Chinese automaker BYD had one particular of the major stands at the IAA clearly show in Munich, Germany in 2023.

Arjun Kharpal | CNBC

Elon Musk dismissed BYD in 2011 by laughing at their goods through a Bloomberg job interview.

“Have you observed their car?” Musk quipped. “I will not feel it is specifically beautiful, the know-how is not quite powerful. And BYD as a business has fairly extreme issues in their house turf in China. I consider their concentration is, and rightly really should be, on generating positive they don’t die in China.”

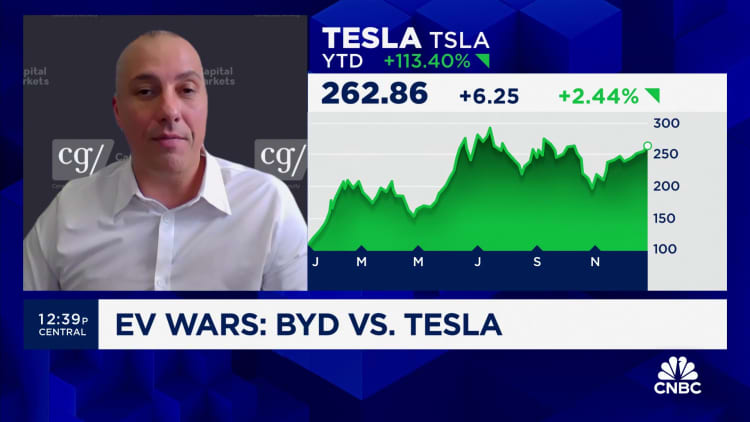

BYD did not get wiped out. Alternatively, BYD dethroned Tesla in the fourth quarter as the top rated EV maker, offering far more battery-driven vehicles than its U.S. rival.

“Their aim was to be China’s biggest automobile manufacturer and set China manufacturing on the map,” Taylor Ogan, CEO of Snow Bull Capital, claimed of BYD’s extensive-standing ambition.

So how did the Chinese corporation, which commenced by building telephone batteries, turn into an electric car large?

BYD’s heritage

When BYD is now regarded as an electric powered car big, its tentacles extend into several spots from batteries to mining and semiconductors, which is a big reason guiding its success.

Chemist Wang Chuanfu founded BYD in 1995 in the southern Chinese city of Shenzhen, China’s massive tech hub. It was established with 20 staff and 2.5 million Chinese yuan of money, or $351,994 at today’s exchange level.

In 1996, BYD commenced manufacturing lithium-ion batteries, the kind that are in our modern working day smartphones. This coincided with the growth of cellular telephones. BYD went onto provide its batteries to Motorola and Nokia in 2000 and 2002, respectively, two of the cell cellphone industry’s juggernaughts at the time.

In 2002, BYD stated on the Hong Kong Inventory Trade, riding the wave of its accomplishment in lithium-ion batteries.

BYD’s pivot to autos

It was not until 2003 that BYD obtained a tiny automaker named Xi’an Qinchuan Automobile.

Two many years later on, it launched its first car or truck termed the F3, which was a combustion product. And then in 2008, it launched the F3DM, its initial foray into electrical cars. The F3DM was a plug-in hybrid electrical motor vehicle.

That identical 12 months Warren Buffett’s Berkshire Hathaway designed what was at the time a $230 million financial investment in BYD.

This gave a improve to BYD’s electric powered auto ambitions.

BYD continued to press into the EV area and this is where by its record as a battery maker came into engage in. In 2020, the organization launched the Blade battery, which a lot of argued helped spark BYD’s advancement in EVs.

It is an LFP or lithium iron phosphate battery. At the time, in accordance to Ogan, numerous battery makers were being relocating absent from LFP batteries due to perceptions that they experienced very poor vitality density, i.e. they were much too weighty for the total of vitality they were being able to give.

But BYD touted the Blade as a breakthrough that presented excellent electricity density and large degrees of basic safety. It committed to putting this in its Han, a sporty sedan which was launched in 2020 and observed as a rival to Tesla’s Model S. BYD then place the Blade in subsequent styles it released.

“The vitality density at the cell stage and the pack stage were being actually larger than what BYD at first unveiled … Every person was blown absent,” Ogan said.

BYD sold 130,970 pure battery electric cars in 2020. Previous yr, the corporation sold 1.57 million battery EVs.

What has been guiding BYD’s accomplishment?

The breakthrough with the Blade underlines why BYD has uncovered achievement in EVs — strategic investments and the reality that it has additional firms than just automobiles.

“BYD slash their enamel remaining a supplier in the significant tech room, constructing up resiliency by providing batteries to really hard to be sure to firms like Apple,” Tu Le of Sino Auto Insights, advised CNBC.

