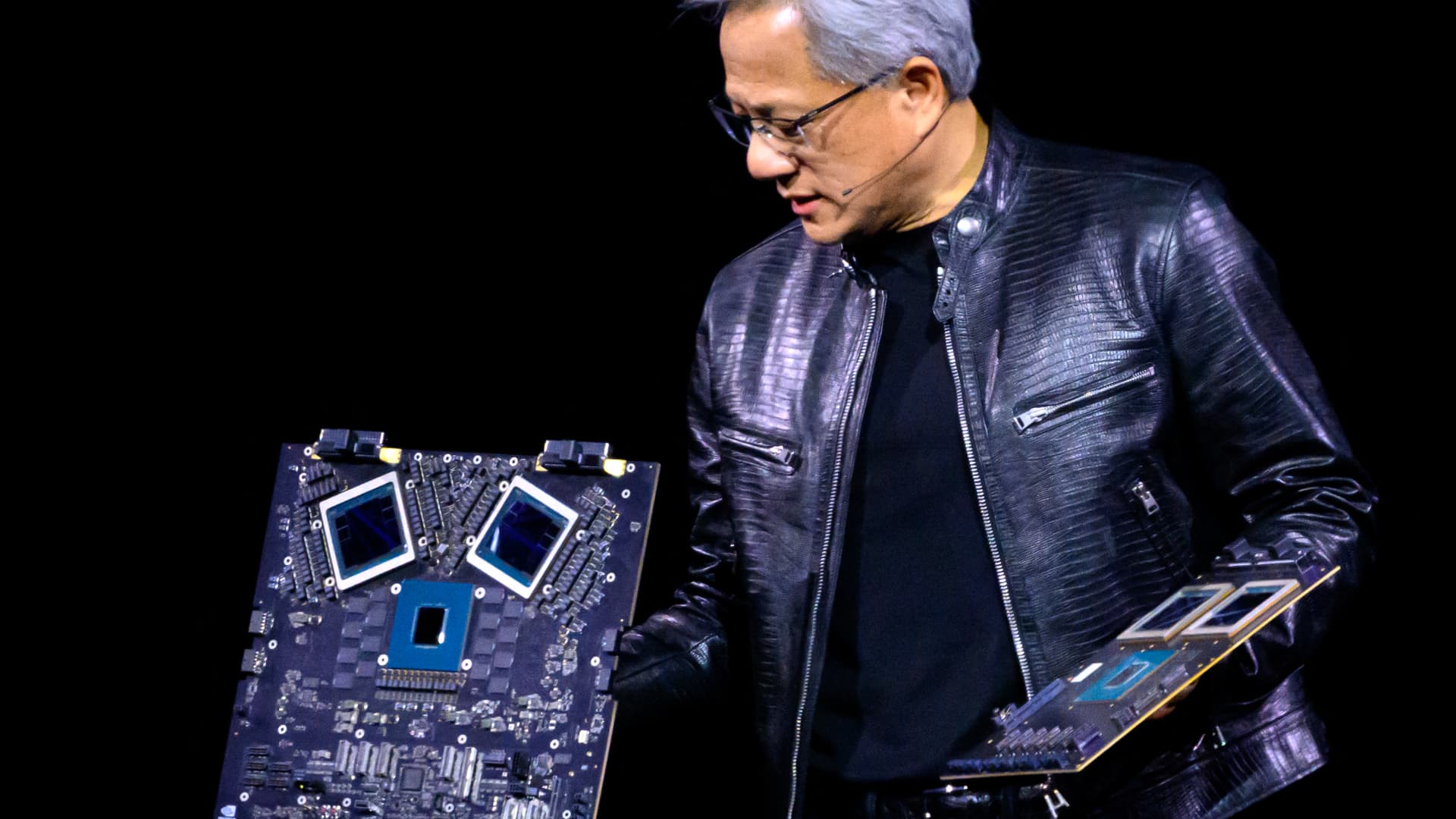

Nvidia founder and CEO Jensen Huang displays solutions onstage during the yearly Nvidia GTC Conference at the SAP Middle in San Jose, California, on March 18, 2024.

Josh Edelson | Afp | Getty Pictures

Chipmaking giant Nvidia has entered “correction territory,” with shares now down 10% from all-time highs.

The business, which helps make graphics processing models — or GPUs — has been a critical beneficiary of the synthetic intelligence boom, which boosted desire for its chips.

Nvidia GPUs are normally utilised for compute-intense AI applications, these as OpenAI’s ChatGPT AI chatbot. Its server chips are also a key ingredient of knowledge centers.

The firm’s monetary general performance has been on a tear in the past yr. It noted a 486% jump in non-GAAP earnings for each diluted share in the December quarter, citing big chips demand from customers, thanks to the attractiveness of generative AI designs.

The stock has occur below force for the past two weeks, on the other hand. Shares are off 10% from their last all-time substantial shut of $950 apiece, which they strike on March 25. The stock closed at a rate of $853.54 on Tuesday, down 2% for the session.

Shares are down 1% in U.S. premarket investing.

Definitions on what constitutes a market correction differ, but it is frequently deemed to be a sustained fall of 10% or much more from all-time highs.

What is the reason for the shift?

The precise rationale for the downward move has not been instantly clear. Traders could be taking profit on the stock, right after a wild get of in excess of 200% for the shares in the previous 12 months. And on Tuesday, rival chipmaker Intel unveiled a new AI chip called Gaudi 3, aimed at powering substantial language styles — the cornerstone technologies at the rear of generative AI applications like OpenAI’s ChatGPT.

Intel explained the new chip is about twice as electrical power-effective as Nvidia’s H100 GPU — the U.S. chip giant’s most highly developed graphics card — and can run AI products a single-and-a-fifty percent times a lot quicker than this tech.

Analysts at D.A. Davidson reported in a investigate be aware that they anticipate a “shrinking” of the dimension of AI designs, which include options like Mistral’s Massive and Meta’s LLaMA model, to push down need for Nvidia’s inventory around time.

“Though NVDA (Neutral-rated) must produce a impressive 2024 (and perhaps into 2025), we keep on to imagine new developments set up a substantial cyclical downturn by 2026,” D.A. Davidson analysts explained in the 9 be aware Tuesday.

“A mixture of shrinking models, more steady progress in desire, maturing hyperscaler investments, and improved reliance by their biggest consumers on their own chips do not bode properly for NVDA’s out a long time.”

– CNBC’s Ganesh Rao contributed to this report