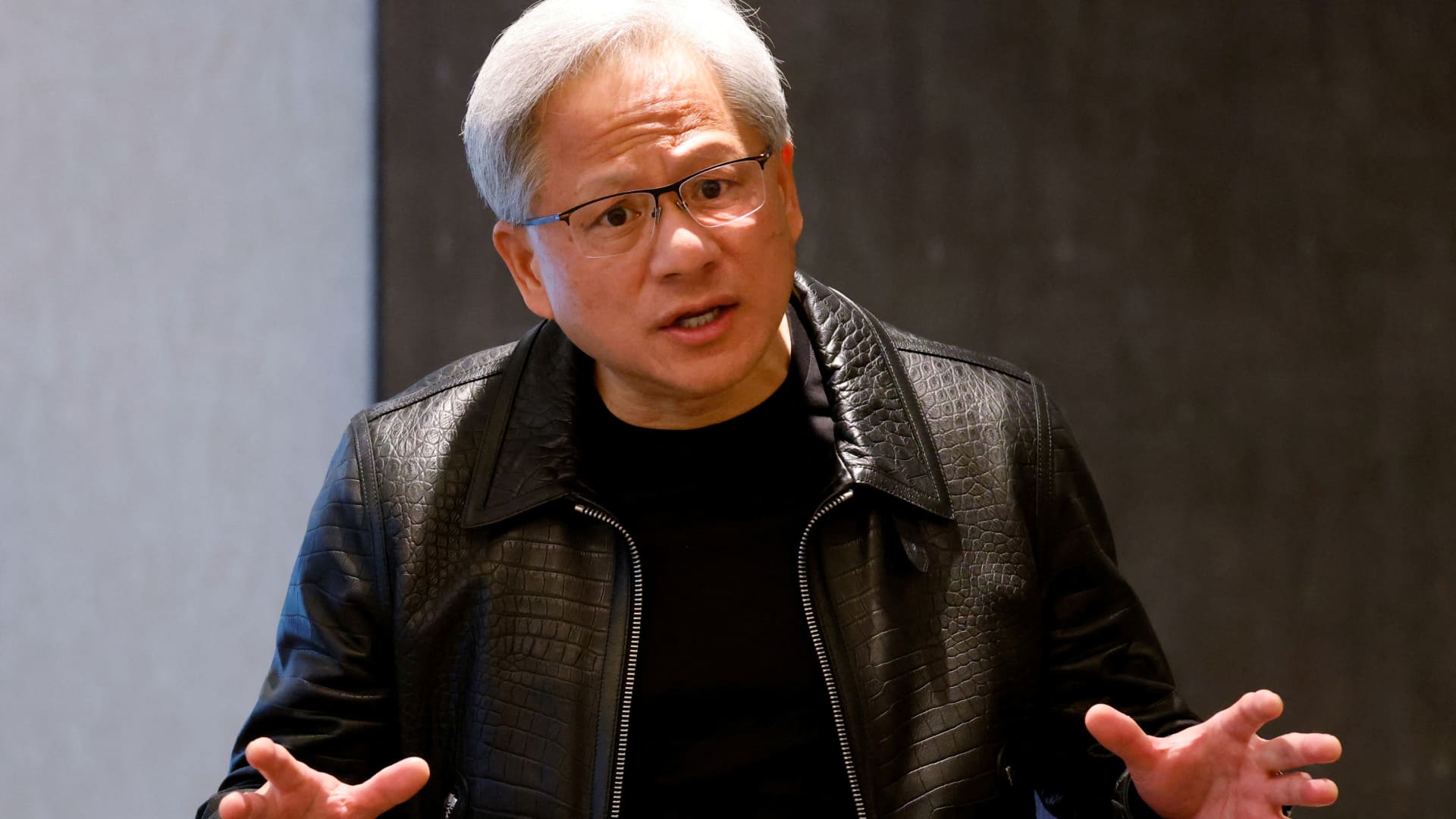

NVIDIA’s CEO Jensen Huang attends a media roundtable meeting in Singapore December 6, 2023.

Edgar Su | Reuters

Nvidia surpassed Google dad or mum Alphabet in current market capitalization on Wednesday. It is really the most up-to-date illustration of how the synthetic intelligence increase has despatched the chipmaker’s inventory soaring.

Nvidia rose about 2% to close at $739.00 for each share, offering it a sector worth of $1.83 trillion to Google’s $1.82 trillion industry cap. The go comes one working day immediately after Nvidia surpassed Amazon in conditions of sector value.

The symbolic milestone is additional affirmation that Nvidia has grow to be a Wall Avenue darling on the back of elevated AI chip sales, valued even more highly than some of the significant software program firms and cloud suppliers that produce and integrate AI know-how into their products and solutions.

Nvidia shares are up about 221% around the previous 12 months on strong demand for its AI server chips that can cost additional than $20,000 every. Companies like Google and Amazon need hundreds of them for their cloud companies. Just before the the latest AI growth, Nvidia was ideal recognised for shopper graphics processors it marketed to Computer system makers to create gaming computers, a less beneficial market place.

Google was mostly predicted to benefit from AI, in particular given that personnel at the organization pioneered many of the procedures — these kinds of as transformer architecture — applied in cutting-edge designs like ChatGPT.

Google shares are even now up 55% in the previous 12 months, even though the firm has grappled with layoffs and lifestyle challenges after it declared a “code pink” scenario to construct AI products and services into its goods. Google announced a $20 for every thirty day period AI membership termed Gemini Highly developed earlier this week, a single of its initially paid out generative AI solutions.

Nvidia is now the third most significant U.S. business, only driving Apple and Microsoft. Nvidia experiences quarterly earnings on Feb. 21. Analysts assume 118% yearly growth in sales to $59.04 billion.