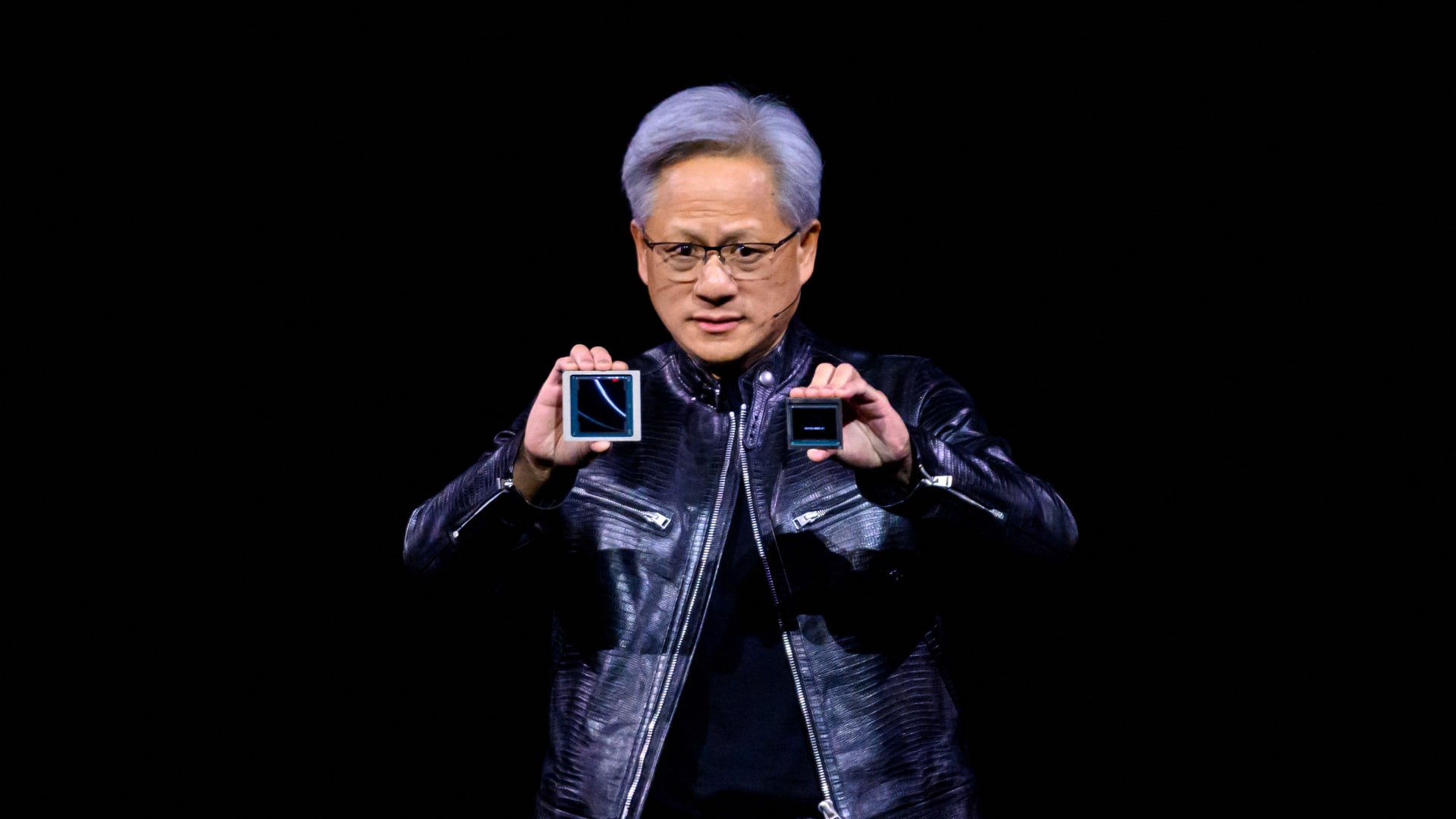

In the wake of Nvidia ‘s launch of effective new artificial intelligence chips, Goldman Sachs is predicting key growth for memory chips used in AI methods. Termed Blackwell, the new GPU chips from Nvidia that ability AI products involve the latest 3rd-era memory chips, also recognized as higher-bandwidth memory (HBM/HBM3E). The investment decision bank expects the complete addressable market for HBM to grow tenfold to $23 billion by 2026, up from just $2.3 billion in 2022. The Wall Avenue lender sees three key memory makers as primary beneficiaries of the booming HBM marketplace: SK Hynix , Samsung Electronics and Micron . All a few shares are also traded in the U.S., Germany, and U.K. Buyers can also make investments in the 3 shares via exchange-traded cash. Although Invesco Next Gen Connectivity ETF (KNCT) retains all 3 stocks in a very concentrated fashion, WisdomTree Synthetic Intelligence and Innovation Fund (WTAI) has considerably less than 2% allocation towards just about every. MU 1Y line Goldman Sachs reported more powerful AI demand from customers was driving greater AI server shipment and greater memory chip density for each GPU – the chip powering AI – foremost them to “meaningfully raise” their estimates. Goldman analysts led by Giuni Lee mentioned in a note to shoppers on March 22 that all 3 “will benefit from the sturdy growth in the HBM current market and the restricted [supply/demand], as this is main to a ongoing significant HBM pricing high quality and very likely accretion to every company’s over-all DRAM margin.” Investors have been cautious about the memory current market for AI systems given that all 3 important suppliers are due to develop production ability and insert downward stress on income margins. On the other hand, Goldman analysts consider challenges like more substantial chip measurements and decrease creation yields for HBM compared with common DRAM memory chips are very likely to maintain supply tight in the near potential. The Wall Avenue lender is not by itself in its view. Citi analysts experienced also advised consumers likewise in February. “Despite sector problems on opportunity HBM oversupply as all a few DRAM makers enter the HBM3E place, we see sustained supply tightness in HBM3E house provided demand progress from Nvidia and other AI customers amid restricted source advancement on minimal generate and improved memory fabrication complexity,” claimed Citi analyst Peter Lee in a take note to clients on Feb. 27. Goldman also cited suppliers as expressing “that their HBM potential for 2024 is completely booked, when 2025 supply is by now becoming allocated to consumers.” However, the expenditure financial institution expects SK Hynix to preserve in excess of 50% current market share for at the very least the subsequent handful of decades, many thanks to its “robust customer/source chain marriage” and its know-how, which is thought to have “greater productivity and produce when compared to its peers’ alternatives.” The Goldman analysts also reported Samsung Electronics has “the possibility to acquire market share around the medium expression.” Previously this thirty day period, Nvidia CEO Jensen Huang hinted during a media briefing that his organization is in the system of qualifying Samsung Electronics’ most current HBM3E chips for its graphics processing units . In the meantime, Micron could begin outgrowing rivals in 2025 by narrowing its concentration on the HBM3E regular, in accordance to the financial commitment bank. — CNBC’s Michael Bloom contributed to this report.