Nvidia shares dipped 3% Tuesday morning just after the enterprise unveiled its hottest generation of synthetic intelligence chips identified as Blackwell.

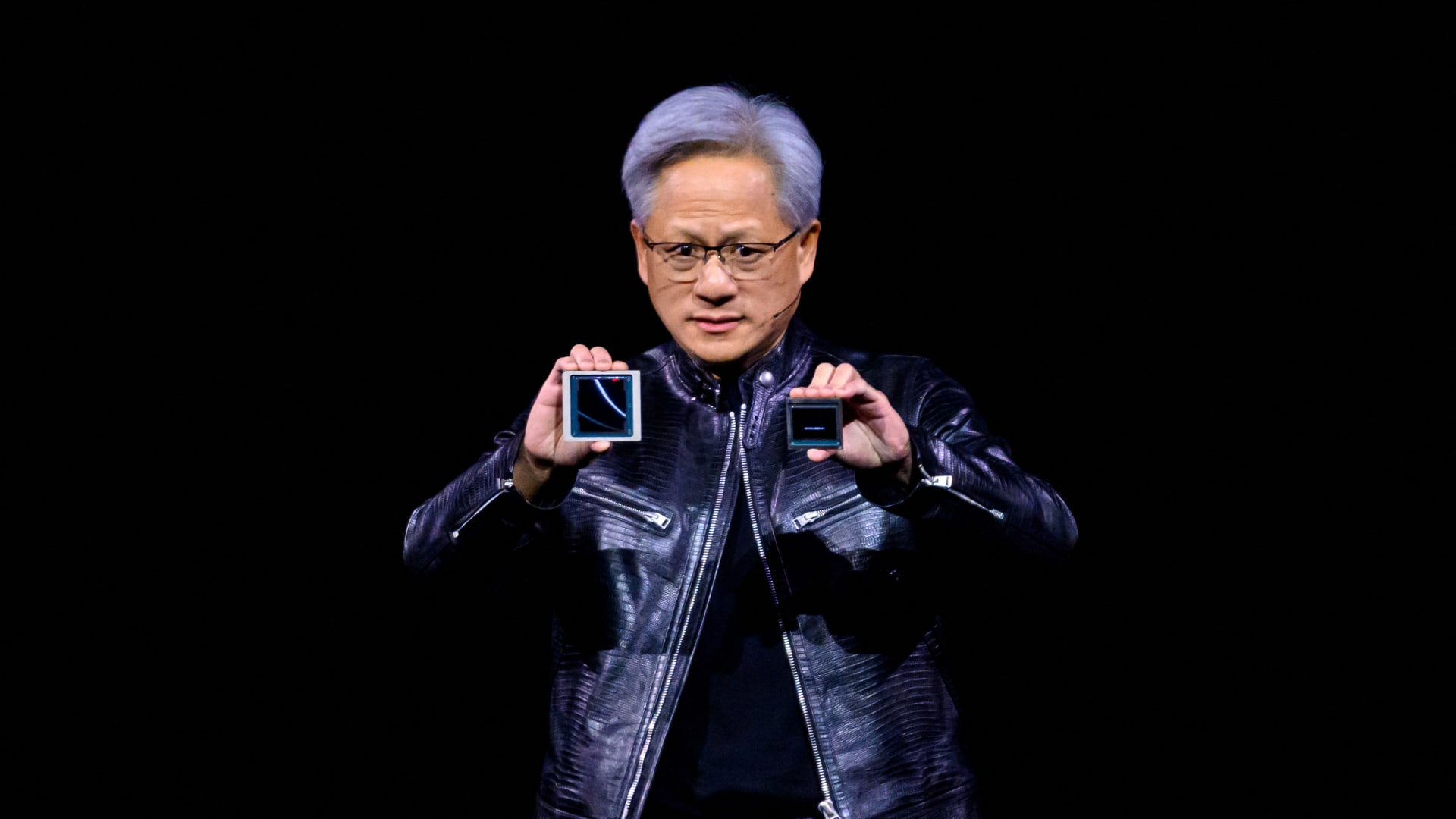

CEO Jensen Huang declared the new chips on Monday at Nvidia’s builders meeting in San Jose, California, touting them as an even much more impressive processor than the recent generation of Hopper graphics processing units, which have been highly sought immediately after for jogging substantial AI versions. The initially Blackwell chip is the GB200 and will ship later this year.

“We had to invent some new technology to make it achievable,” mentioned Huang, keeping up just one of the new chips for the duration of an job interview with CNBC’s “Squawk on the Street” on Tuesday. He believed a person chip could expense $30,000 to $40,000 and that the R&D price range for the processor totaled all around $10 billion.

The corporation on Monday also introduced a new company program merchandise regarded as Nvidia Inference Microservice, which can make it less complicated to run older generations of Nvidia GPUs.

“Go over Taylor Swift, you are not the only 1 that can offer out a stadium as Jensen introduced his GTC keynote to a packed crowd at the SAP Middle in San Jose,” Bernstein analysts wrote in an investor take note Tuesday, keeping an outperform rating and $1,000 value target on the stock.

Wells Fargo analysts reacted to the chipmaker’s announcement with measured optimism, reiterating their chubby rating on Nvidia shares although boosting their price tag target to $970 from $840.

“When NVDA as soon as yet again highlighted its comprehensive stack / platform differentiation, we think some may have predicted a little bit much more out of the Blackwell B200 start,” the analysts wrote in a notice.

Still, the Wells Fargo analysts wrote the information reinforced their “prolonged-standing positive thesis” on Nvidia’s technological know-how and monetization possibilities.

Analysts at Goldman Sachs, retaining a obtain rating of Nvidia stock, lifted their selling price concentrate on to $1,000 from $875 on Tuesday and expressed “renewed appreciation” for Nvidia’s innovation, consumer and partner associations, and pivotal job in the generative AI place subsequent the company’s keynote.

“Dependent on our the latest market conversations, we count on Blackwell to be the fastest ramping item in Nvidia’s heritage,” the analysts wrote in a be aware to investors. “Nvidia has performed (and will carry on to engage in) an instrumental job in democratizing AI across lots of field verticals.”