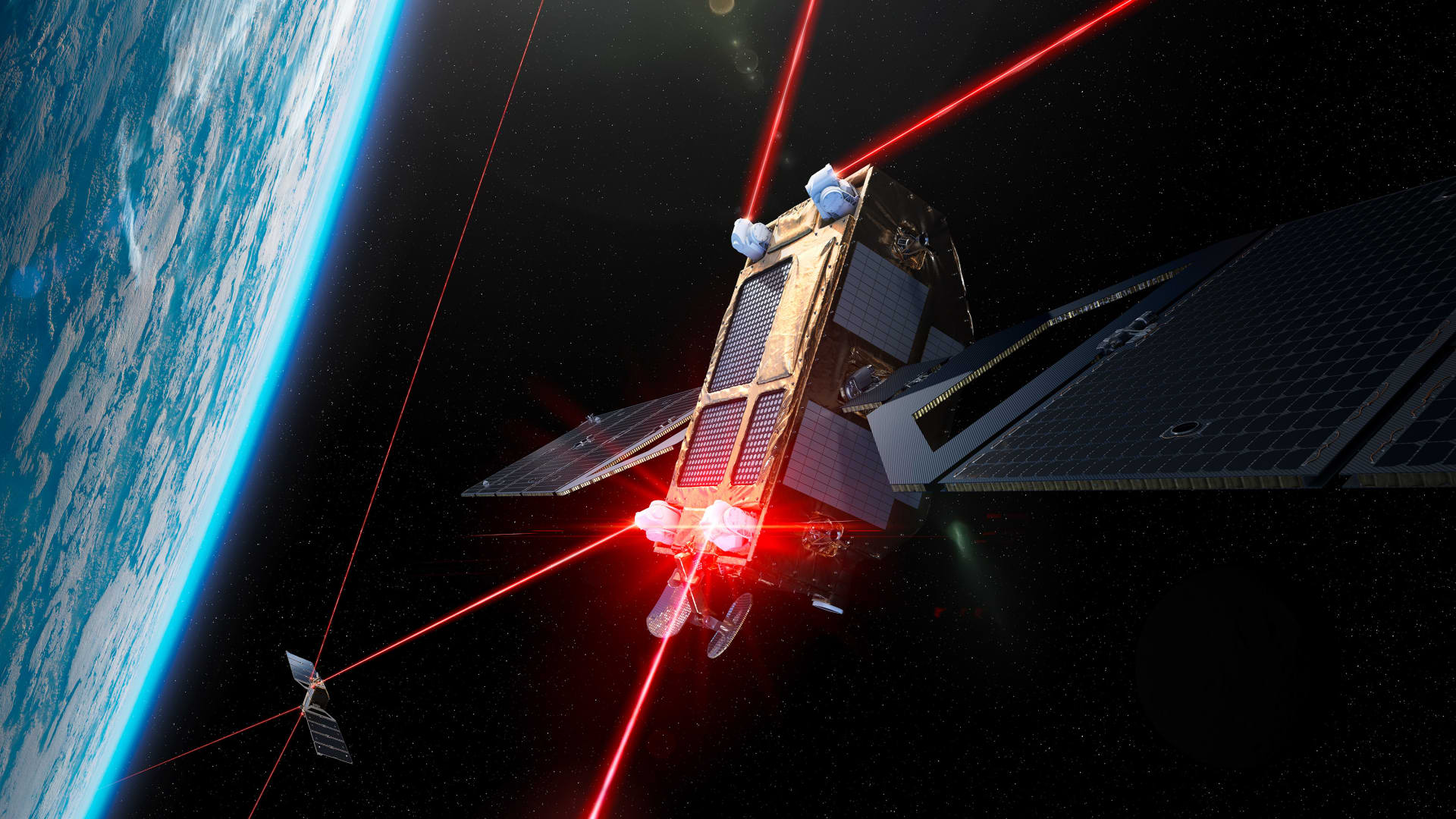

A rendering of the company’s laser communications system on satellites in orbit.

Mynaric

Space stock Mynaric tanked in trading Tuesday after the company announced heavy cuts to its previous revenue forecast and the departure of the company’s chief financial officer.

Germany-based Mynaric slashed its 2024 revenue guidance nearly 70% at the midpoint, cutting its previous range of 50 million euros to 70 million euros, to a range of 16 million euros to 24 million euros, or $18 million.

The company had stated that revenue outlook as recently as June 20.

“The guidance decrease is due to production delays of [our satellite laser communication terminal] CONDOR Mk3 caused by lower than expected production yields and component supplier shortages of key components,” Mynaric said in a press release.

At the same time, Mynaric announced “the voluntary departure of CFO Stefan Berndt von-Bulow for personal reasons, effective last week.” Berndt von-Bulow has been with the company since 2018, serving in the CFO role for the past four years.

The German space lasers company debuted on the Nasdaq in late 2021 at a market value of about $325 million. But the stock has fallen steadily since, dropping below $2 a share and trading below a market value of $50 million, according to FactSet.

Mynaric shares fell more than 56% on Tuesday to close at $1.83, their worst single day of trading since going public.

Mynaric makes optical communication terminals, devices that use a laser to send data from one point to another. Its target market is supplying companies and government organizations building satellite constellations, including for broadband and imagery uses.

Mynaric has won several contracts — notably for companies building satellites for the network being built by the Space Force’s Space Development Agency — and has a backlog representing orders for as many as 1,000 of its terminals.

The company warned that, as of Friday, it had cash reserves totaling 6.3 million euros.

“With the lower than previously expected revenue and cash-in from customers for fiscal year 2024, we will need to pursue additional capital sources to secure our on-going operations and production ramp,” Mynaric said.