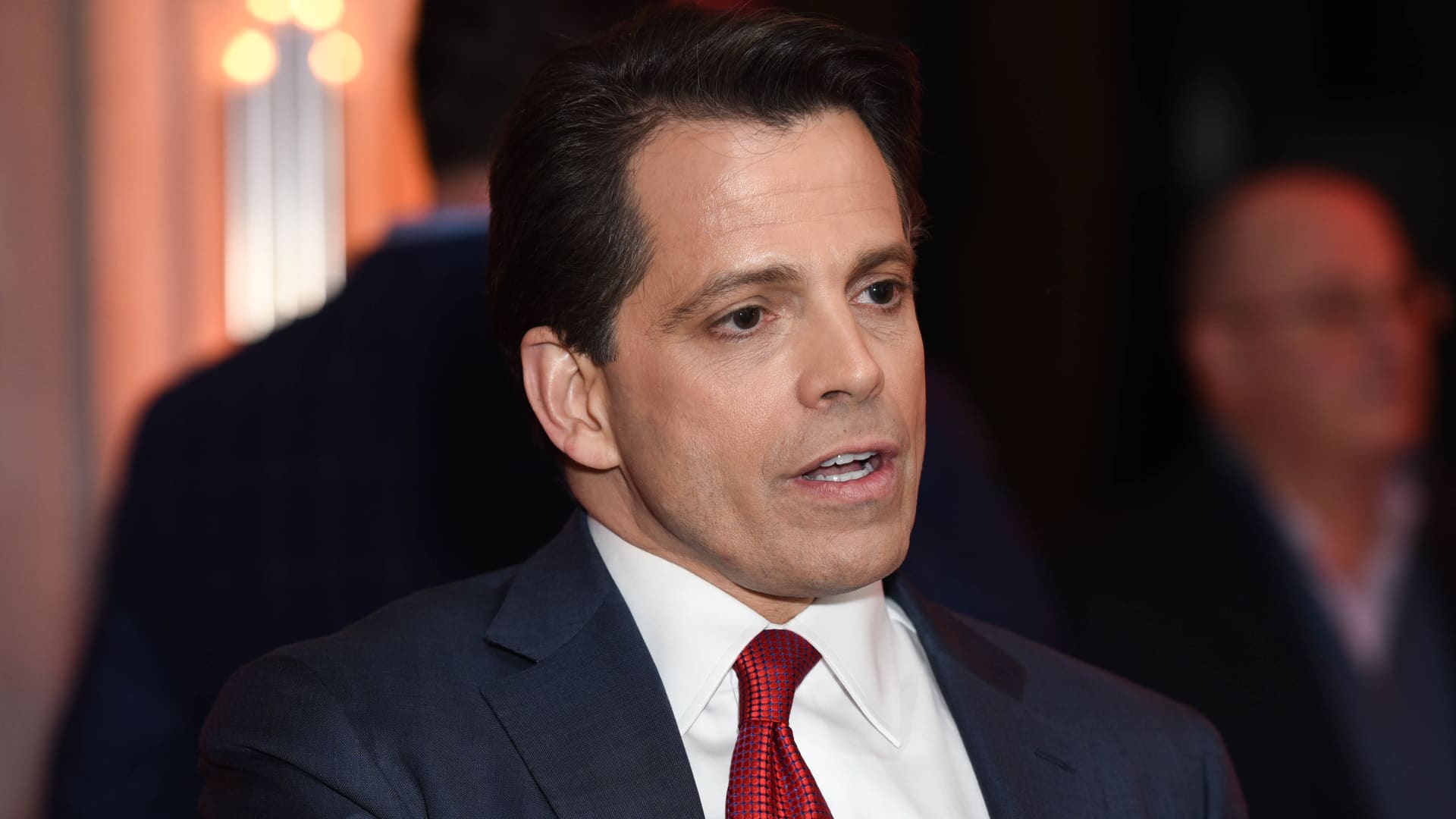

Anthony Scaramucci, founder and co-handling partner of Skybridge Funds.

