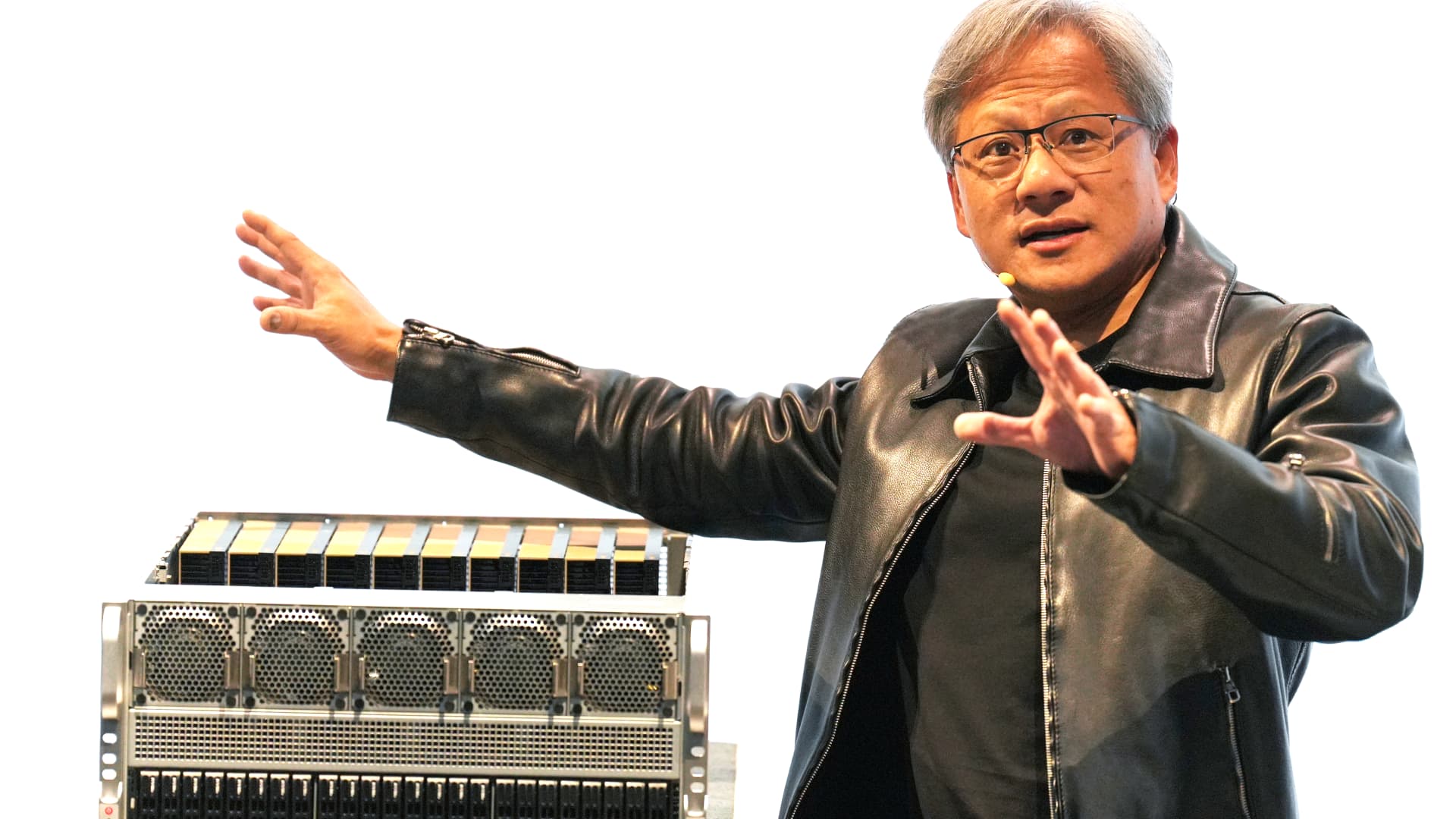

Nvidia CEO Jensen Huang speaks at the Supermicro keynote presentation all through the Computex convention in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Pictures | Lightrocket | Getty Images

Buyers have become so enamored with Nvidia’s synthetic intelligence tale that they want a piece of everything the chipmaker touches.

