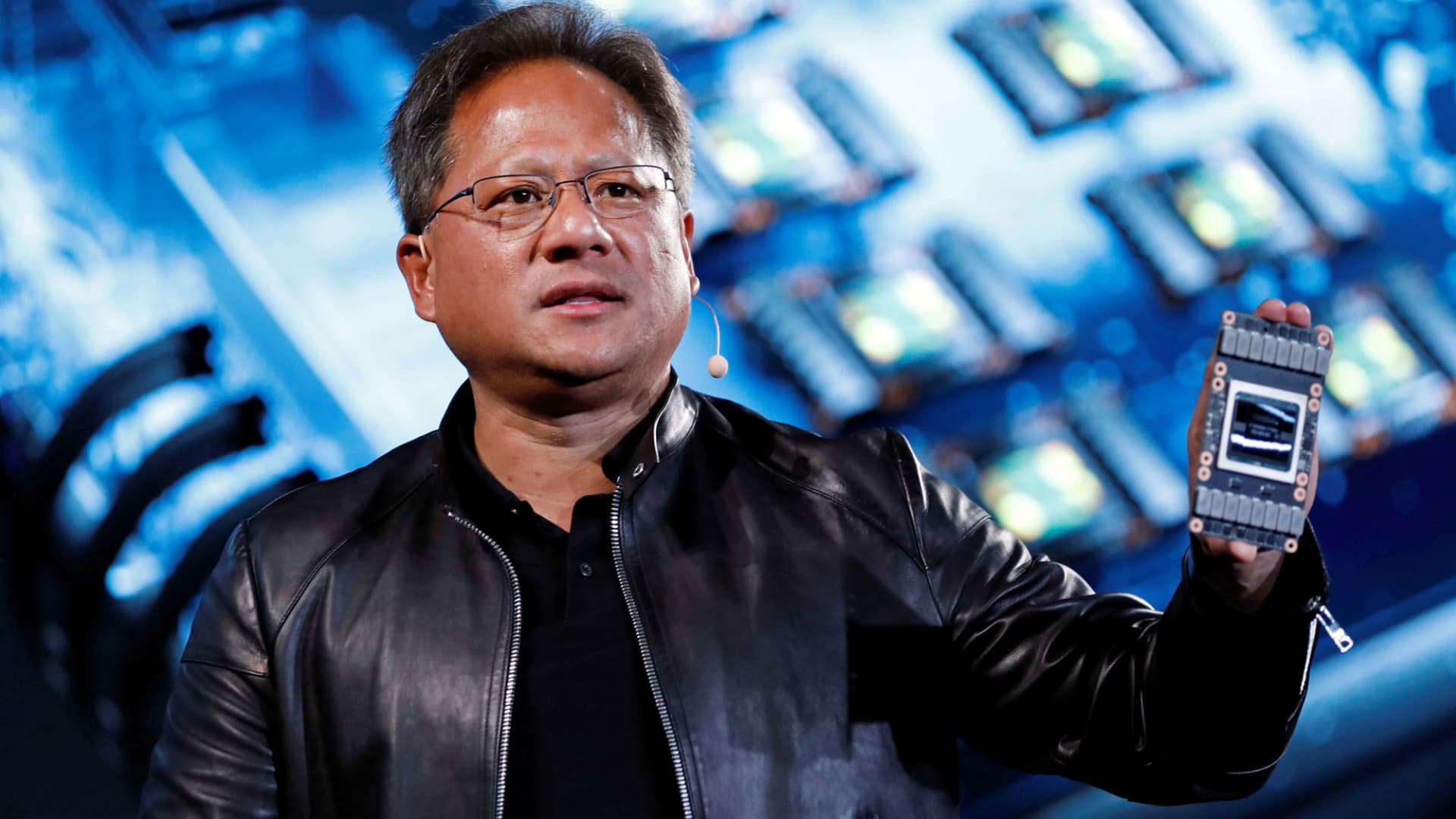

Nvidia co-founder and CEO Jensen Huang attends an function throughout the yearly Computex computer exhibition in Taipei.

Tyrone Siu | Reuters

Nvidia claimed 1st-quarter earnings for its fiscal 2024 on Wednesday, with a more robust-than-envisioned forecast that drove shares up 15% in extended buying and selling.

This is how the organization did vs . Refinitiv consensus estimates for the quarter ending in April:

- EPS: $1.09, altered, versus $.92 anticipated

- Earnings: $7.19 billion, compared to $6.52 billion envisioned

Internet earnings for the quarter was $2.04 billion, vs . $1.61 billion from the very same period of time very last yr. Even so, Nvidia’s in general sales fell 13% on a calendar year-above-calendar year basis.

Nvidia explained it anticipated $.82 for each share on about $11 billion in income, far surpassing Refinitiv expectations of $1.06 for each share on $7.15 billion in revenue.

Nvidia’s gaming division, which features the company’s graphics cards for Laptop profits, noted $2.24 billion in sales, vs . anticipations of $1.98 billion, though all round income for the class was down 38% on an yearly foundation.

Nvidia’s datacenter group, on the other hand, noted $4.28 billion in product sales, as opposed to expectations of $3.9 billion, a 14% once-a-year boost. Nvidia said that the company’s overall performance was pushed by demand for the firm’s GPU chips from cloud providers as very well and significant client net corporations, which use Nvidia chips to practice and deploy generative AI programs like OpenAI’s ChatGPT.

Nvidia inventory is up 109% so significantly in 2023, mostly driven by optimism stemming from the firm’s major place in the industry for AI chips.