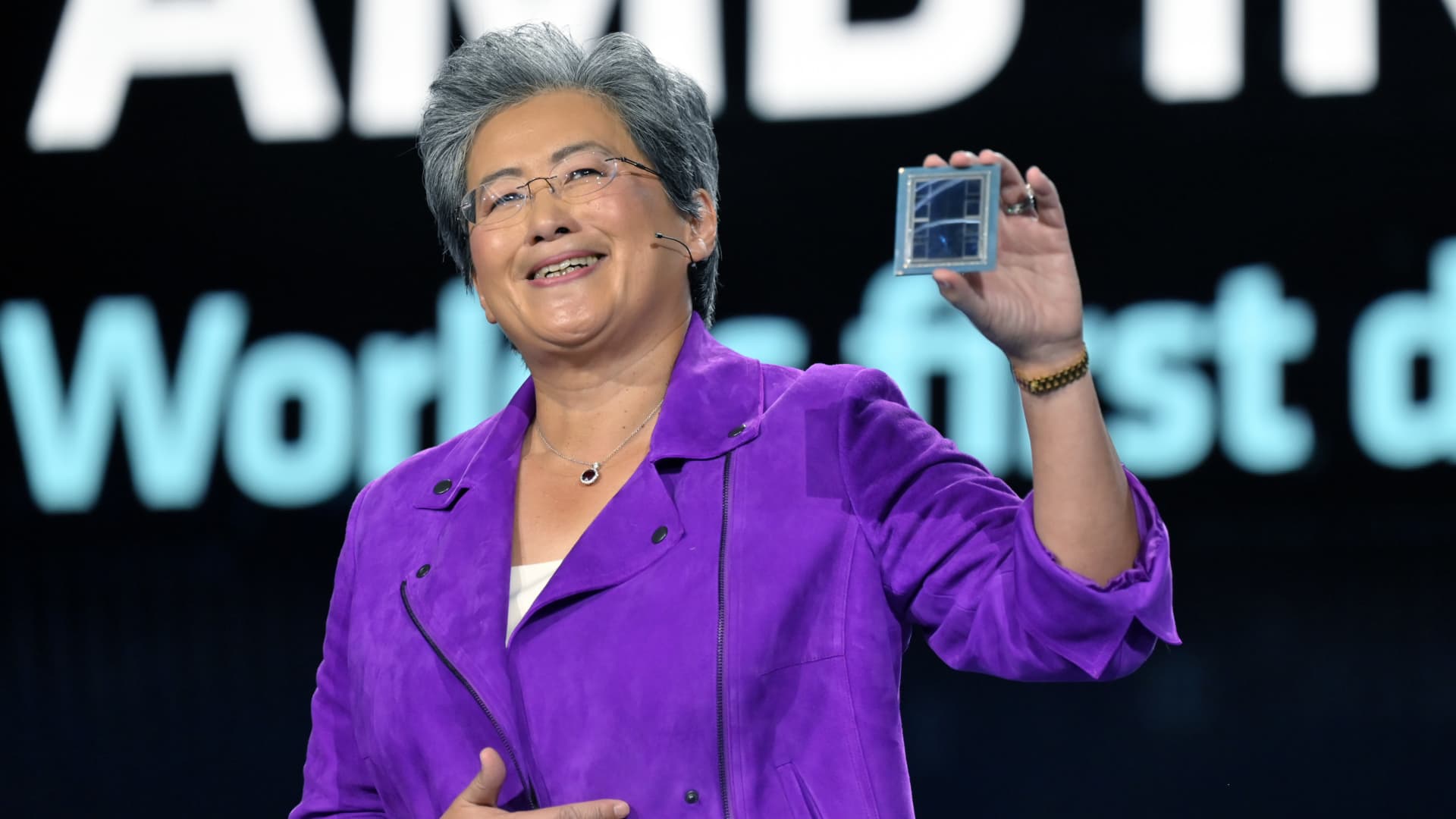

Lisa Su shows an ADM Intuition M1300 chip as she provides a keynote address at CES 2023 at The Venetian Las Vegas on January 04, 2023 in Las Vegas, Nevada.