Jared Siskin/Patrick McMullan | Getty Illustrations or photos

You might not know this, but Goldilocks and the Three Bears is basically a tale about the discussion presently surrounding regulation of the blockchain and crypto industries.

Some persons say you will find way too small regulation. Some men and women say there is certainly too a great deal. Some individuals feel somewhere in the middle is just suitable.

But nobody can concur about where by that “somewhere” is, we argue about it for years, and Goldilocks receives on Twitter to angrily threaten to move to yet another state the place the soup is a lot more to her flavor.

Thankfully, “Also very little, way too substantially, or just correct” is just one particular of the numerous ways we can have a civil conversation about how to control this industry. And it comes about to be a terribly oversimplified just one. A extra nuanced framework that justifies much additional attention than it receives: “Quit undesirable, aid good.”

For a very long time now, Gary Gensler’s SEC has been the (de facto, not de jure) most well known and outspoken regulator of cryptocurrencies.

The company virtually doubled the sizing of its crypto assets enforcement device very last May well. It demanded above a million pounds from Kim Kardashian for her job in pumping crypto final Oct (large score for everyone who had the foresight to put “SEC publishes a press launch with Kim K’s name in the headline” on their 2022 bingo card). It cracked down on Kraken’s staking method with a major unwanted fat (for Kraken) $30 million good very last thirty day period.

The fanbase cheering on these moves just isn’t accurately massive.

Even from within, other commissioners—like Hester Peirce—have publicly criticized the agency’s approach. Its tug-of-war with other agencies, which include but not minimal to the CFTC, carries on despite President Biden’s call for harmony in his government purchase on crypto previous March. And, of training course, marketplace executives are happy to offer you their two (non-curiosity bearing, of program) cents.

Several in the crypto field want this “regulation by enforcement” to cease. But as Alison Frankel at Reuters and former SEC Office of World wide web Enforcement Main John Reed Stark each proposed previously this 12 months, you can find possibly no close in sight.

Why? Because this is what the SEC does ideal. Enforcement is in its DNA.

The SEC is a weed killer. We can’t get mad at a weed killer for not expanding fruit. At finest, we can argue about what does or will not represent a weed, and whether or not or not the factor that just bought sprayed should’ve been.

The strategy the U.S. federal governing administration has taken to regulating this field is a little bit like spray coating your overall back garden with Weed B Gon (not an endorsement) and then, waiting for the harvest.

This is just why “Way too minor, as well considerably, just suitable” just isn’t ample. But “Prevent poor, assistance very good” allows us understand that we are lacking 50 % the puzzle.

Well-crafted government coverage will not just halt bad actors. It also encourages progress and prosperity. It can be as a great deal of a trellis for excellent vegetation as it is a weed killer. That’s what we have misplaced sight of.

That is why it are not able to be just the SEC. We require a a lot more holistic approach at the federal level.

That’s why we will need to advocate for community-non-public partnerships like Abu Dhabi’s not long ago introduced $2B initiative to again blockchain and Web3 startups or the older UNICEF Undertaking Fund launched in collaboration with Giga to make investments with crypto in early-stage tech startups.

That is why we want to increase consciousness about big grants supporting exploration and schooling at the university amount like Ripple’s University Blockchain Analysis Initiative, the Wyoming Advanced Blockchain Lab created possible by a donation from IOHK at the University of Wyoming or the Algorand Foundation’s ACE plan.

And which is why we require governing administration officers to harmony the narrative, helping the American community to see that it really is about holding the newborn as a lot as it is about throwing out the bathwater—whether that’s making money expert services inclusive and much more frictionless, funding new and interesting purposes of blockchain tech or simply supporting the spirit of American innovation.

Scaramucci is the founder and taking care of husband or wife of SkyBridge, an option asset supervisor and SEC-registered expense adviser. The author’s firm, Skybridge, has various investments in cryptocurrencies, such as the Algorand Foundation’s ALGO token, and crypto and blockchain-similar corporations, which includes Kraken.