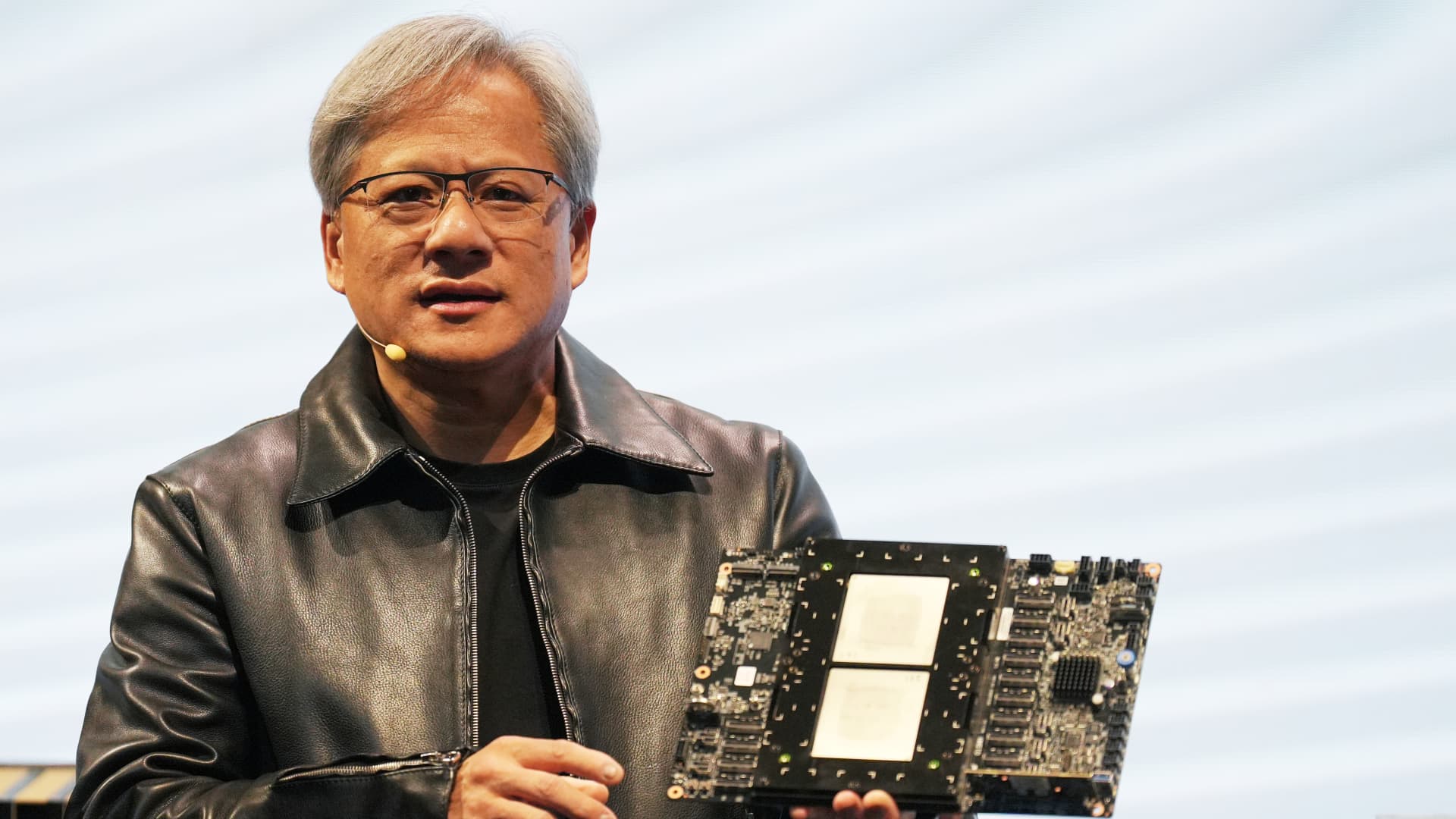

Jensen Huang, president of Nvidia, keeping the Grace hopper superchip CPU applied for generative AI at the Supermicro keynote presentation through Computex 2023.

Walid Berrazeg | Lightrocket | Getty Visuals

Nvidia shares jumped extra than 12% in premarket trade on Thursday soon after the chip large posted bumper earnings that conquer Wall Street estimates.

The U.S. tech big posted income of $22.10 billion for its fiscal fourth quarter, a increase of 265% 12 months-on-yr, when net cash flow surged by 769%, as the corporation continues to see a boost from pleasure over synthetic intelligence.

Nvidia chips are applied to teach the big AI styles these as those people formulated by Microsoft and Meta.

Nvidia sees no indications of slowing. The enterprise forecast its earnings in the latest quarter will strike $24 billion, way in advance of estimates.

“Essentially, the situations are superb for ongoing growth” in 2025 and beyond, Nvidia CEO Jensen Huang instructed analysts on Wednesday, including to the bullish sentiment all over the stock.

Nvidia’s Facts Heart business enterprise, which features the company’s H100 graphics cards that are applied for AI teaching, posted profits of $18.4 billion in the fourth quarter, representing 409% calendar year-on-12 months advancement.

The good outlook from Nvidia prompted a round of broker upgrades on Thursday. JPMorgan elevated its selling price focus on on Nvidia’s inventory from $650 to $850, whilst Financial institution of The us Worldwide Analysis hiked its focus on from $800 to $925.

Nvidia’s stock shut at $674.72 on Thursday. Shares have been underneath pressure ahead of the earnings report as traders took income and traders were being worried that Nvidia could not be ready to strike lofty anticipations.

But its marketplace-beating numbers dispelled people fears and also pulled other world wide chip shares better.