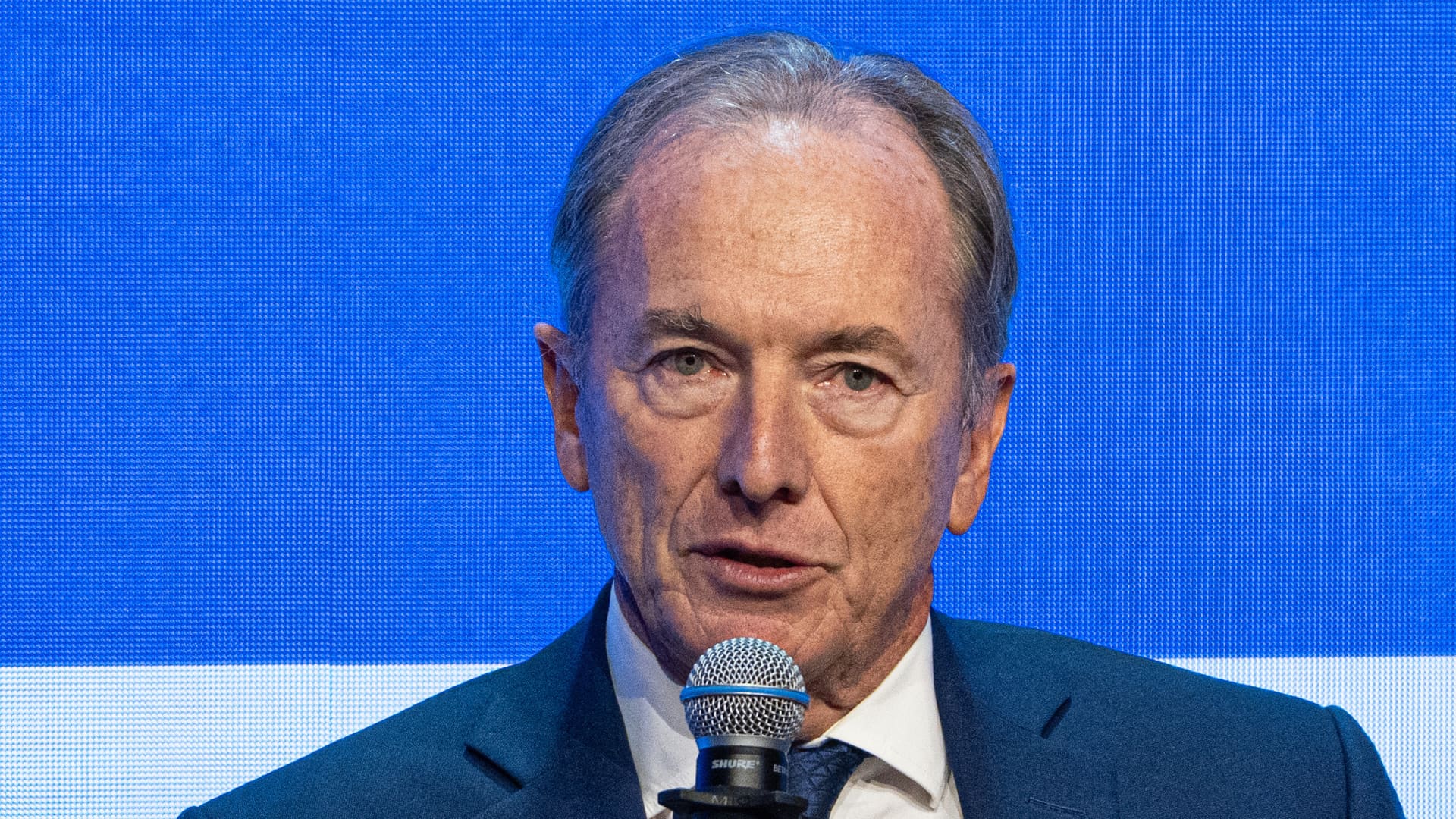

James Gorman, chairman and chief executive of Morgan Stanley, speaks throughout the International Economic Leader’s Investment decision Summit in Hong Kong, China, on Tuesday, Nov. 7, 2023. The de-facto central financial institution of the Chinese territory is this week keeping its world-wide finance summit for a second yr in a row. Photographer: Lam Yik/Bloomberg through Getty Images

Bloomberg | Bloomberg | Getty Images

SINGAPORE — Morgan Stanley Chairman and CEO James Gorman mentioned his organization will be in a position to cope with “any form” that new banking polices conclude up taking, but additional he expects some watering down prior to the remaining guidelines are verified.