David Becker | Getty Photographs

Meta, OpenAI, and Microsoft said at an AMD investor party on Wednesday they will use AMD’s latest AI chip, the Intuition MI300X. It really is the most important indication so significantly that technology businesses are browsing for alternate options to the pricey Nvidia graphics processors which have been critical for building and deploying synthetic intelligence programs like OpenAI’s ChatGPT.

If AMD’s most up-to-date high-end chip is good enough for the technology firms and cloud company companies making and serving AI styles when it starts transport early subsequent calendar year, it could decrease expenditures for establishing AI styles, and put competitive strain on Nvidia’s surging AI chip product sales growth.

“All of the desire is in significant iron and huge GPUs for the cloud,” AMD CEO Lisa Su stated on Wednesday.

AMD states the MI300X is based on a new architecture, which frequently qualified prospects to major functionality gains. Its most distinct element is that it has 192GB of a chopping-edge, substantial-general performance form of memory regarded as HBM3, which transfers data faster and can in shape greater AI designs.

At an function for analysts on Wednesday, CEO Lisa Su immediately compared its Instinct MI300X and the methods developed with it to Nvidia’s most important AI GPU, the H100.

“What this overall performance does is it just straight interprets into a far better consumer encounter,” Su reported. “When you ask a product something, you’d like it to appear back faster, in particular as responses get extra intricate.”

The principal issue going through AMD is whether or not providers that have been developing on Nvidia will invest the time and money to include a different GPU supplier. “It usually takes do the job to adopt AMD,” Su reported.

AMD on Wednesday advised investors and associates that it experienced improved its software program suite referred to as ROCm to compete with Nvidia’s sector common CUDA software program, addressing a essential shortcoming that experienced been one particular of the principal explanations why AI builders at present prefer Nvidia.

Rate will also be important — AMD failed to expose pricing for the MI300X on Wednesday, but Nvidia’s can price tag around $40,000 for a single chip, and Su advised reporters that AMD’s chip would have to value significantly less to acquire and operate than Nvidia in buy to influence clients to buy it.

Who claims they are going to the MI300X?

AMD MI300X accelerrator for artificial intelligence.

On Wednesday, AMD stated it had already signed up some of of the corporations most hungry for GPUs to use the chip. Meta and Microsoft have been the two largest purchasers of Nvidia H100 GPUs in 2023, in accordance to a the latest report from investigate firm Omidia.

Meta explained that it will use Instinct MI300X GPUs for AI inference workloads like processing AI stickers, graphic editing, and working its assistant. Microsoft’s CTO Kevin Scott mentioned it would supply entry to MI300X chips through its Azure net company. Oracle‘s cloud will also use the chips.

OpenAI said it would assistance AMD GPUs in just one of its software package goods referred to as Triton, which isn’t really a major large language product like GPT, but is used in AI study to access chip features.

AMD is just not yet forecasting enormous gross sales for the chip but, only projecting about $2 billion in overall knowledge centre GPU earnings in 2024. Nvidia described more than $14 billion in facts center profits in the most recent quarter alone, even though that metric features other chips beside GPUs.

Nevertheless, AMD suggests that the full sector for AI GPUs could climb to $400 billion about the following 4 yrs, doubling the company’s previous projection, demonstrating how significant anticipations and how coveted higher-finish AI chips have develop into — and why the enterprise is now concentrating investor notice on the item line. Su also instructed to reporters that AMD won’t believe that it needs to defeat Nvidia to do well in the market.

“I consider it’s apparent to say that Nvidia has to be the huge the greater part of that correct now,” Su informed reporters, referring to the AI chip industry. “We believe that it could be $400-billion-as well as in 2027. And we could get a great piece of that.”