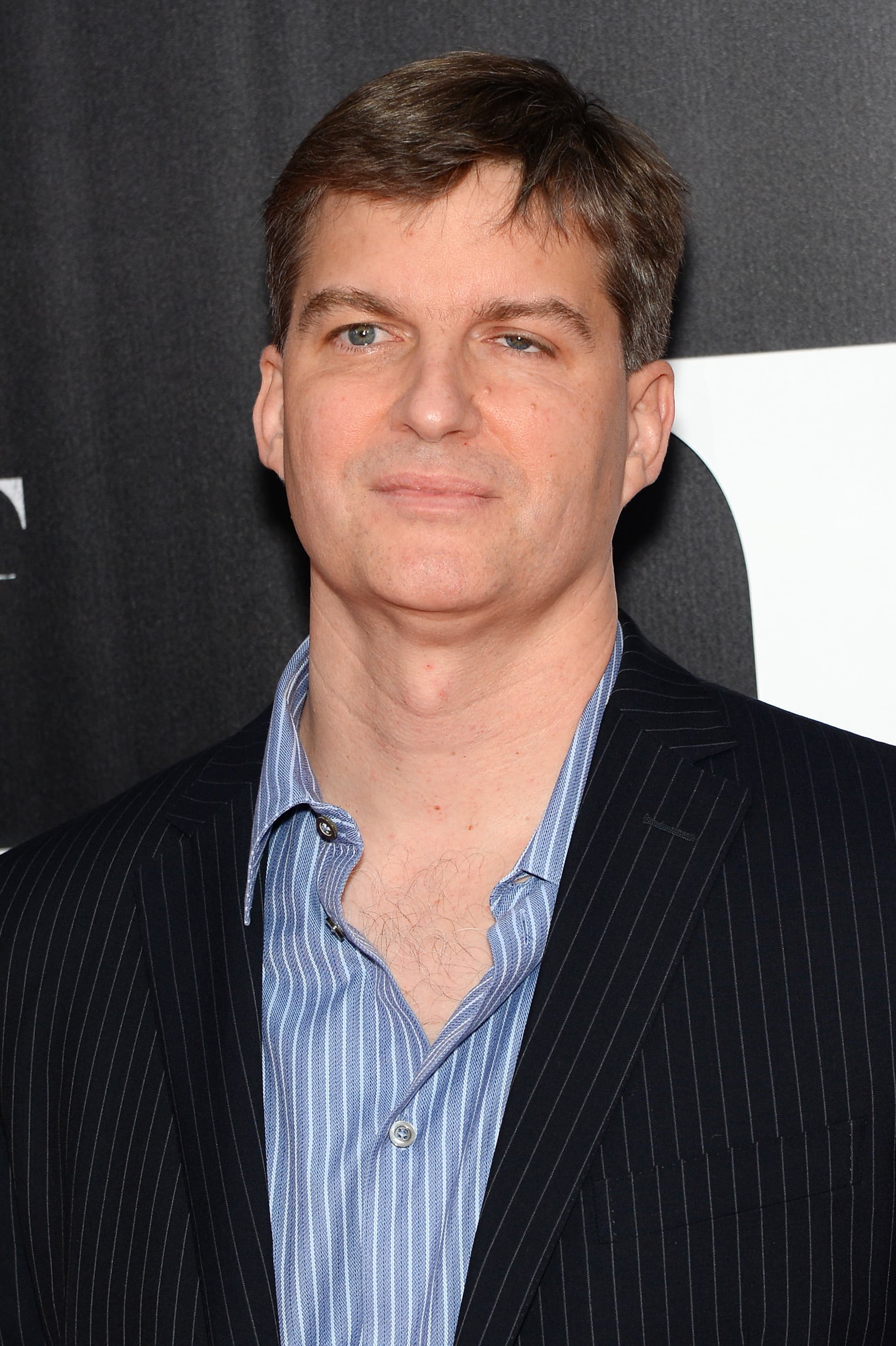

Sam Bankman-Fried, co-founder and CEO of FTX, in Hong Kong, China, on Tuesday, Could 11, 2021.

Lam Yik | Bloomberg | Getty Illustrations or photos

Freshly appointed FTX CEO John Ray III minced no terms in a filing with the U.S. Personal bankruptcy Court docket for the District of Delaware, declaring that “in his 40 many years of lawful and restructuring encounter,” he experienced never found “these types of a full failure of company controls and these a finish absence of reputable monetary details as happened listed here.”

Ray previously served as CEO of Enron soon after the implosion of the electrical power titan. He promised to operate with regulators to investigate FTX founder Sam Bankman-Fried.

associated investing information

In the submitting, Ray disclosed that he did “not have self esteem” in the precision of the equilibrium sheets for FTX and its sister firm Alameda Investigate, composing that they had been “unaudited and created whilst the Debtors [FTX] were controlled by Mr. Bankman-Fried.”

The doc is a declaration from Ray in his new position as CEO of FTX and affiliated entities, which filed for individual bankruptcy past week in an implosion that remaining the crypto earth reeling and buyers shaken.

Ray excoriated Bankman-Fried and his administration workforce for what ended up explained as lackadaisical controls on units and regulatory compliance.

“The focus of manage in the palms of a quite small group of inexperienced, unsophisticated and possibly compromised individuals” was unparalleled, the previous Enron recovery boss stated.

Ray explained a “sizeable part” of assets held with FTX may well be “lacking or stolen,” adhering to widespread stories on social media of the theft of hundreds of millions in cryptocurrencies.

Coordinating with regulators, Ray wrote, the Chapter 11 personal bankruptcy method would study the actions of Bankman-Fried in connection with FTX’s collapse.

Alarmingly, Ray wrote that part of his remit would be to put into action controls and fundamental company expectations this sort of as “accounting, audit, hard cash management, cybersecurity, human assets, possibility management, knowledge security and other methods that did not exist, or did not exist to an suitable degree, prior to my appointment.”

Bankman-Fried and FTX “management techniques incorporated the use of an unsecured group e-mail account as the root user to entry private private keys and critically delicate info for the FTX Group businesses all-around the entire world, the absence of day by day reconciliation of positions on the blockchain, the use of program to conceal the misuse of client resources.”

Bankman-Fried was not immediately obtainable for comment.

Advanced software program was equally applied to conceal mismarked and fraudulent buyer positions in the 2008 collapse of Bernie Madoff’s Ponzi plan.

FTX is presently operating to account for an accurate statement of money and crypto belongings. Ray explained it would not be “ideal for stakeholders or the Court to depend on the audited economic statements as a reputable indication of the money situations” of FTX.