U.S. regulators on Tuesday defended their strategies for a sweeping set of proposed variations to banks’ capital requirements, speaking in front of the U.S. Senate Banking Committee. They are aimed at tightening regulation of the marketplace soon after two of its biggest crises in current memory — the 2008 money disaster, and the March upheaval in regional creditors.

These proposed variations in the U.S. search for to include components of global banking regulations known as Basel III, which was agreed to following the 2008 crisis and has taken many years to roll out.

Regulators say the alterations in the proposals are estimated to result in an aggregate 16% improve in widespread equity tier 1 cash requirements — which is a evaluate of an institution’s presumed fiscal toughness and is observed as a buffer from recessions or investing blowups.

“I consider it will appear out in a different way from the way it truly is been proposed,” Gorman informed CNBC Thursday in an special job interview on the sidelines of Morgan Stanley’s once-a-year Asia-Pacific conference in Singapore.

“It is really significant to point out it is a proposal. It truly is not a rule, and it’s not performed.”

“I think [the U.S. banking regulators] are listening,” Gorman additional. “I have put in a lot of several years with the Federal Reserve. I was on the Fed board in New York for 6 yrs and I just believe they are trying to discover the correct solution.”

“I am not sure the banking institutions need to have extra funds,” Morgan Stanley’s outgoing CEO stated. “In reality, the Fed’s personal anxiety examination claims they you should not. So there is certainly that … sort of purity of function and in pursuit of perfection that can be the enemy of fantastic.”

Whichever the consequence though, Gorman stated his New York-based bank will be equipped to handle.

“We have been conservative with our money. We operate a CET1 ratio, which is between the best in the entire world, drastically in extra of our demands, so we’re all set for any final result. But I don’t imagine it will be as dire as most of the expense committee thinks it will be,” Gorman stated.

The lender explained in its hottest earnings report that its standardized CET1 ratio was 15.5%, around 260 basis points above the prerequisite.

Prosperity management and inflation

In late Oct, Morgan Stanley announced that Ted Pick will succeed James Gorman as chief executive at the begin of 2024, nevertheless Gorman will continue to be as government chairman for an undisclosed period.

Led by Gorman since 2010, Morgan Stanley has managed to prevent the turbulence afflicting some of its competition.

While Goldman Sachs was compelled to pivot following a foray into retail banking, the major dilemma at Morgan Stanley is about an orderly CEO succession.

There will possible be some continuity with the bank’s concentrate on creating out its wealth administration organization in Asia.

“We consider there’s going to be remarkable expansion,” Gorman said Thursday.

“So we would like to do extra. We have. If I was remaining quite a few years, we would quite aggressively be pushing our wealth administration in this location. And I am guaranteed my successor would do the same.”

On the problem of inflation, Gorman reported central bankers have brought surging inflation underneath control.

“Give the central banking companies credit. They moved aggressively with costs,” Gorman explained. “I assume they were being late —that’s my individual perspective — but it won’t issue. When they bought there, they seriously received likely. Took premiums from zero to five and a 50 % %. The Fed did five, 5 and a fifty percent p.c in just about record time, quickest level boost in 40 years. And it truly is had the effect.”

U.S. Federal Reserve Chairperson Jerome Powell explained final Thursday that he and his fellow policymakers are inspired by the slowing speed of inflation, but extra function could be ahead in the struggle towards high selling prices as the central financial institution seeks to provide inflation down closer to its mentioned 2% concentrate on.

The U.S. client cost index, which steps a wide basket of generally used merchandise and solutions, enhanced 3.2% in October from a calendar year ago despite being unchanged for the thirty day period, in accordance to seasonally adjusted numbers from the Labor Department on Tuesday.

“Are we carried out? We’re not completed,” Gorman reported.

“Is 2% totally important? My personal look at is no, but directionally to be heading in that to all over 2, 3% — I consider is a really appropriate final result offered the cards that they ended up dealt with.”

— CNBC’s Hugh Son and Jeff Cox contributed to this story.