Position development was much better than anticipated in September, a indicator that the U.S. overall economy is hanging tricky irrespective of increased desire charges, labor strife and dysfunction in Washington.

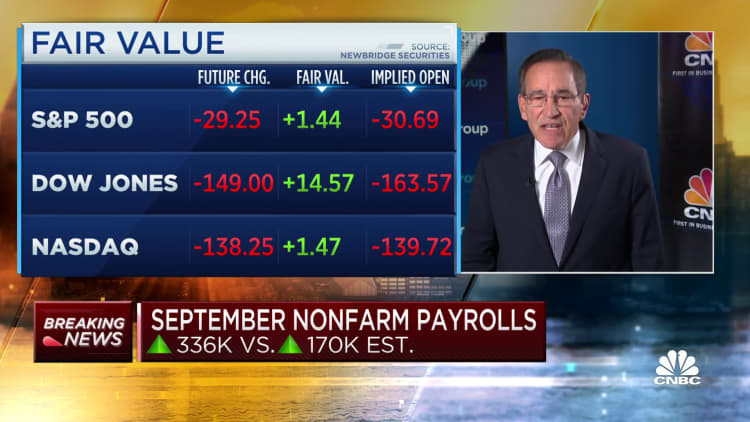

Nonfarm payrolls increased by 336,000 for the thirty day period, much better than the Dow Jones consensus estimate for 170,000 and additional than 100,000 better than the former month, the Labor Division reported Friday in a substantially-expected report. The unemployment level was 3.8%, compared to the forecast for 3.7%.

Inventory industry futures turned sharply negative following the report and Treasury yields jumped. Dow futures ended up down far more than 250 pints, when the 10-12 months Treasury produce soared .17 percentage stage to 4.87%, up around its greatest levels considering the fact that the early times of the monetary crisis.

“Slowdown? What slowdown? The U.S. labor marketplace continues to show wonderful energy, with the quantity of new positions designed very last thirty day period nearly two times as substantial as anticipated,” explained George Mateyo, main expenditure officer at Important Non-public Financial institution.

Investors have been on edge these days that a resilient economic climate could power the Federal Reserve to retain curiosity costs higher and maybe even hike extra as inflation stays elevated.

Wage raises, even so, ended up softer than envisioned, with ordinary hourly earnings up .2% for the month and 4.2% from a year back, when compared to respective estimates for .3% and 4.3%.

Nevertheless, traders in the fed resources futures marketplace enhanced the odds of a fee boost ahead of the stop of the 12 months to about 44%, according to the CME Group’s tracker.

“Clearly it is relocating up anticipations that the Fed is not carried out,” reported Liz Ann Sonders, main expense strategist at Charles Schwab. “All else equivalent, it in all probability moves the get started position for level cuts, which has been a shifting target, to afterwards in 2024.”

Sonders explained the bond current market is “in the driver’s seat” as significantly as shares go, a trend that accelerated earlier in the week right after the Labor Section described a bounce in work openings for August.

From a sector viewpoint, leisure and hospitality led with 96,000 new careers. Other gainers provided authorities (73,000), well being treatment (41,000) and specialist, scientific and technical expert services (29,000). Movement photo and seem recording careers fell by 5,000 and are down 45,000 since May possibly amid a labor impasse in Hollywood.

Assistance-similar industries contributed 234,000 to the whole work expansion, whilst goods-generating industries extra just 29,000. Typical hourly earnings in the leisure and hospitality marketplace were flat on the thirty day period, even though up 4.7% from a calendar year in the past.

The personal sector payrolls obtain of 263,000 was properly in advance of a report previously this 7 days from ADP, which indicated an maximize of just 89,000.

In addition to the powerful September, the earlier two months noticed significant upward revisions. August’s attain is now 227,000, up 40,000 from the prior estimate, though July went to 236,000, from 157,000. Blended, the two months had been 119,000 better than previously documented.

The household study, utilised to compute the unemployment amount, was a little bit lighter, soaring 215,000.

The labor force participation price, or those people doing the job towards the complete measurement of the workforce, held continuous at 62.8%, still a half proportion issue under the pre-Covid pandemic degree. A extra encompassing evaluate of unemployment that features discouraged employees and people holding portion-time positions for economic reasons edged down to 7%.

The September report comes at a vital time for the markets and economic climate.

Treasury yields have surged and stocks have slumped amid worry that a even now-warm economy could retain Federal Reserve plan tight. The central bank has elevated interest prices 5.25 proportion factors considering that March 2022 in an endeavor to curb inflation that is still functioning nicely in advance of the Fed’s 2% goal.

In modern times, several policymakers have stated they are nonetheless involved about inflation. They mainly have cautioned that when a further fee hike in advance of the stop of the calendar year is an open up issue, fees are virtually certain to stay at an elevated degree for “some time.”

Nevertheless market pricing puts minor opportunity on the Fed mountaineering all over again, the increased-for-longer narrative has been creating angst for buyers. Bigger curiosity prices increase the charge of cash and operate counter to the effortless monetary plan that has underpinned Wall Road toughness for a lot of the earlier 14 decades.

A potent position market is central to the prices equation.

Policymakers truly feel that a restricted labor photo will go on to place upward pressure on wages which then will push charges larger. Fed officials have stated they you should not consider wages played a position in the original inflation surge in 2021-22, but have grow to be extra of a issue these days.