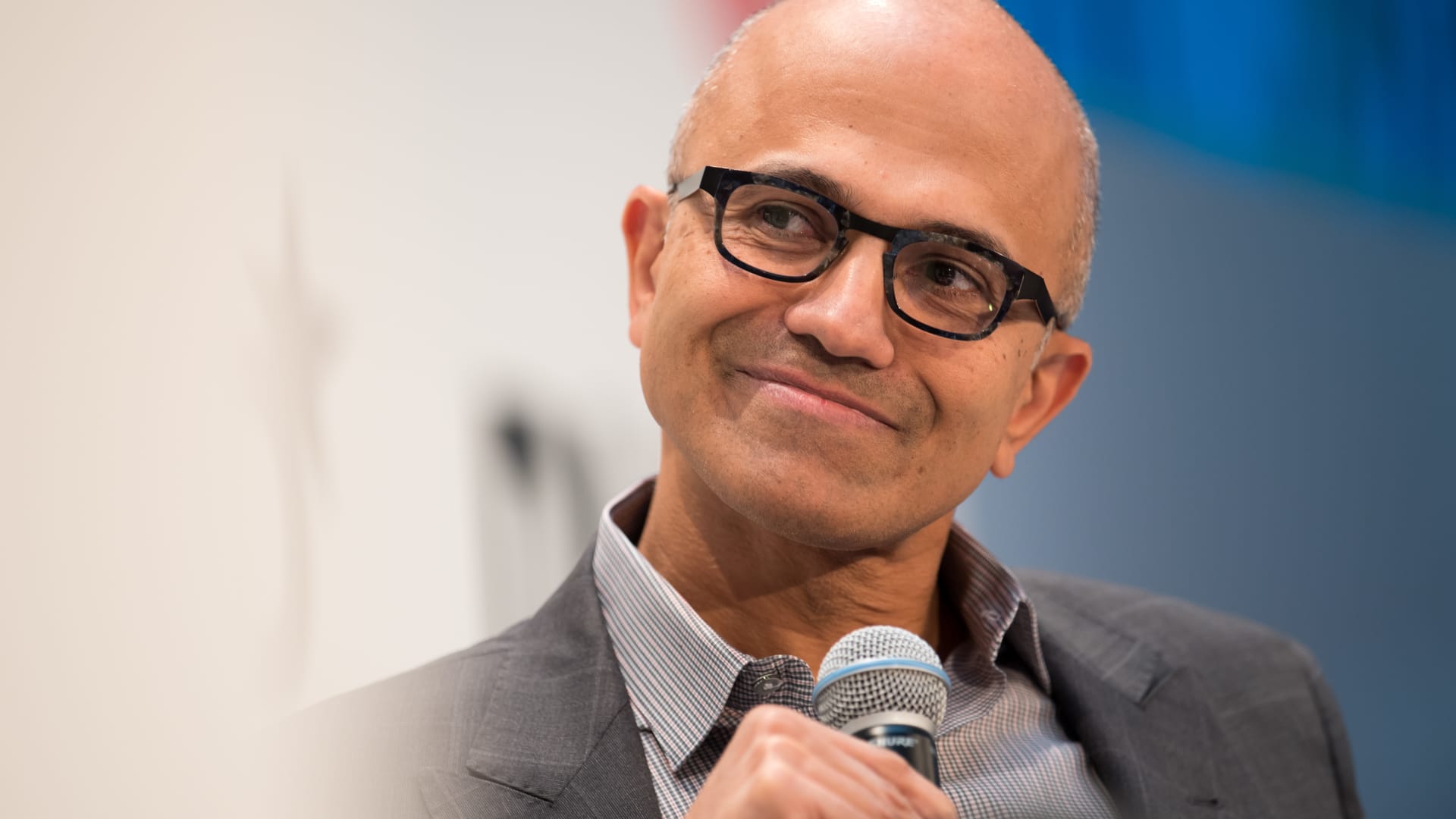

Microsoft CEO Satya Nadella speaking at the DLD (Digital-Life-Design) conference in Munich, Germany, on Jan. 16, 2017.

Tobias Hase | dpa | picture alliance | Getty Images

Microsoft shares were flat in extended trading on Tuesday after the software maker issued fiscal third-quarter earnings that exceeded analysts’ expectations.

Here’s how the company did:

- Earnings: $2.22 per share, adjusted, vs. $2.19 as expected by analysts, according to Refinitiv.

- Revenue: $49.36 billion, vs. $49.05 billion as expected by analysts, according to Refinitiv.

Microsoft’s revenue increased by 18% year over year in the quarter, which ended on March 31, compared with 20% in the previous quarter, according to a statement.

The company’s Intelligent Cloud segment, which contains Microsoft’s Azure public cloud for application hosting, along with SQL Server, Windows Server and enterprise services, generated $19.05 billion in revenue. That’s up 26% and above the $18.90 billion consensus among analysts polled by StreetAccount.

Revenue from Azure and other cloud services jumped 46% in the quarter, compared with 46% growth in the prior quarter. The expectation was 45.3%, according to a CNBC survey of 13 analysts, while analysts polled by StreetAccount had been looking for 43.6% growth.

Microsoft’s Productivity and Business Processes segment, containing Office productivity software, LinkedIn and Dynamics, posted $15.79 billion in revenue in the quarter, up about 17% and slightly more than the StreetAccount consensus estimate of $15.75 billion. Microsoft raised the prices of certain Office 365 productivity software subscriptions during the quarter.

The More Personal Computing Segment, which includes Windows, Xbox, search advertising and Surface, kicked in $14.52 billion in revenue, up 11% and higher than the $14.27 billion StreetAccount consensus.

Microsoft said revenue from Windows license sales to PC manufacturers increased 11% in the quarter. Microsoft had projected high-single-digit growth in January. Research firm Gartner estimated that PC shipments fell 6.8% in the quarter, marking the sharpest decline since the first quarter of 2020, after a pandemic-fueled market expansion. Excluding PCs running Google’s Chrome OS operating system, which became more popular during Covid, shipments rose by 3.9%.

Revenue from security products and services falls under each of Microsoft’s three segments. In January Microsoft said its security revenue grew nearly 45% in 2021, faster than any other major product category. The company disclosed financial figures from its security business for the first time last year, surprising some observers.

In the quarter Microsoft announced a plan to acquire video-game publisher Activision Blizzard for $68.7 billion, the largest transaction in Microsoft’s 47-year history. Microsoft also closed its Nuance Communications acquisition and laid out a strategy for expanding in health care, an industry Nuance focuses on. Nuance took away a penny from Microsoft’s quarterly earnings but added $111 million in revenue.

Excluding the after-hours move, Microsoft stock has declined 19% since the start of 2022, underperforming the S&P 500 index, which is down about 12% over the same period.

Executives will discuss the results with analysts and issue guidance on a conference call starting at 5:30 p.m. ET.

This is breaking news. Please check back for updates.

WATCH: ‘We’re seeing about a thousand vulnerabilities patched by Microsoft each year,’ says SentinelOne’s Weingarten