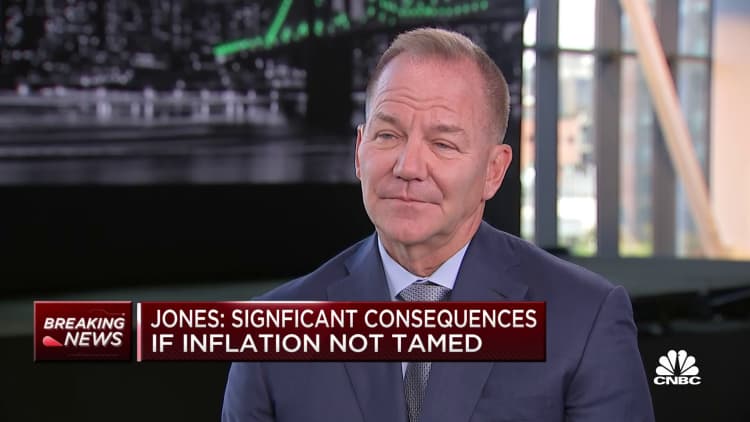

Billionaire hedge fund manager Paul Tudor Jones believes the U.S. overall economy is both near or already in the center of a recession as the Federal Reserve rushed to tamp down soaring inflation with intense fee hikes.

“I really don’t know no matter if it started off now or it started out two months in the past,” Jones stated on CNBC’s “Squawk Box” on Monday when asked about economic downturn dangers. “We often find out and we are normally amazed at when recession formally starts off, but I am assuming we are heading to go into 1.”

The National Bureau of Economic Study is the formal arbiter of recessions, and utilizes many things in producing its perseverance. The NBER defines economic downturn as “a important decrease in economic exercise that is distribute throughout the economic climate and lasts much more than a few months.” However, the bureau’s economists profess not even to use gross domestic solution as a main barometer.

GDP fell in both of those the first and next quarters, and the initially looking through for the Q3 is launched October 27.

The founder and chief expenditure officer of Tudor Expenditure stated there is a precise recession playbook to stick to for buyers navigating the treacherous waters, and historical past exhibits that possibility property have more area to slide just before hitting a bottom.

“Most recessions last about 300 days from the commencement of it,” Jones said. “The stock industry is down, say, 10%. The first matter that will happen is brief prices will prevent going up and begin going down in advance of the stock market truly bottoms.”

The famed trader stated it truly is incredibly tough for the Fed to carry inflation again to its 2% concentrate on, partly because of to considerable wage improves.

“Inflation is a bit like toothpaste. At the time you get it out of the tube, it is really really hard to get it again in,” Jones claimed. “The Fed is furiously hoping to wash that style out of their mouth … If we go into recession, that has truly detrimental repercussions for a selection of property.”

To battle inflation, the Fed is tightening monetary coverage at its most aggressive rate considering the fact that the 1980s. The central financial institution final 7 days lifted prices by 3-quarters of a share point for a 3rd straight time, vowing a lot more hikes to arrive. Jones claimed the central lender ought to maintain tightening to stay clear of very long-expression ache for the financial state.

“If they don’t hold going and we have higher and everlasting inflation, it just produces I assume more concerns down the road,” Jones stated. “If we are going to have prolonged-time period prosperity, you have to have a stable forex and a secure way to value it. So yes you have to have a little something 2% and less than inflation in the quite prolonged run to have a stable culture. So you will find limited-time period ache associated with very long-expression get.”

Jones shot to fame soon after he predicted and profited from the 1987 inventory marketplace crash. He is also the chairman of nonprofit Just Money, which ranks public U.S. corporations based mostly on social and environmental metrics.