Traders get the job done on the flooring of the New York Inventory Trade throughout early morning buying and selling on February 29, 2024 in New York Town.

Michael M. Santiago | Getty Photos

A new day, a new all-time superior. From stocks to bitcoin, asset courses throughout the board have been hitting uncharted territories.

Why?

There are a several reasons at perform.

Unabating artificial intelligence buzz, hopes that worldwide desire premiums may well fall, and extra distinct to the crypto area: bitcoin ETF approvals.

A fiery rally in tech stocks powered the Nasdaq 100 to a contemporary history and assisted the S&P 500 complete previously mentioned the 5,000 mark for the very first time at any time previous week. AI ecstasy has also boosted individual tech stocks to historic degrees, with Nvidia‘s stock sector worth smashing a $2 trillion valuation for the initial time ever.

Because those peaks nonetheless, Wall Avenue equities have pulled again as borrowing price uncertainty weighs on investors’ minds.

In Asia, Japan’s Nikkei 225 has echoed an eye-popping performance with the country’s stock current market index newly crossing 40,000 points on Monday. Which is right after the Nikkei zoomed previous 1989 highs previous thirty day period – with the gains mostly pushed by strong earnings and corporate governance reforms.

Around in the choice asset planet, a mix of investors pouring dollars into U.S. location exchange-traded crypto goods, and bitcoin’s approaching halving occasion supercharged the world’s biggest cryptocurrency earlier mentioned $69,000 — a rate level not found in much more than two a long time.

Stellar selling prices for gold have also stolen investor focus, with the important steel scaling a new file of above $2,100. The gains have been fueled by U.S. level lower expectations and China financial woes, with gold customarily rallying in moments of economic anxiety.

The file-breaking quantities for marketplaces, even so, have not stopped some buyers from worrying about a few critical troubles.

Inflation resurgence

Right after months of cooling, U.S inflation is proving by itself to be extra stubborn than industry experts had predicted.

Nobel laureate Paul Krugman flagged inflationary pressures in the U.S. in a the latest write-up on X, in which he built on Moody’s economist Mark Zandi’s feelings above an boost in main PCE (particular intake expenses) deflator numbers.

“Business surveys hold failing to display an inflation surge. People January numbers search like a blip ‘juiced by problematic seasonals’, as Mark Zandi places it,” Krugman explained.

Economist Nouriel Roubini, typically called “Dr. Doom,” also chimed in on the subject, saying a Trump reelection could spell difficulties for the global financial state, offered his guidelines could stoke inflation yet again and may perhaps even bring about stagflation.

JPMorgan’s chief sector strategist developed on pitfalls of stagflation way too. Marko Kolanovic warned a “2nd inflation wave” could choose hold, with the prospects of the “narrative turning back again from goldilocks to one thing like 1970s stagflation,” he stated in a latest investigate observe. A goldilocks financial state refers to a favorable atmosphere whether or not knowledge is neither too hot or cold.

Fiscal instability

A data-obsessed Fed is also on the fret playing cards for financial investors.

Leading economist and Allianz advisor Mohamed El-Erian claimed in a Bloomberg op-ed that a Fed “held hostage” by information could cause fiscal instability.

“Do not get me mistaken substantial-frequency inputs are crucial in any assessment of financial ailments and policy responses,” El-Erian claimed.

“In modern economic climate, an extreme target on the quantities ideas the balance of dangers toward maintaining curiosity rates as well restrictive for way too long, unduly increasing the chance of output loss, greater unemployment and economic instability,” he extra.

El-Erian has long-been important of the Fed, blaming it for mischaracterizing inflation as a transitory difficulty as nicely as remaining much too late in its struggle towards shopper selling price pressures.

Talking to CNBC, El-Erian explained if the Fed doesn’t slash prices this yr, then “the market place is right to get worried about financial development and earnings.”

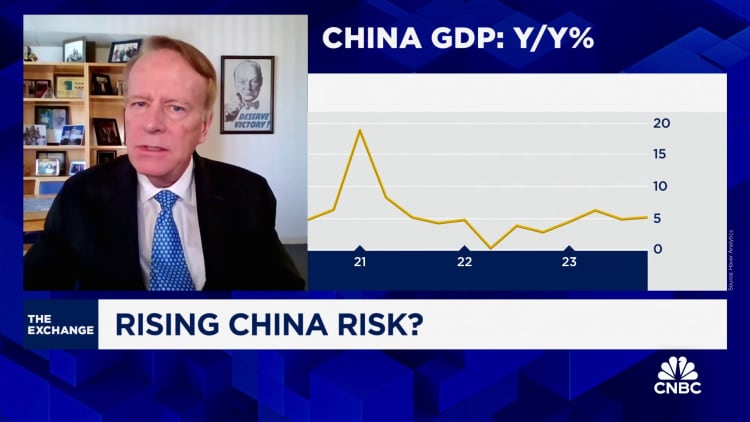

China woes

Problems in the world’s next-biggest overall economy have also gripped buyers. The region is blistered with economic challenges, from a house disaster to deflationary pressures — and marketplace watchers are nervous those woes could spill about to the rest of the planet.

Ariel Investments’ Vice Chair Charlie Bobrinskoy instructed CNBC marketplaces are not centered on China’s residential genuine estate issues. “The industry does realize there is a trouble, but will not understand the sizing of the challenge,” he reported, discussing the ripple effects of the country’s home industry on the rest of the environment.

The car marketplace has previously started seeing the effects of a China slowdown in their earnings final results.

Tesla as nicely as Chinese carmaker BYD reported a 19% and nearly 40% yr-on-yr plunge in China product sales, respectively, in February.

Document highs or not, it looks marketplace professionals are not able to be swayed to the upside just but.