Demand for mortgages increased for the second straight week, despite some volatility in mortgage rates.

Total application volume rose 6.5% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.71% from 6.79%, with points falling to 0.79 from 0.80 (including the origination fee) for loans with a 20% down payment.

That was the average, but mortgage rates were largely higher for most of the week before dropping sharply Friday on news of the Silicon Valley Bank failure.

Despite rates being higher, mortgage applications to purchase a home rose 7% for the week but were still 38% lower than the same week a year ago. Homebuying basically stalled in early February, after rates rose about a full percentage point, but they seem to be coming back now, perhaps because buyers are concerned rates will go even higher. The question is how long will that last?

“That always happens when rates surge and it only lasts a few weeks,” said John Burns of John Burns Real Estate Consulting, who said he saw an increase in sales of newly built homes in February despite higher rates.

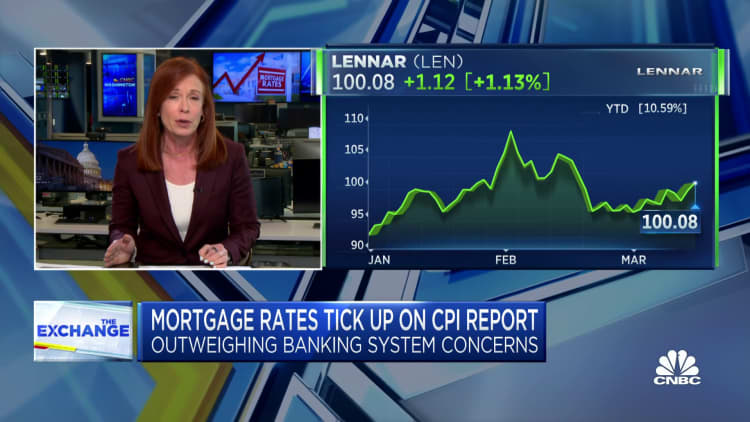

Lennar, the nation’s second-largest homebuilder, posted better-than-expected earnings Tuesday, with the company’s chairman, Stuart Miller, saying in the release: “Homebuyers are considering the possibility that today’s interest rate environment may be the new normal. Accordingly, the housing market continues shifting as growing household and family formation continued to drive demand against a chronic supply shortage.”

Applications to refinance a home loan increased 5% from the prior week but were 74% lower than one year ago.

Mortgage rates dropped further Monday, according to a separate survey from Mortgage News Daily, but bounced higher again Tuesday after the February consumer price index was released, suggesting that the Federal Reserve may raise interest rates again next week despite recent banking industry turmoil.