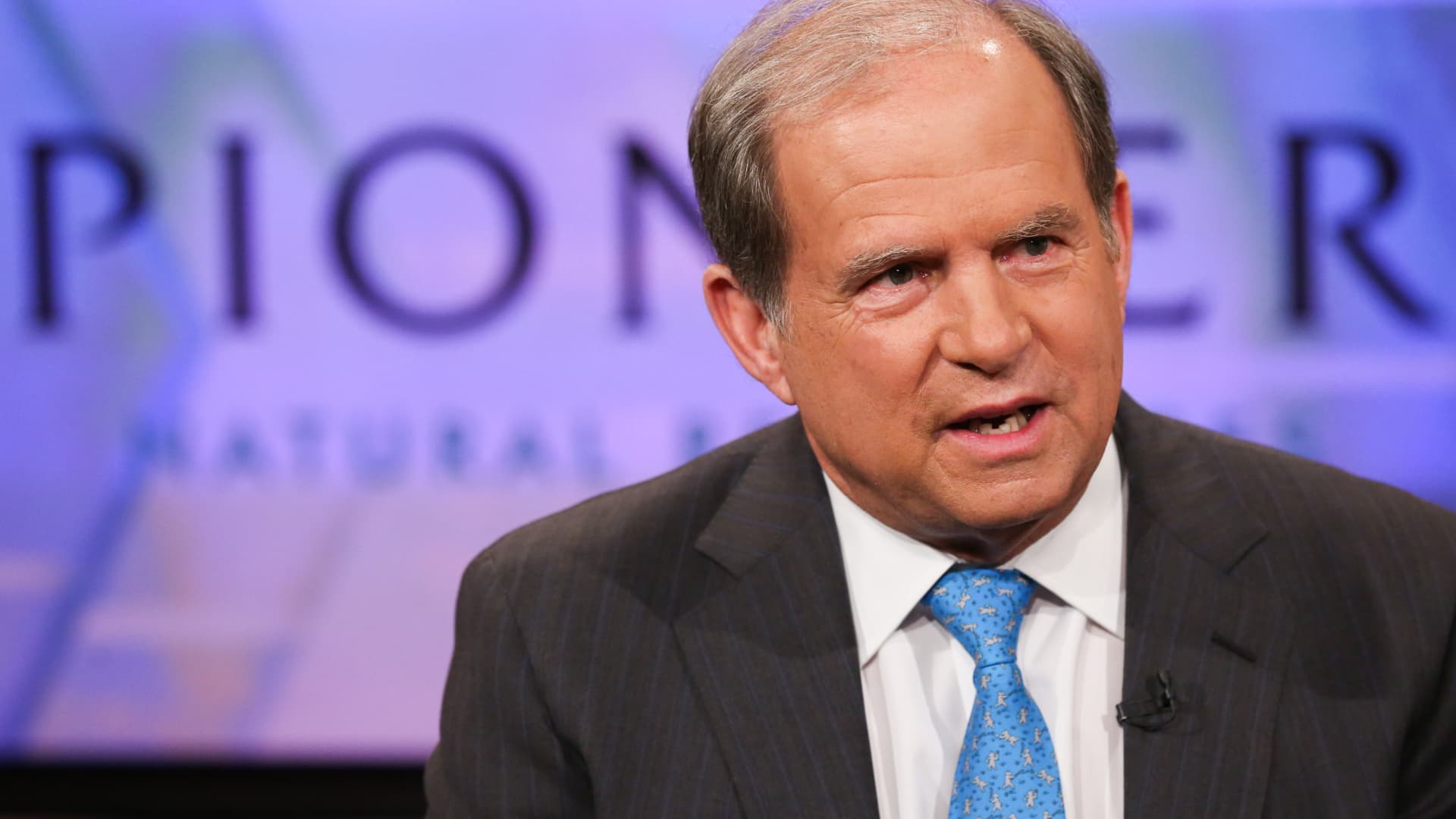

Scott Sheffield, CEO of Pioneer Normal Methods.

Adam Jeffery | CNBC

Pioneer Normal Assets CEO Scott Sheffield said oil selling prices could move a lot higher if Iran will get involved in Hamas’ war on Israel.

“If Iran enters the war, we are likely to see a great deal bigger oil charges, certainly,” Sheffield explained on CNBC’s “Squawk Box” Wednesday.

Iran is a main oil producer and crucial backer of Hamas, the Palestinian Islamist group designated by the U.S. as a terrorist corporation. A wider conflict could pose a important danger to global crude materials, which have been lower again by Saudi Arabia and Russia in modern months.

Brent crude traded a little bit reduce to $86.93 a barrel Wednesday, while the U.S. West Texas Intermediate (WTI) crude fell by 78 cents, or .91%, to $85.19. Brent and WTI experienced surged a lot more than $3.50 on Monday on issue that the clash amongst Israel and Hamas could escalate into a broader conflict.

U.S. West Texas Intermediate

“It is really going to be up to [Prime Minister Benjamin] Netanyahu, I believe that. So is dependent on how a lot proof he has that they’re guiding it and whether or not or not he decides to do something about it,” Sheffield said.

The death toll is growing in Israel as missiles rain down and hostilities head into the fifth working day. The Israeli military stated it is amassing troops around the Gaza Strip.

U.S. Secretary of Point out Antony Blinken, who is because of to arrive in Israel on Thursday, said Sunday that it is not obvious there was any involvement by Iran.

Exxon Mobil reported Wednesday it agreed to purchase shale rival Pioneer Purely natural Resources for $59.5 billion in an all-inventory deal, or $253 for every share.