“Wang Chuanfu then experienced the wherewithal to acquire a damaged down neighborhood Chinese automotive brand and was ready to aim on innovating on battery tech, more than enough so that it can sell to other automakers. If that wasn’t enough they had been head down grinding, frequently enhancing the design, engineering and top quality of it’s personal secure of cars. We didn’t know this at the time, but anything it really is completed above the final 15-20 several years established it up to surpass Tesla in Q4 ’23.”

Wang Chuanfu, Chairman and President of BYD.

Might Tse | South China Morning Article | South China Morning Publish | Getty Images

At the start, BYD did not leap straight into pure EVs. The business still marketed hybrid cars, which Alvin Liu, analyst at Canalys, stated was important to BYD’s original achievement.

“In the early phases of the Chinese EV market place, BYD selected to at the same time start Battery Electric powered Motor vehicles (BEV) and Plug-in Hybrid Electric Motor vehicles (PHEV). This approach allowed BYD to earn the industry when charging infrastructure was not perfectly-proven, and customers had been not pretty apparent about the strengths of EVs,” Liu instructed CNBC.

“PHEV’s features like higher financial efficiency and not obtaining variety stress and anxiety played a considerable position in assisting BYD to get the industry.”

Liu reported BYD postioned alone in the mid-vary market place the place there were less opponents in China which served propel its advancement. BYD has finished perfectly on branding, according to Liu, generating differetn sub-manufacturers to tackle various rate details in the current market. 1 this kind of illustration is BYD’s mid-to-superior-finish EV brand name Denza.

Beijing backs EVs

As effectively as BYD’s have methods, its increase has been served by the Chinese government’s massive assistance of the country’s EV sector. More than the previous handful of years, Beijing has presented subsidies to incentivize potential buyers of electrical cars and offered point out help to the field. These steps commenced close to 2009, at the time BYD was hunting to ramp up its EV force.

Rhodium Group estimates that BYD been given somewhere around $4.3 billion in point out help among 2015 and 2020.

“BYD is a really revolutionary and adaptive organization, but its rise has been inextricably linked to Beijing’s defense and assist,” Gregor Sebastian, senior analyst at Rhodium, instructed CNBC. “Without having Beijing’s backing, BYD wouldn’t be the worldwide powerhouse it is currently.”

“Over time, the firm has loved under-sector fairness and personal debt funding allowing for it to scale up creation and R&D actions.”

World-wide ambitions

Following dominating China’s EV industry, BYD is now epanding aggressively abroad. It sells cars in a selection of nations from the United Arab Emirates to Thailand and the U.K.

In southeast Asia, BYD has a 43% industry share in electric autos. But BYD’s interntional growth is not just about advertising cars, it consists of manufacturing and resources much too.

BYD stated in December it would open up its to start with European manufacturing plant in Hungary. And the company is also searching to purchase lithium mining assets in Brazil. Lithium is a critical part of BYD’s batteries.

On the other hand, with world wide enlargement arrives scrutiny from governments who are involved about the subisides that Chinese carmakers have gained.

In September, the European Commission, the government arm of the European Union, introduced an investigation into subsidies supplied to electric powered car or truck makers in China.

Meanwhile the U.S. is attempting to boost its personal domestic EV sector as a result of the Inflation Reduction Act, with an intention of holding out Chinese competitors.

“Initiatives like the IRA and the EU anti-subsidy probe goal to impede China’s development in these markets,” Rhodium’s Sebastian said.

“To be certain sustained growth, BYD is proactively addressing these political hurdles, as witnessed in its the latest expense in an EV plant in Hungary, underscoring its motivation to global enlargement.”

What subsequent?

The fight involving Tesla and BYD — the world’s two major EV makers — is set to keep on. Sino Auto Insights’ Le mentioned he beleives that BYD however has not “reached max opportunity.”

“Most automotive corporations for the longest time didn’t take them critically. That is where by portion of their journey mirrors Tesla’s because folks didn’t take Tesla significantly in the early times both,” Le reported.

As for Tesla, the firm is struggling with stiffer levels of competition in 2024 with Chinese opponents launching much more designs and standard automakers seeking to capture up in the EV race.

Daniel Roeska, senior exploration analyst at Bernstein Investigate, explained to CNBC that there is just not a major driver of profits volumes in Tesla’s automobile portfolio in the coming months. BYD on the other hand could see more quickly advancement.

“BYD really to the contrary is really pushing the pedal to the metal … by accelerating advancement in Europe and other abroad marketplaces. And so there is a great deal far more development in the BYD story in the future 12 to 24 months for confident,” Roeska claimed.

Tesla’s Musk has regarded that he should not have taken BYD evenly. In a remark posted in X in response to a video clip of his 2011 Bloomberg interview, Musk reported: “That was a lot of a long time in the past. Their cars and trucks are very aggressive these days.”