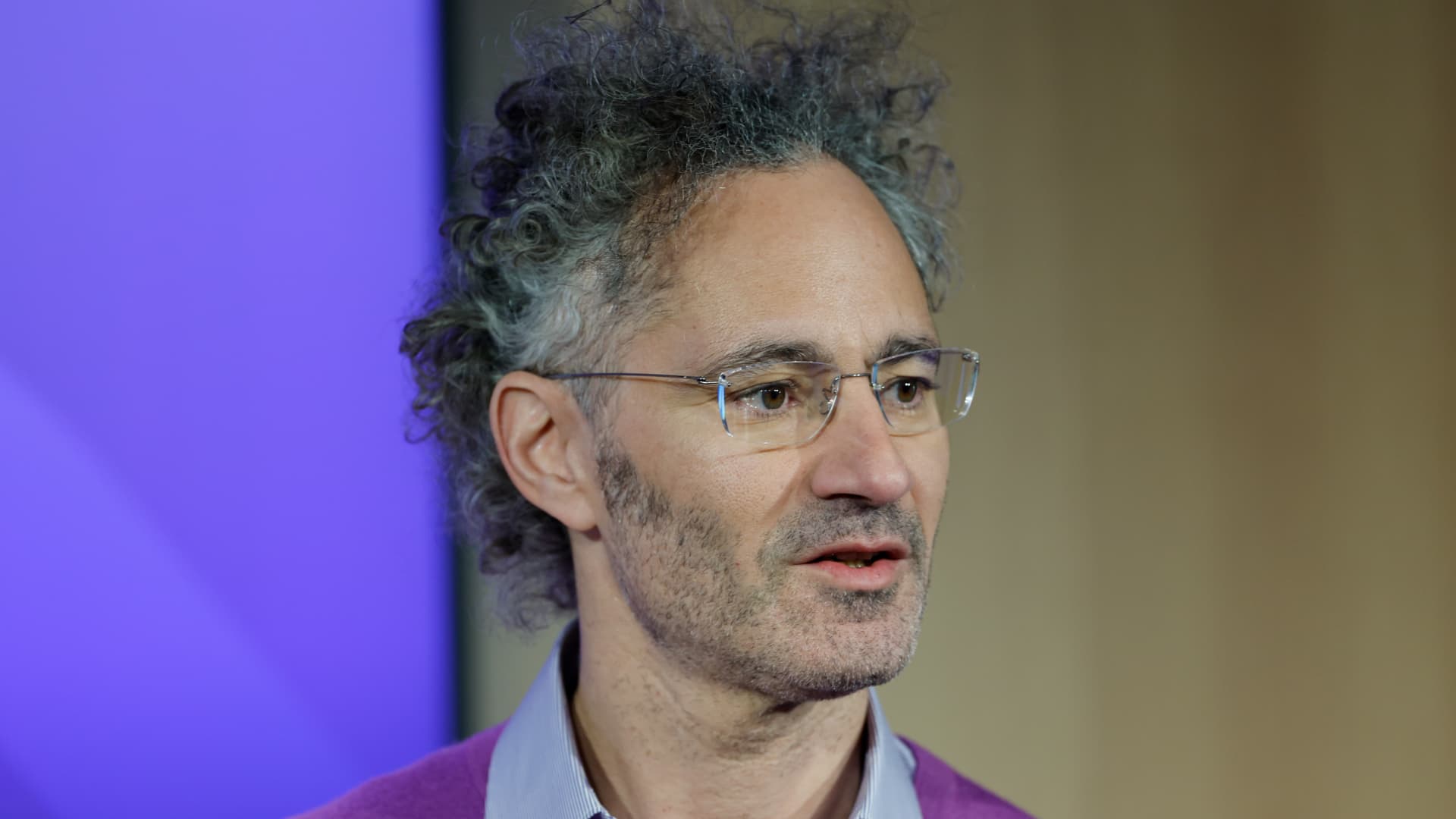

Alex Karp, CEO of Palantir, on working day two of the Environment Financial Discussion board in Davos, Switzerland.

Stefan Wermuth | Bloomberg | Getty Illustrations or photos

In August 2021, details analytics software vendor Palantir acquired in excess of $50 million well worth of 100-ounce gold bars. Much less than two decades later on, Palantir reported goodbye to the cherished metal.

“In the course of the a few months ended March 31, 2023, the Enterprise marketed all of its gold bars for whole proceeds of $51.1 million,” Palantir stated in its initially-quarter money submitting Tuesday. The organization explained the sale resulted in “an immaterial recognized obtain” on its assertion of operations.

At the time of Palantir’s investment in gold, the market was in a much unique spot. Stocks ended up months absent from peaking, crypto was flying superior and curiosity premiums have been in close proximity to zero. Other tech providers were being pumping funds into fairness investments and even bitcoin, but Palantir selected a additional conservative path in parking some of its extra cash.

Palantir didn’t say at the time why it bought gold, noting only that the bars ended up “located in the northeastern United States” and that the business could “just take bodily possession of the gold bars stored at the facility at any time with realistic see.”

In its most current submitting, the enterprise gave no rationalization as to why it made the sale, and a spokesperson did not immediately respond to a request for remark.

As a hedge versus inflation, Palantir manufactured a savvy bet.

Food items and power selling prices, which had been now on the rise by mid-2021, soared as a result of mid-2022, with the yr-more than-year client price index peaking at 9.1% in June. That variety has considering the fact that appear steadily down, achieving 4.9% previous month, the slowest speed since April 2021.

Gold prices are up much more than 12% given that early August 2021, although the S&P 500 has dropped about 6% above that same stretch.

But gold as an different to money loses its enchantment for a lot of investors in an surroundings of increasing curiosity charges, due to the fact you can find instantly income to be designed in govt bonds and substantial-generate savings items.

According to the quarterly submitting, Palantir shut the interval with $1.62 billion in U.S. Treasury securities, accounting for extra than 50 % of its money, equivalents and short-term investments. Which is up from zero at the conclusion of 2022, according to its once-a-year report.

“Income equivalents mostly consist of funds market funds and U.S. treasury securities with initial maturities of a few months or a lot less, which are invested principally with U.S. money establishments,” Palantir’s submitting explained.

The disclosure comes a 7 days right after the Federal Reserved lifted its benchmark price by an additional .25 proportion position, its 10th enhance in a small in excess of a 12 months, to a focus on assortment of 5%-5.25%, the best due to the fact August 2007.

Palantir shares soared 23% on Tuesday following the corporation noted earnings and revenue that topped analysts’ estimates. The stock rose yet another 4.1% Wednesday to $9.94.

Check out: Palantir CEO talks about actual benefit in AI