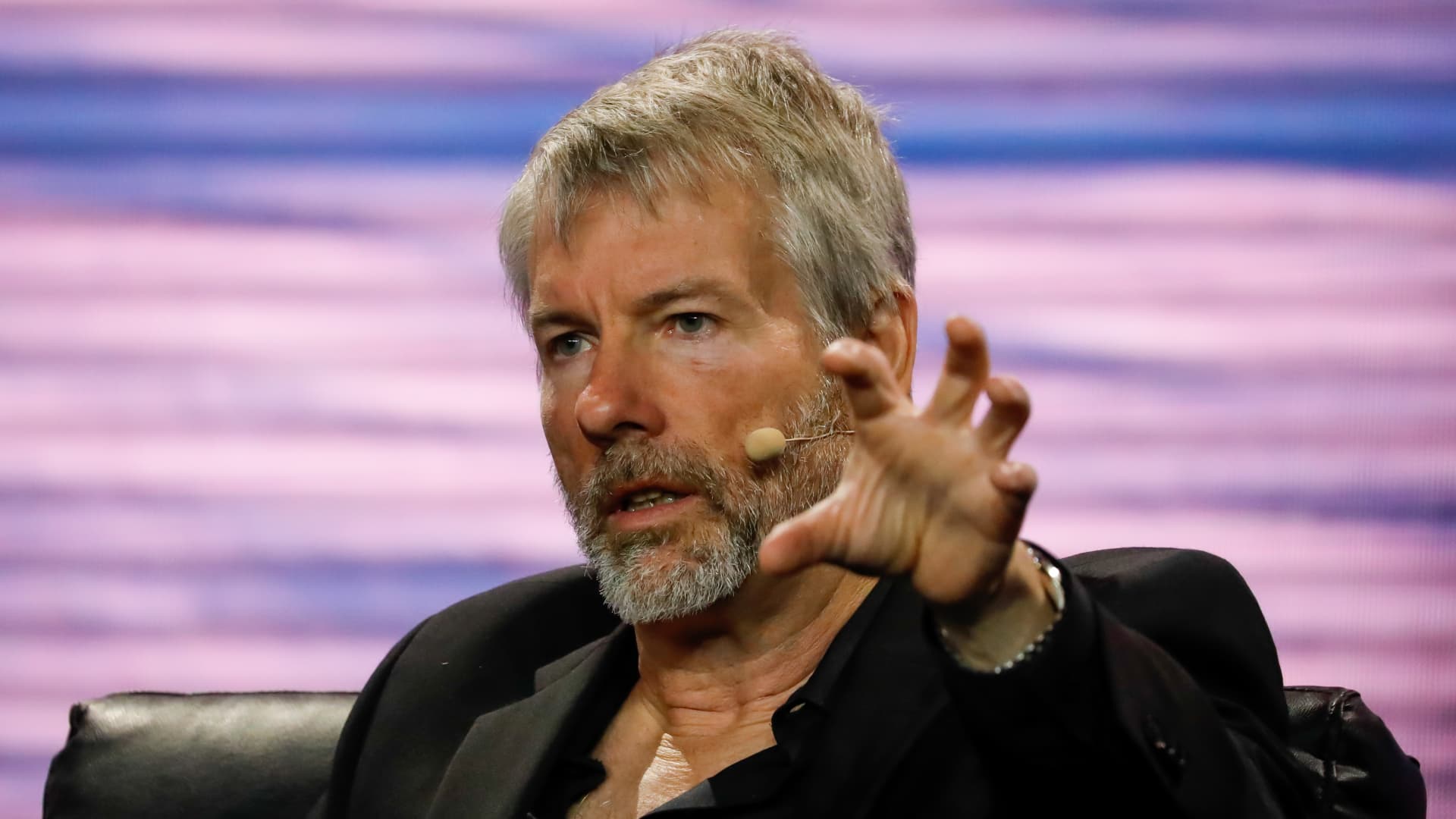

Michael Saylor, chairman and CEO of MicroStrategy, speaks in the course of the Bitcoin 2022 conference in Miami on April 7, 2022.

Eva Marie Uzcategui | Bloomberg | Getty Photographs

Every time Michael Saylor utters the phrase “bitcoin,” MicroStrategy shares pop. He has been performing a large amount of uttering recently.

On Monday, the MicroStrategy founder posted on social media platform X that his business experienced just bought a further 12,000 bitcoins for near to $822 million “making use of proceeds from convertible notes & excess dollars.” That brings MicroStrategy’s total holdings to 205,000 bitcoins, which are now worthy of much more than $15 billion, as the cryptocurrency carries on to hit clean highs.

Bitcoin rose 2.7% on Wednesday, topping $73,400.

MicroStrategy, a organization that develops computer software but serves mostly as a proxy for bitcoin, climbed 11% on Wednesday, adhering to Tuesday’s 7.4% rally, which adopted Monday’s 4.1% gain and Friday’s 9.7% leap. The inventory is now up 68% due to the fact March 6, the day the enterprise declared the pricing of a credit card debt sale, and has rocketed 180% this year after soaring 346% in 2023.

Saylor explained to CNBC’s “Squawk Box” on Monday that bitcoin is likely to “try to eat gold.” He claimed many additional institutional traders are likely to very own the electronic forex as it will get added to exchange-traded money. In addition, Saylor is bullish on subsequent month’s halving process, which occurs every 4 decades and slows the provide of cash, decreasing the amount of money of providing.

“The value of bitcoin is heading to have to modify up in order to meet up with that investor demand from customers,” Saylor said. “That is what’s going to happen next for the asset class.”

MicroStrategy mentioned on Monday that it experienced completed an presenting of .625% convertible notes because of in 2030, with net proceeds of about $782 million. Canaccord Genuity analysts wrote in a observe that working day that they believe it truly is the first $800 million convert thanks in 2030 that is promoted at a coupon rate below 1% with such a superior conversion premium.

“Even though significantly of the firm’s BTC accumulation late final yr and early this year was funded working with equity,” the analysts wrote, “the company this time in its place exploited a lot more of its complete cash composition by issuing a change.”

MicroStrategy mentioned in the launch that it “applied the internet proceeds from the sale of the notes to get extra bitcoin.”

MicroStrategy has acquired close to 16,000 bitcoins due to the fact the start off of the year.

Its stock benefit is appreciating at a much speedier clip than the bitcoin that it can be obtaining. As of Monday, Canaccord’s investigation showed that MicroStrategy’s equity value top quality in excess of its bitcoin holdings was 86%.

That variety has risen significantly in the earlier three times. Working with Canaccord’s methodology, MicroStrategy’s equity benefit quality is now up to about 99%.

Established in 1989, MicroStategy has a company in business program and cloud-based mostly solutions, but its shareholder value is just about solely tied to its bitcoin possession. The business announced its plan to spend in bitcoin in mid-2020, disclosing in an earnings phone that it would commit $250 million more than the up coming 12 months to “1 or a lot more alternative property,” which could contain electronic currencies such as bitcoin.

At the time, MicroStrategy’s market place cap was about $1.1 billion. The business is now really worth $30 billion.

“Is there any organization in the environment that you wouldn’t like to devote in that could borrow $1 billion at considerably less than 1% interest to invest in your most effective strategy?” Saylor questioned on CNBC. “It really is offered our shareholders additional bitcoin for each share this week than they experienced a several weeks back, so it can be extremely accretive for them.”