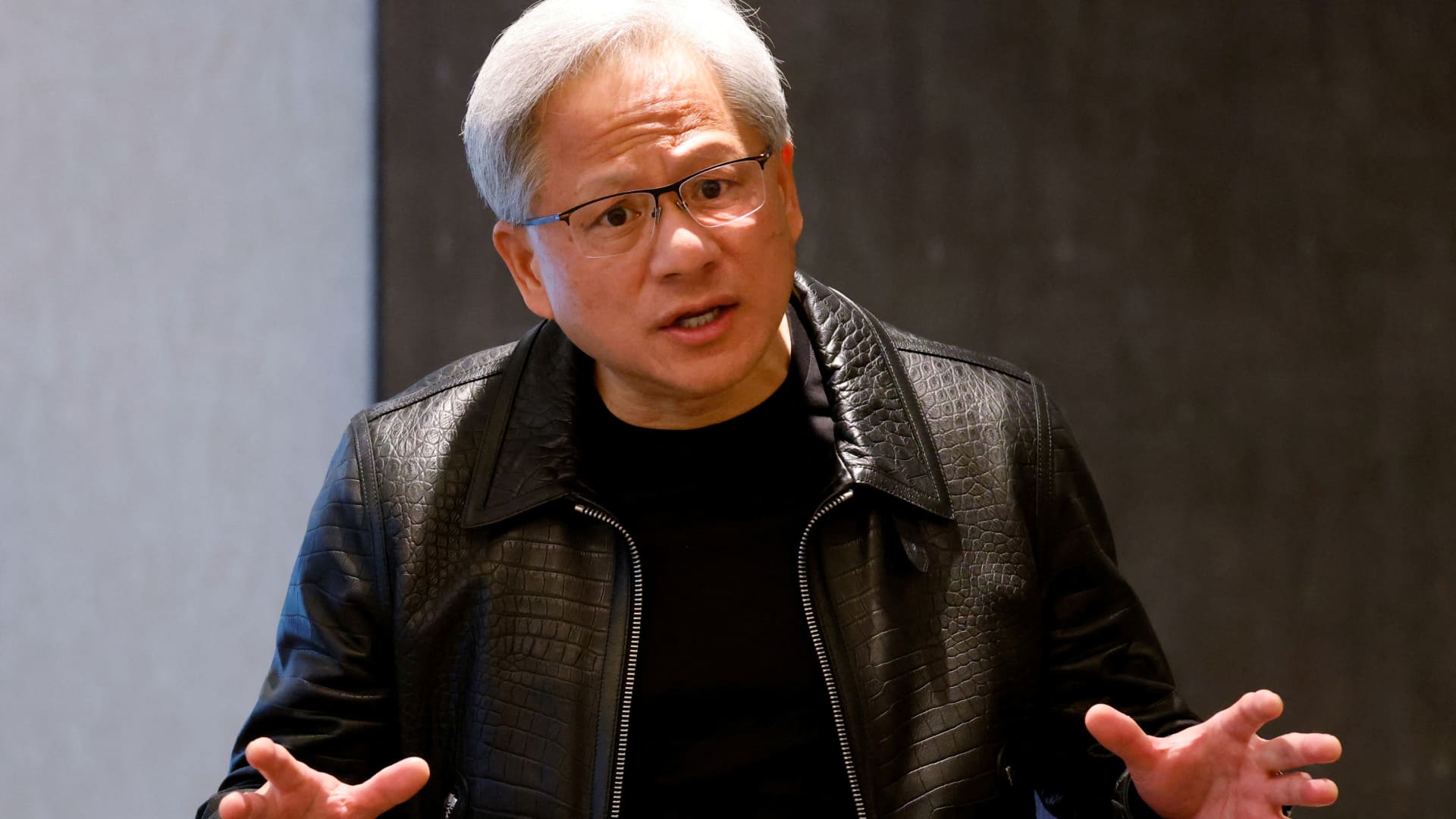

NVIDIA’s CEO Jensen Huang attends a media roundtable assembly in Singapore December 6, 2023.

Edgar Su | Reuters

Nvidia is scheduled to announce fiscal fourth-quarter earnings just after the bell Wednesday in a highly expected report that will give Wall Street a perception of how prolonged the AI increase can past.

Nvidia has been the most important beneficiary of the recent technologies sector obsession with huge synthetic intelligence products, which are formulated on the company’s dear graphics processors for servers.

Nvidia’s inventory price has soared nearly fivefold since the close of 2022, giving the company a current market value of $1.72 trillion, briefly surpassing tech giants Amazon and Alphabet.

Nvidia has to meet up with elevated expectations stoked by trader appetite for AI firms.

Analysts expect Nvidia to post a 240% enhance in profits from the yr-ago interval, for a complete of $20.6 billion, pushed by $17.06 billion in information heart earnings — the organization that sells AI GPUs like the H100. Internet profits is forecast to surge a lot more than sevenfold to $10.5 billion in the January quarter.

Buyers want to hear from Nvidia CEO Jensen Huang about how lengthy these stratospheric expansion charges can previous. 1 worry is that quite a few of Nvidia’s GPUs are offered to huge tech organizations this kind of as Microsoft, Amazon, Meta and Google.

Those corporations reported earnings in new months and signaled they will keep on to invest in new GPUs in the brief expression, but some analysts believe the lengthy-phrase photograph for demand could be more mixed.

“They referred to their purchasing as ‘flexible’ and ‘demand pushed,’ implying they would scale it down if we bought previous the existing hype cycle,” D.A. Davidson analyst Gil Luria wrote in a recent take note to investors. “Although we do not think we are there however, we are observing doable early signals.”

Nvidia is also arranging to start off delivery a new best-conclusion server GPU called the B100 in 2024. The timing of that chip could affect the company’s expansion fee.

In the existing quarter, Wall Road analysts hope a 208% level of progress to about $22.17 billion in sales.

Nvidia has other firms, from chips for Computer gaming to automotive chips. But the concentration Wednesday will continue being mostly on its AI GPUs, which make up extra than 80% of Nvidia revenue.

“The [data center] GPU variety will be the only crucial metric that issues alongside with commentary on broader industry adoption,” wrote Barclays analyst Thomas O’Malley in a notice earlier this thirty day period.