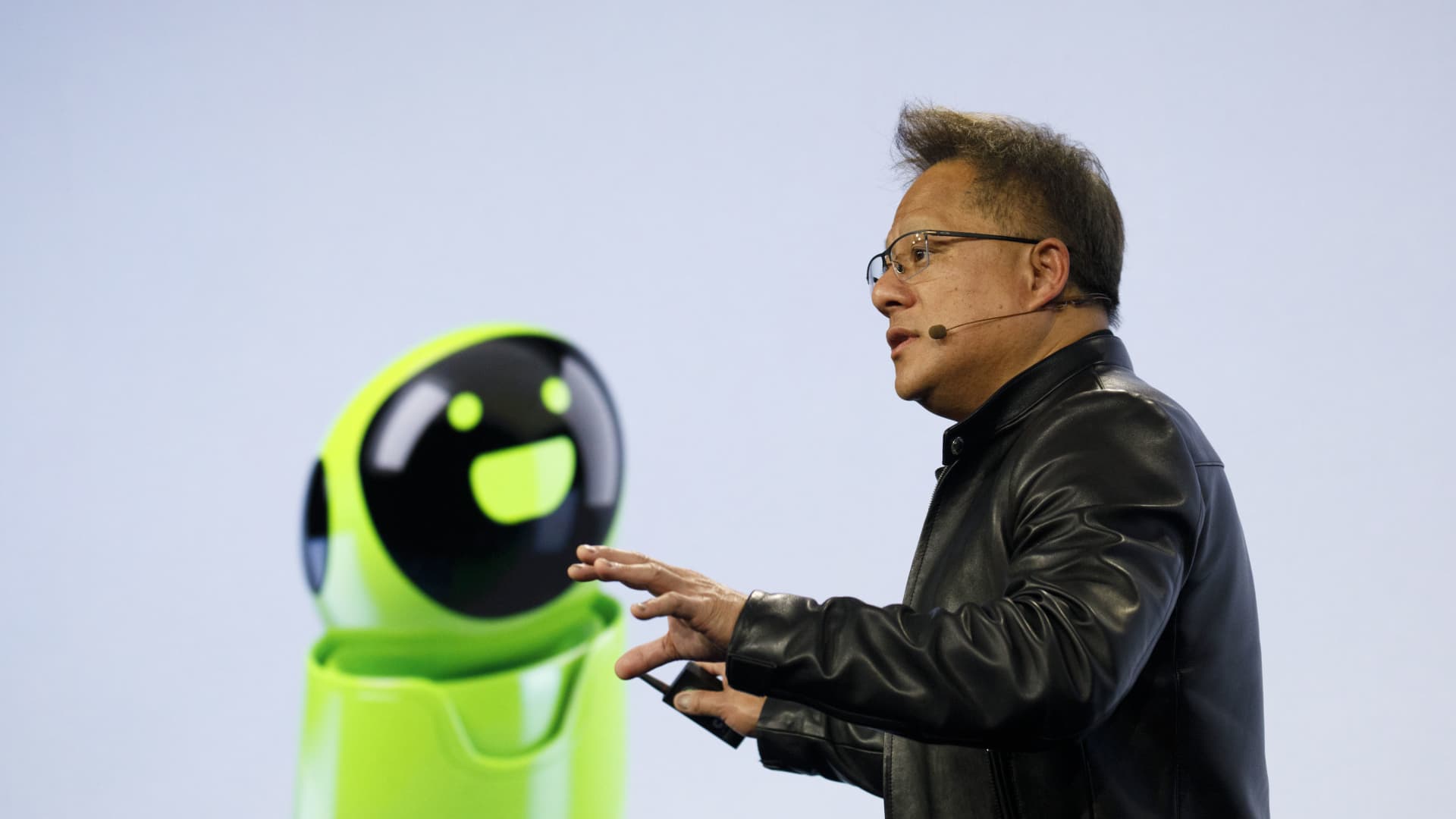

Jen-Hsun Huang, president and main govt officer of Nvidia Corp., speaks all through the firm’s function at Mobile Earth Congress Americas in Los Angeles, California, U.S., on Monday, Oct. 21, 2019.

Patrick T. Fallon | Bloomberg | Getty Visuals

As long as firms are interested in generative synthetic intelligence, Nvidia stands to advantage.

Nvidia shares shut up extra than 7% Monday, underscoring how buyers imagine the firm’s graphics processing units (GPUs) will carry on to be the most well known personal computer chips used to power huge, big language versions that can crank out compelling textual content.

Morgan Stanley introduced an analyst observe on Monday reiterating that Nvidia proceeds to be a “Top rated Decide” coming off the firm’s most modern earnings report, in which it supplied a far better-than-envisioned forecast.

“We feel the new selloff is a good entry stage, as regardless of supply constraints, we even now hope a meaningful defeat and increase quarter — and, far more importantly, potent visibility in excess of the future 3-4 quarters,” the Morgan Stanley analysts wrote. “Nvidia continues to be our Best Select, with a backdrop of the huge change in shelling out towards AI, and a relatively remarkable offer demand from customers imbalance that should really persist for the subsequent a number of quarters we feel the recent selloff is a great entry position.”

Nvidia, now valued at about $1 trillion, bested all other organizations all through this year’s tech rebound adhering to a market slump in 2022, with the chip giant’s shares up virtually 200% so considerably in 2023.

While Nvidia shares dropped a very little over 10% this month, partly attributed to offer constraints and ongoing issues about the broader economic system and whether or not it will encounter a significant rebound, the Morgan Stanley analysts predict that Nvidia will profit in the lengthy operate.

“The bottom line is that this is a incredibly constructive condition, October figures are entirely gated by offer, and the upper conclusion of the acquire facet consensus has been reined in,” the analysts wrote. “We see numbers are likely up at the very least ample that this inventory will trade at P/Es additional comparable to the higher end of semis, with product upside still in advance.”