Mark Zuckerberg, CEO, Meta Platforms, in July 2021.

Kevin Dietsch | Getty Visuals News | Getty Images

Meta will report very first-quarter results soon after the bell Wednesday.

Here is what analysts are anticipating.

- Earnings for every share: $4.32, according to LSEG.

- Profits: $36.16 billion, according to LSEG.

- Everyday energetic end users (DAUs): 2.12 billion, according to StreetAccount

- Regular monthly energetic people (MAUs): 3.09 billion, according to StreetAccount

- Regular profits for every consumer (ARPU): $11.75 in accordance to StreetAccount

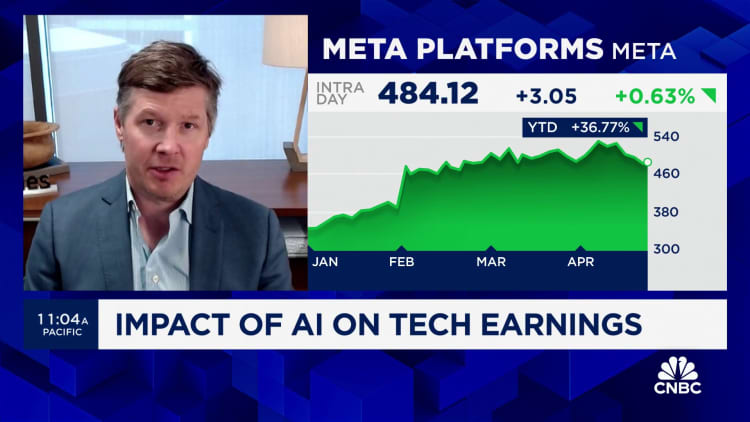

Meta has been a favorite on Wall Street given that early 2023, when CEO Mark Zuckerberg informed buyers it would be the “calendar year of effectiveness.” The stock pretty much tripled previous calendar year, trailing only Nvidia amongst members of the S&P 500, and is up yet another 40% in 2024.

The Fb mother or father has been clawing back again electronic ad sector share following a dismal 2022. At that time, the business was reeling from Apple’s iOS privacy update and macroeconomic concerns that led quite a few models to rein in paying out.

Zuckerberg spearheaded an initiative to rebuild the advert organization with a focus on synthetic intelligence. On the firm’s previous earnings simply call in February, finance chief Susan Li said Meta has been investing in AI models that can precisely predict pertinent adverts for people, as properly as tools that automate the ads-creation procedure.

Analysts count on Meta to report a 26% improve in earnings from $28.65 billion a 12 months before. That would mark the fastest fee of development given that the 3rd quarter of 2021, which was right before Apple’s privacy alter began to show up on other companies’ stability sheets.

Meta is benefiting from a stabilizing financial state and surge in expending from Chinese price cut suppliers like Temu and Shein, which have been pumping cash into Fb and corporation-owned Instagram in an exertion to get to a broader swath of buyers. Analysts at Baird claimed in a Monday take note that slower shelling out from China-based advertisers could be a supply of worry in the first-quarter benefits.

Nevertheless, the Baird analysts see continuing momentum for Meta, and explained they have “moderately large” expectations for the organization due to the fact of its increasing advertiser applications and results in short-sort video monetization.

Investors will keep on being targeted on Meta’s fees, which have been central to the stock rally. Early past calendar year, Zuckerberg claimed the firm would be superior at eliminating pointless assignments and cracking down on bloat, which would assistance Meta come to be a “more robust and extra nimble organization.”

The corporation lower about 21,000 employment in the 1st 50 % of 2023, and Zuckerberg said in February of this calendar year that using the services of will be “somewhat small in comparison to what we would have completed historically.”

As of Dec. 31, Meta experienced a world-wide workforce of 67,317, down from a peak of extra than 87,000 staff in 2022, in accordance to Securities and Exchange Commission filings.

Jefferies analysts wrote in a report very last 7 days that it really is “challenging to argue with excellence.” The analysts anticipate Meta to conquer on its very first-quarter benefits and deliver better-than-envisioned steerage for the 2nd quarter. As of now, the typical analyst estimate calls for income advancement of 20% in the next quarter to $38.29 billion, according to LSEG.

“We go on to be inspired by META’s ability to sustain double-digit rev advancement, presented the blend of better engagement from AI investments, and expanding advertiser ROI & efficiency,” the Jefferies analysts wrote.

Meta’s Actuality Labs device, which residences the company’s hardware and program for enhancement of the nascent metaverse, carries on to bleed money. Analysts be expecting the division to present an operating decline of $4.31 billion for the quarter, on top rated of the $42 billion it is shed because the conclusion of 2020. Revenue in the unit is projected to achieve $512.5 million, a 51% improve from $339 million a yr earlier.

Executives will explore the company’s outcomes on a call with analysts at 5 p.m. ET.