Markets retained their great on Monday amid a quickly-going and unstable geopolitical landscape in the Center East — but the longer-expression risk high quality has possible risen, although oil charges continue to be on edge, analysts stated.

Iran launched more than 300 drones and missiles against military services targets in Israel on Saturday, marking the very first direct assault on the Jewish condition from Iranian territory. The offensive induced minimal destruction and no fatalities.

Iran stated it was performing in self-protection in reaction to a strike on its diplomatic compound in Damascus, Syria, before this month. Israel has declined to remark on its involvement.

Also on Saturday, forward of the strike, Iran seized a container ship in the Strait of Hormuz that Tehran reported was joined to Israel. The sea passage is described as the “world’s most significant oil chokepoint,” with flows totalling all around 21% of world petroleum liquids usage in 2022, in accordance to the U.S. Strength Data Administration.

By Monday, worldwide gamers like the U.S. and European leaders ended up in search of to cool tensions, urging Israel to exhibit restraint in its response.

Foreign exchange marketplaces are pricing in “near expression de-escalation” in the wake of the weekend gatherings, Adarsh Sinha, co-head of Asia Fx and fees strategy at Lender of The us, told CNBC’s “Squawk Box Europe” on Monday. The ‘safe haven’ U.S. dollar was .15% reduced in opposition to a basket of major currencies early Monday, also weakening in opposition to the Iranian rial and the Israeli shekel.

Sinha nonetheless extra that “the actuality that we moved from a proxy confrontation to a direct confrontation, even nevertheless that de-escalates in the close to phrase, the longer time period danger quality most likely goes up.”

“I assume the Fx industry finally will consider its cue from oil selling prices because finally, that is the channel by way of which it spills about to the Forex current market,” he mentioned.

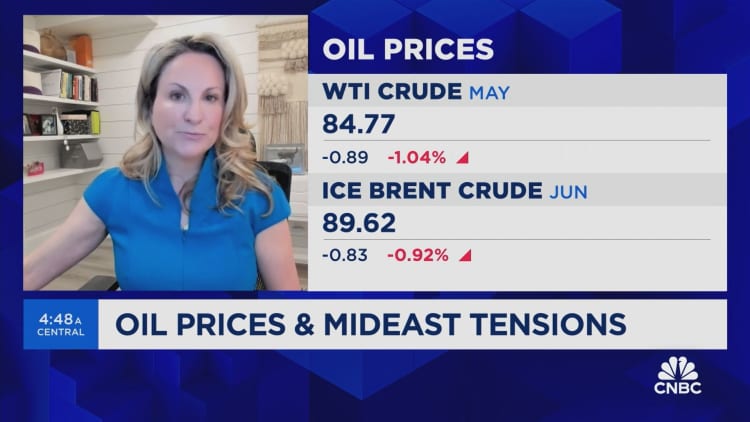

Oil selling prices had been reduced in early Asia hours on Monday, cooling off from Friday gains which designed on the expectation of an Iranian strike. Nymex WTI crude futures contracts with Could expiry were being .81% decreased at $84.97 for every barrel by early afternoon in London, when the ICE Brent agreement with June shipping was down .73% at $89.79 for every barrel.

Marketplaces experienced priced in the “very well-telegraphed” party, which points out the rate decline, Amrita Sen, founder of Power Elements, told CNBC’s “Avenue Indications Europe.”

That will not signify costs will continued to go down, she added — even though their training course will hinge on Israel’s response and subsequent actions.

Dangers amplified

Economists and analysts agreed that all round very long-time period hazards and uncertainty are now heightened.

“The unparalleled Iranian attack on Israeli targets casts a shadow around the economic and money outlook over and above the region alone. The risk that the conflict in the Center East could escalate more has amplified,” Holger Schmieding, main economist at Berenberg Lender, said in a Monday notice.

Conflict between Israel and Iran is not likely to have a significant affect on the world economic climate, Schmieding continued, pointing to the rather minimal impact to the economic outlook caused by Houthi assaults on cargo ships in the Red Sea.

Disruption to oil shipments as a result of the Strait of Hormuz “would be a pretty distinct make a difference,” he said, calling this the “vital possibility to watch.” On the other hand, this strike to oil exports would harm Iran badly, Schmieding continued, meaning that Tehran is unlikely to want to escalate to this kind of a degree.

A attainable Iranian blockade of the Strait of Hormuz will hold Brent prices over $84 dollars per barrel for the remainder of the 12 months and cause a possible rally to above $100 per barrel in the party of “open war,” according to Bartosz Sawicki, industry analyst at Conotoxia.

Iran’s assault has by now threatened regional oil supply in a industry that has been “broadly balanced” in the 1st section of the yr, and improved the danger of flipping to undersupply, Sawicki explained. Iran’s crude production totals just about 3.5 million barrels for each working day, accounting for about 3.3% of worldwide manufacturing, he observed.

“A more durable stance on Iran and stricter enforcement of past sanctions should really be anticipated,” Sawicki, claimed. Significant retaliation by Israel could in the meantime result in an oil selling price rally, potent desire for the U.S. dollar and renewed obtaining of gold, he additional.

European equity markets had been a bit greater Monday, with U.S. futures also brightening from a Friday retreat.

Impression on stocks could come by way of a transform to desire level expectations, analysts at Deutsche Financial institution reported in a note.

Still what type that will get is unsure, they insert. Bigger oil selling prices could preserve inflation sticky in key economies, pushing back the timing of interest charge cuts — even though a “geopolitical shock” could carry this kind of trims forward by threatening development.