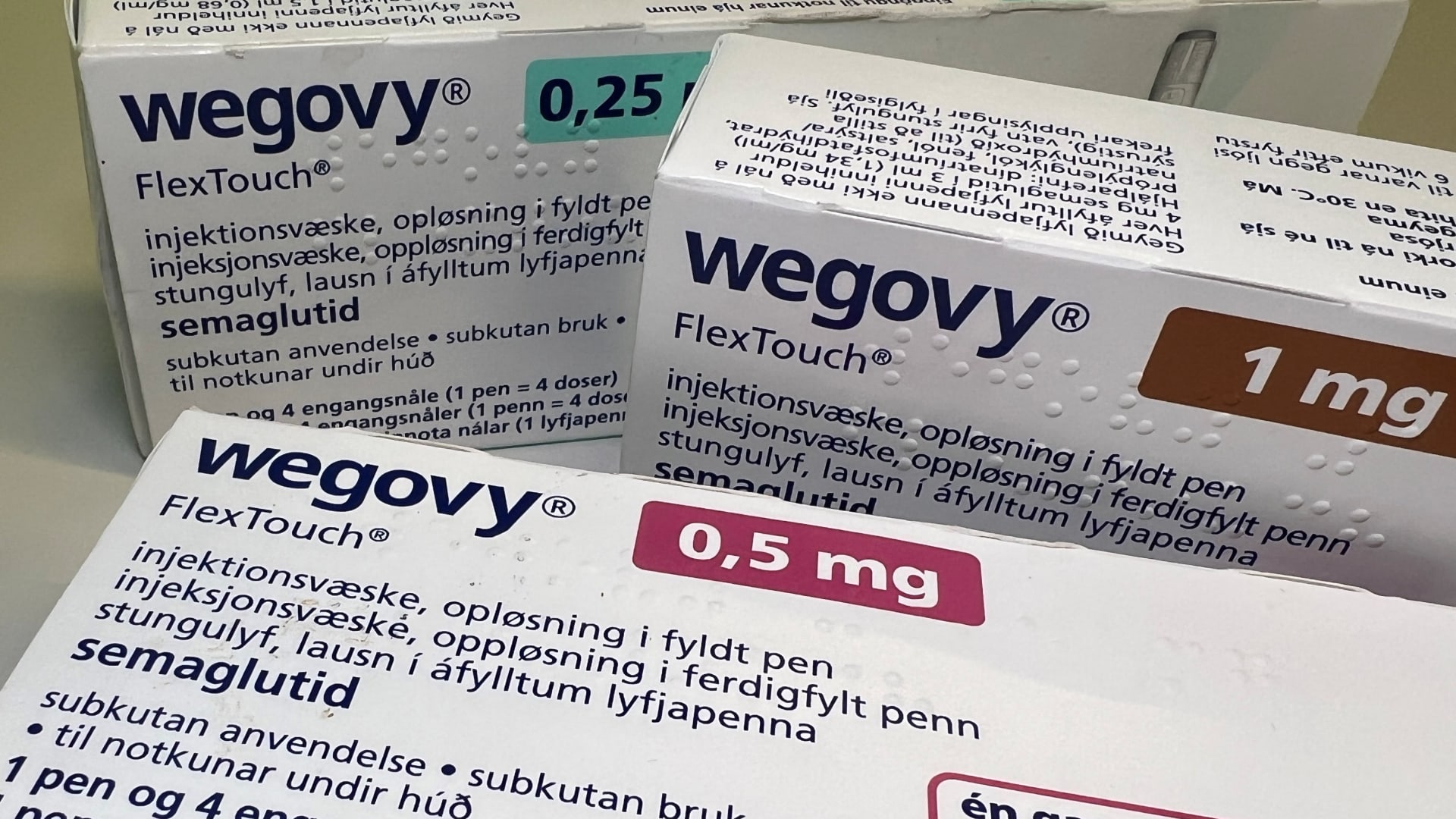

Boxes of Novo Nordisk’s weight-loss drug Wegovy in Oslo, Norway, Nov. 21, 2023.

Victoria Klesty | Reuters

Pharmaceutical companies breathed a sigh of relief Wednesday after U.S. President Donald Trump revealed that they would not be subject to reciprocal tariffs — but that reprieve could prove fleeting as the White House moves ahead with plans for the sector.

The Trump administration is considering launching a so-called 232 investigation into pharmaceuticals, among other industries, which could lead to import duties under the Trade Expansion Act.

“The pharmaceutical companies are going to come roaring back, they are coming roaring back, they are all coming back to our country because if they don’t they got a big tax to pay. And if they do, I’ll be very happy,” Trump said during his “Liberation Day” tariff announcement.

In a national emergency declaration accompanying the tariff plan, the White House cited the “particularly acute” need to reinforce domestic manufacturing across sectors such as pharmaceuticals, autos and shipbuilding.

Health care stocks opened slightly higher Thursday, but the Stoxx Healthcare index then dipped 0.4% by 11:00 a.m. London time, extending losses from the previous session as investors braced for more uncertainty ahead.

Switzerland’s Roche led declines, shedding 2.4%, while Wegovy-maker Novo fell 0.7%. Other regional players including Novartis, Bavarian Nordic, AstraZeneca ticked slightly higher.

The pharma industry’s hopes of a sector-wide tariff carve-out faded after Trump last week confirmed that an announcement would come soon, but drugmakers have since been lobbying the administration for a phased approach to allow companies time to relocate their manufacturing Stateside.

“A whispered potential for a phase-in approach, if it materializes, could dampen immediate shocks across the industry,” Citi said in a note Thursday.

Nevertheless, even with a delayed approach, the complex nature of pharmaceutical supply chains mean that “larger-scale shifts are on a multi-year timeline,” making any relief potentially short lived.

Novo Nordisk declined to comment on the tariff developments on Thursday, but chairman Helge Lund told CNBC last week that the company was not speculating on any levy announcements and was instead focused on remaining “flexible.”

Novo Nordisk already has a sizeable U.S. manufacturing presence, which Lund said was “expanding,” but he would not comment on the share of U.S. sales derived from U.S. plants nor the possible impact of tariffs on Wegovy drug prices.

Roche said in a statement Thursday that it has a full pharma and diagnostics value chain in the U.S., where it employs 25,000 staff — but added that it was “considering additional U.S. investments to continue to meet patients’ needs.”

British drugmaker AstraZeneca declined to comment ahead of further sector-specific announcements.

Meanwhile, Danish biotech Novonesis, which has a significant footprint in the U.S., told CNBC Tuesday that “uncertainty” around the tariff strategy was likely to curb investment and dent consumer demand.

“It drives uncertainty, and when you’re uncertain, you pause. You pause innovation, you post launches, you pause investments,” she said.