Oracle main know-how officer Larry Ellison speaks at a organization function in Redwood Shores, Calif., on Aug. 7, 2018.

Oracle livestream screenshot

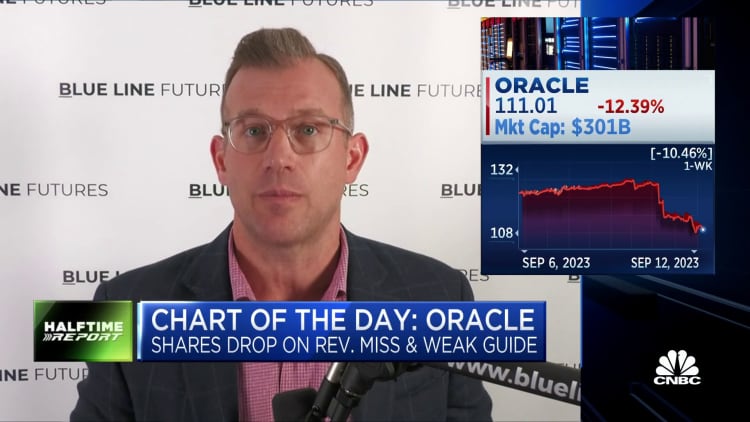

Oracle shares plummeted 12% on Tuesday, their steepest drop in around two decades, following the software package maker noted disappointing income and issued weaker-than-anticipated advice.

The very last time the stock experienced a steeper percentage drop was a 15% decrease in March 2002, at the tail finish of the dot-com bust.

The plunge on Tuesday resulted in Oracle Chair Larry Ellison dropping roughly $18 billion in wealth. Ellison is the world’s fourth-richest individual, with a net worthy of of $140.6 billion, according to Forbes, just guiding Amazon founder Jeff Bezos and ahead of Warren Buffett.

When Oracle’s earnings topped estimates, the organization described fiscal to start with-quarter earnings of $12.45 billion, slipping shorter of the $12.47 billion average analyst estimate, according to LSEG. For the present quarter, Oracle explained income will raise 5% to 7%, slipping shorter of the 8% typical analyst estimate.

Like massive firms throughout the tech sector, Oracle has been advertising traders on the positive aspects of artificial intelligence to its small business. Throughout the quarter, it added AI options in its Fusion Cloud and Human Money Management Software program, and Ellison explained in the earnings statement that “as of right now, AI advancement businesses have signed contracts to order far more than $4 billion of capacity in Oracle’s Gen2 Cloud,” double the sum it had booked at the stop of the prior quarter.

Even so, analysts at Stifel wrote in a report following the effects that “it is distinct that buyers were pricing in more AI and cloud-associated upside.” The business has a maintain rating on the inventory and a $120 value concentrate on.

Oracle CEO Safra Catz pointed to issues at the company’s Cerner device. In June of previous calendar year, Oracle closed the $28.2 billion order of the electronic wellness file software corporation, and now it can be in an “accelerated changeover” to the cloud, Catz reported.

“This transition is resulting in some in close proximity to-time period headwinds to the Cerner growth level as prospects transfer from certified buys, which are identified upfront, to cloud subscriptions which are regarded ratably,” she mentioned.

Earnings in Oracle’s cloud services and license assistance segment rose 13% from a year previously, topping StreetAccount’s consensus of $9.44 billion. But gross sales in the cloud license and on-premises license section fell 10% to $809 million, lacking estimates.

Even with Tuesday’s stock drop, Oracle shares are up 34% yr to day, beating the S&P 500, which is up 16%.

— CNBC’s Jordan Novet contributed to this report

View: Oracle’s around-phrase volatility suggests buyers need to regulate chance