On Wednesday, Nvidia disclosed in a regulatory filing that it has stakes in a handful of community businesses: Arm, SoundHound AI, Recursion Pharmaceuticals, Nano-X Imaging, and TuSimple.

With the exception of Arm, which topped $130 billion in current market cap a short while ago, shares of the Nvidia-backed organizations soared on Thursday next the 13F filing, a sort that should be submitted by institutional expenditure administrators overseeing at minimum $100 million in assets.

But none of these investments would be surprising to anyone who took the time to sift by means of previous information experiences and filings. The AI mania is firmly in an irrational exuberance phase, and investors are pouncing on nearly anything and almost everything in the house.

No inventory is hotter than Nvidia, which passed Amazon in current market worth on Tuesday and then Alphabet on Wednesday to come to be the 3rd most valuable business in the U.S., behind only Apple and Microsoft. Nvidia shares are up extra than 200% in excess of the earlier 12 months thanks to seemingly limitless demand for its AI chips, which underpin highly effective AI versions from Google, Amazon, OpenAI and other folks.

SoundHound, which works by using AI to approach speech and voice recognition, jumped 68% on Thursday, after Nvidia disclosed a stake that amounted to $3.7 million at the time of the filing. Nvidia invested in SoundHound again in 2017 as element of a $75 million enterprise spherical.

SoundHound went general public through a specific objective acquisition business in 2022, and Nvidia was named as a strategic trader in its presentation.

Nano-X utilizes AI in professional medical imaging. Nvidia’s disclosure of a $380,000 financial investment in the enterprise sent the inventory up 59% on Thursday. Nvidia’s involvement dates back decades to a undertaking investment decision in Zebra Professional medical, an Israeli health-related imaging startup. Nano-X obtained Zebra in 2021.

TuSimple, an autonomous trucking organization, rocketed 40% on Thursday just after the disclosure of Nvidia’s $3 million stake. The share rally will come a month following the corporation introduced designs to delist from the Nasdaq because of to a “sizeable change in money markets” considering the fact that its 2021 IPO. TuSimple debuted at $40 a share and now trades for around 50 cents.

“Accordingly, the Special Committee determined that the added benefits of remaining a publicly traded firm no for a longer time justify the expenditures,” TuSimple mentioned in a release on Jan. 17. “The Organization is undergoing a transformation that the Company thinks it can superior navigate as a non-public firm than as a publicly traded one.”

Nvidia invested in TuSimple in 2017, four decades in advance of the IPO.

Nvidia acquired its stake in biotech organization Recursion extra lately. Like TuSimple, Recursion went public in 2021, but Nvidia acquired in two many years later on by what’s referred to as a personal financial commitment in community equity (PIPE). Nvidia purchased $50 million value of shares in 2023 and now has an investment worthy of $76 million, according to its filing.

Recursion shares spiked 15% on Thursday.

Nvidia’s possess financials will be on complete display up coming week, when the organization stories quarterly earnings. Analysts are expecting calendar year-above-calendar year profits progress over 200% to far more than $20 billion.

The company’s much more modern investments are most likely to be considerably a lot more considerable than its previously bets, disclosed late Wednesday, due to the fact they’re at the coronary heart of the AI boom. In current decades, Nvidia has backed very hot AI startups such as Cohere, Hugging Experience, CoreWeave and Perplexity.

“AI is reworking the way consumers obtain details,” mentioned Jonathan Cohen, Nvidia’s vice president of utilized investigate, in Perplexity’s announcement of a $73.6 million funding spherical last month “Perplexity’s planet-class team is making a trustworthy AI-driven lookup platform that will support press this transformation ahead.”

Enjoy: Perplexity AI aims to rival Google