With lingering high inflation, stock market volatility and recession fears, it’s easy to see why some Americans might trim charitable giving.

But some donors may be eyeing bigger gifts for 2022 because of that economic uncertainty, according to a study from Fidelity Charitable, a nonprofit enabling investors to give through a so-called donor-advised fund, a charitable investment account.

Nearly 75% of those surveyed said they worry about other community members, and 64% are concerned about nonprofits amid threats of a recession. As a result, 59% of donors may be willing to give more this year, according to the survey, which polled 969 of the nonprofit’s donors in July and August.

More from Personal Finance:

The best time to apply for college financial aid is coming up

What the Fed’s third 75 basis point interest rate hikes mean for you

Benchmark bond yields are ‘bad news’ for investors as the Fed hikes rates

Individual Americans donated an estimated $326.87 billion to charity in 2021, a 4.9% rise compared to the prior year, according to Giving USA.

While the organization predicted “a robust year” for giving in 2022, it also emphasized the link between philanthropy and the strength of the stock market. The report came out as the stock market approached record highs in December, but the S&P 500 has dropped more than 20% year-to-date.

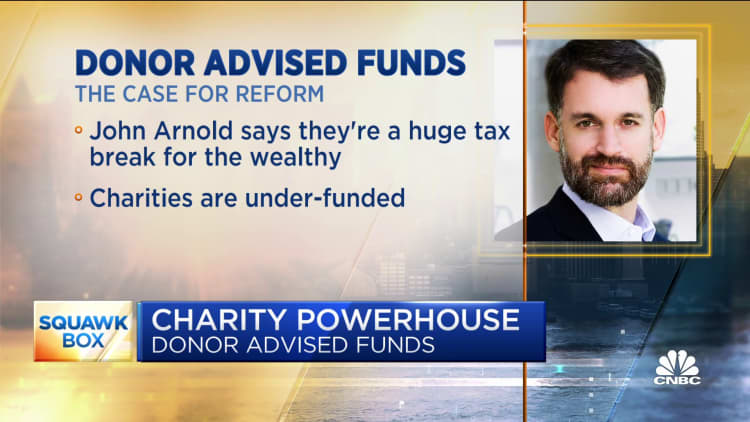

Donor-advised funds may make it easier to give

While some donors may be unsure about 2022, it may be an easier choice if you already have money in a donor-advised fund, allowing an upfront donation and the option to pick recipients over time, said certified financial planner David Foster, founder of Gateway Wealth Management in St. Louis. A donor-advised fund is a charitable account for future gifts.

“You’ve already made that decision,” he said. “Now it’s just a matter of doing it a little quicker.”

Indeed, 67% of donors said they have given more to charity than they would have without a donor-advised fund, the Fidelity Charity study shows, and 57% have used their account to “respond to an emergency or disaster situation.”

However, if someone didn’t transfer money upfront, new donations for 2022 may be smaller than previous years due to less income or lower account balances.

“From my experience, people are still giving roughly the same percentage of either their income or their wealth,” said Foster. “It’s just that their incomes and wealth are down because of the economy.”

“There’s just less wealth to give,” he added.

While donor-advised funds are a popular option, older investors may also consider so-called qualified charitable distributions, or QCDs.

These are direct gifts from an IRA to an eligible charity. If you’re age 70½ or older, you may donate up to $100,000 per year, and it may count as a required minimum distribution once you turn 72.

“There are relatively few circumstances where that would not be the first source of giving if you’re over 70½,” Foster said.

Although QCDs don’t provide a charitable deduction, the transfer won’t count as part of your adjusted gross income, which can trigger higher Medicare Part B and Part D premiums.