Tech shares on show at the Nasdaq.

Peter Kramer | CNBC

The market’s affinity for Major Tech stocks this yr is “shortsighted,” according to portfolio supervisor Freddie Lait, who said the up coming bull market place stage will broaden out to other sectors featuring larger price.

Shares of America’s tech behemoths have been buoyant so considerably in 2023. Apple closed Wednesday’s trade up almost 33% year-to-day, while Google parent Alphabet has risen 37%, Amazon is 37.5% larger and Microsoft is up 31%. Fb father or mother Meta has viewed its inventory soar much more than 101% considering that the turn of the yr.

relevant investing news

This tiny pool of organizations is diverging starkly from the broader marketplace, with the Dow Jones Industrial Regular much less than 1% higher in 2023.

The gulf amongst Significant Tech and the broader market widened after earnings period, with 75% of tech corporations beating anticipations, in comparison to a pretty combined photograph throughout other sectors and broadly downbeat financial information.

Buyers are also betting on further rallies as central banking companies begin to gradual and at some point reverse the intense financial coverage tightening that has characterized recent occasions. Huge Tech outperformed for years all through the interval of reduced fascination rates, and then acquired a main increase from the Covid-19 pandemic.

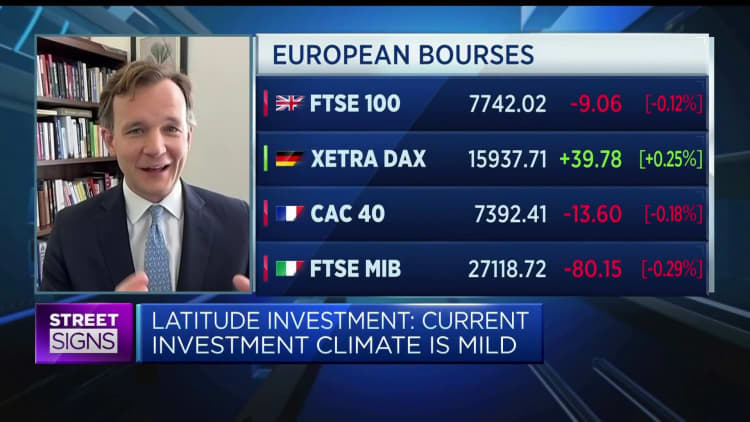

On the other hand Lait, handling lover at Latitude Investment Management, instructed CNBC’s “Street Indications Europe” on Wednesday that despite the fact that the market’s positioning was “rational” in the instances, it was also “extremely shortsighted.”

“I believe we are coming into a pretty different cycle for the up coming two-to-five a long time, and when we may possibly have a challenging time period this calendar year, and people today could be hiding back out in Significant Tech as fascination rates roll above, I feel the next leg of the bull market — when it does appear — will be broader than the last one particular that we saw, which was seriously just form of tech and healthcare led,” Lait explained.

“You’ve received to get started accomplishing the work in some of these more Dow Jones form shares — industrials or aged economic system shares, to a diploma — in order to locate that deep benefit that you can uncover in or else good growth corporations, just outdoors in distinct sectors.”

Lait predicted that as industry contributors learn worth across sectors over and above tech over the upcoming 6-to-12 months, the increasing valuation hole in between tech and the rest of the current market will get started to near.

However, given the sturdy earnings trajectory shown by Silicon Valley in the to start with quarter, he believes it is really worth holding some tech stocks as element of a extra diversified portfolio.

“We personal some of those technological innovation shares as properly, but I believe a portfolio completely exposed to them does operate a concentration of possibility,” he described.

“Far more apparently, it misses out on a substantial range of chances that are out there in the broader market place: other corporations that are compounding expansion fees at very similar amounts to the engineering shares, investing at 50 % or a 3rd of the valuation, providing you extra diversification, additional exposure if the cycle is distinct this time.”

He hence suggested traders not to be roundly skeptical of tech shares, but to imagine about the broadening out of the rally and the “narrowing of the differential concerning valuations,” and to “pick their moments to get publicity.”