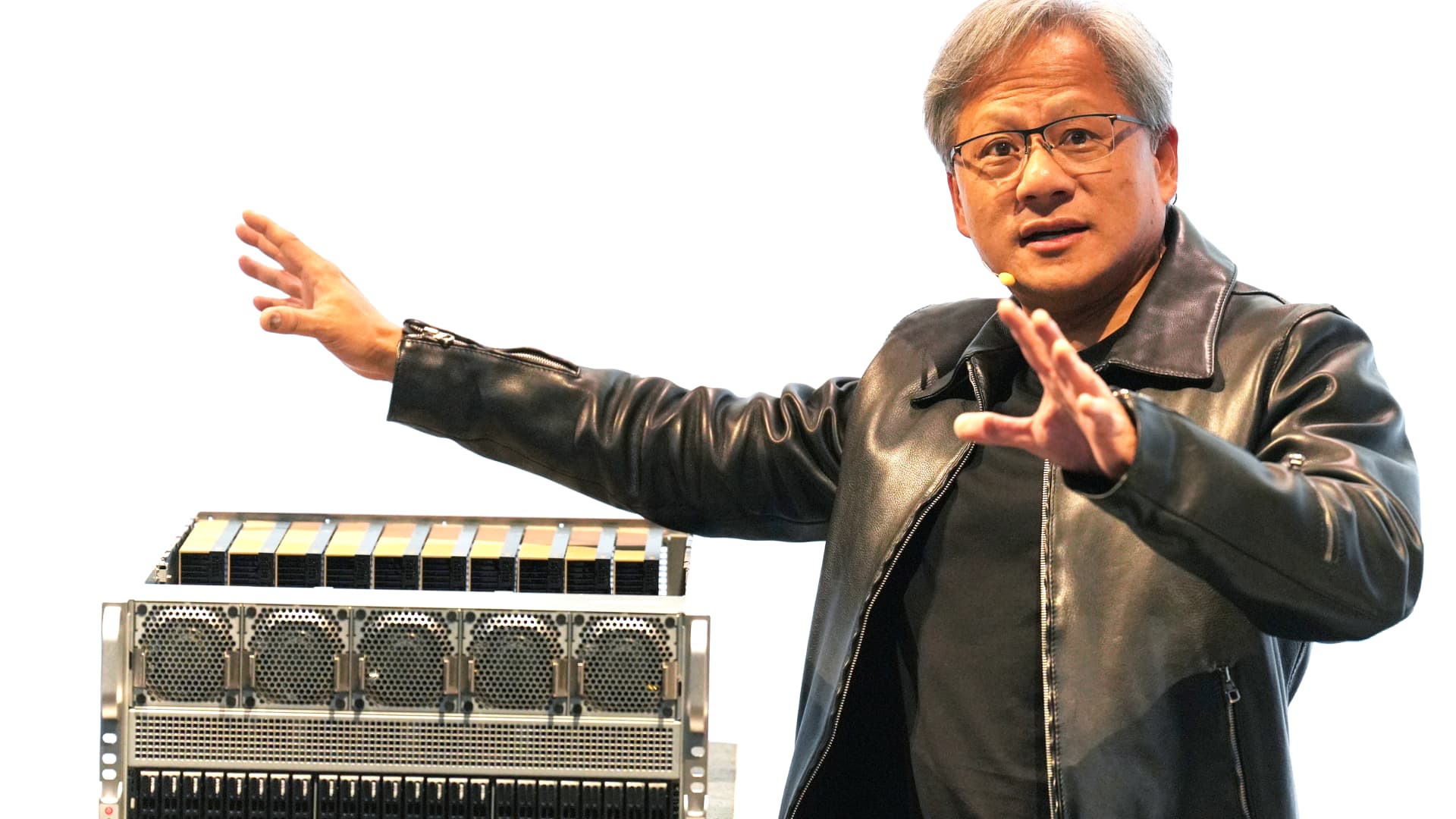

Nvidia CEO Jensen Huang,speaks at the Supermicro keynote presentation in the course of the Computex meeting in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Illustrations or photos | Lightrocket | Getty Pictures

Nvidia is set to report fiscal 2nd-quarter earnings on after current market near Wednesday. The chipmaker’s stock price tag has additional than tripled this yr, sparked by a growth in synthetic intelligence purposes.

Here’s what analysts are anticipating:

- Earnings: $2.09 per share, in accordance to Refinitiv.

- Income: $11.22 billion, according to Refinitiv.

This is what Wall Road is expecting from Nvidia’s best enterprise models:

- Gaming: $2.38 billion in revenue, according to StreetAccount

- Datacenter: $8.03 billion in profits, in accordance to StreetAccount

Pushed by insatiable desire for graphics processing models (GPUs), which are at the heart of most generative AI solutions, Nvidia’s profits very likely amplified 67% in the quarter ended July 31, from $6.7 billion a calendar year earlier.

Investors will be notably centered on Nvidia’s outlook to see if the momentum is poised to keep on. Analysts expect third-quarter profits of $12.61 billion, according to Refinitiv, which would be an improve of in excess of 110% from the prior yr.

Nvidia CEO Jensen Huang has positioned his business at the center of the AI wave, and mentioned just lately it was viewing “surging demand from customers.” He in contrast last year’s launch of OpenAI’s ChatGPT chatbot to the introduction of the Apple iphone in 2007. Nvidia is the most important vendor of GPUs necessary to practice and run AI styles like ChatGPT.

The inventory has been by much the very best performer this yr in the S&P 500, which is up about 16% in 2023. Facebook father or mother Meta is upcoming in line, up 146%.

But Nvidia’s soaring stock price tag suggests that the organization is going for walks a tightrope. It demands to show remarkable progress in both of those earnings and earnings to justify its $1 trillion-additionally valuation and a earnings multiple that dwarfs richly valued businesses like Tesla and Amazon.

A closer glance at estimates demonstrates just how reliant Nvidia has turn into on AI chips. Gaming, the company’s traditionally main small business, isn’t thriving in practically the exact same way.

Nvidia is expected to post $2.38 billion in gaming income throughout the quarter, which would be a 16% maximize from a yr earlier. But that is an straightforward comparison to 2022 numbers, which reflected a deep slump in graphics cards due to the fact so quite a few people today refreshed their gaming technologies during the pandemic. It also incorporates gross sales from the chip at the heart of Nintendo’s Switch.

By contrast, Nvidia’s Datacenter group, which residences AI chips, is hunting at a 111% maximize in profits to $8.03 billion, in accordance to estimates. Nvidia’s AI chips, together with the A100 and H100, have been challenging to acquire in recent months as startups, significant companies, governments and cloud suppliers all area their orders at the similar time.

Nvidia faces some difficulties that administration could address on the phone. Offer is an situation, offered that Taiwan Semiconductor Producing Enterprise (TSMC) manufactures the chips Nvidia styles. Huang experienced dinner with TSMC chairman Morris Chang in the course of the quarter.

China is an additional huge topic. Last calendar year, the U.S. positioned export restrictions on Nvidia, which compelled the firm to make specialised, slower versions of its AI chips for the Chinese market place. Additional export restrictions at the moment being considered by the Biden administration could further more restrict the products Nvidia sells to Chinese companies.

Enjoy: Nvidia earnings could shift index absent from seasonally weak interval