Investor Mark Mobius was place off Adani’s huge prepared share sale because of worries about the group’s credit card debt pile and exposure to political threat, he advised CNBC Tuesday.

But he does not imagine the fraud accusations that have rocked a single of India’s most important conglomerates will have a knock-on influence on the broader Indian current market — and in actuality he claims any publicity could be very good for investing.

“When you’re in these large infrastructure tasks, particularly if it is really exterior of India, and, you know, they’ve been exploring other parts of the world, you get into loads of political pitfalls,” Mobius advised CNBC’s “Capital Link.”

The Adani conglomerate spans ports, airports, mining, cement, ability and far more.

“The political possibility will become paramount when you have a extremely massive debt pile and you happen to be hoping to make revenue to pay out off that personal debt, and probably some political occasion will set up a wrench into the gears so that you happen to be not able to shell out back. So which is a single of the big complications that I had,” Mobius reported.

His firm, Mobius Cash Associates, focuses on emerging markets and India is a single of its best allocations.

On Jan. 24, U.S.-based mostly short promoting company Hindenburg Investigate revealed an explosive report alleging the Adani Team experienced engaged in “brazen inventory manipulation and accounting fraud scheme about the program of decades.”

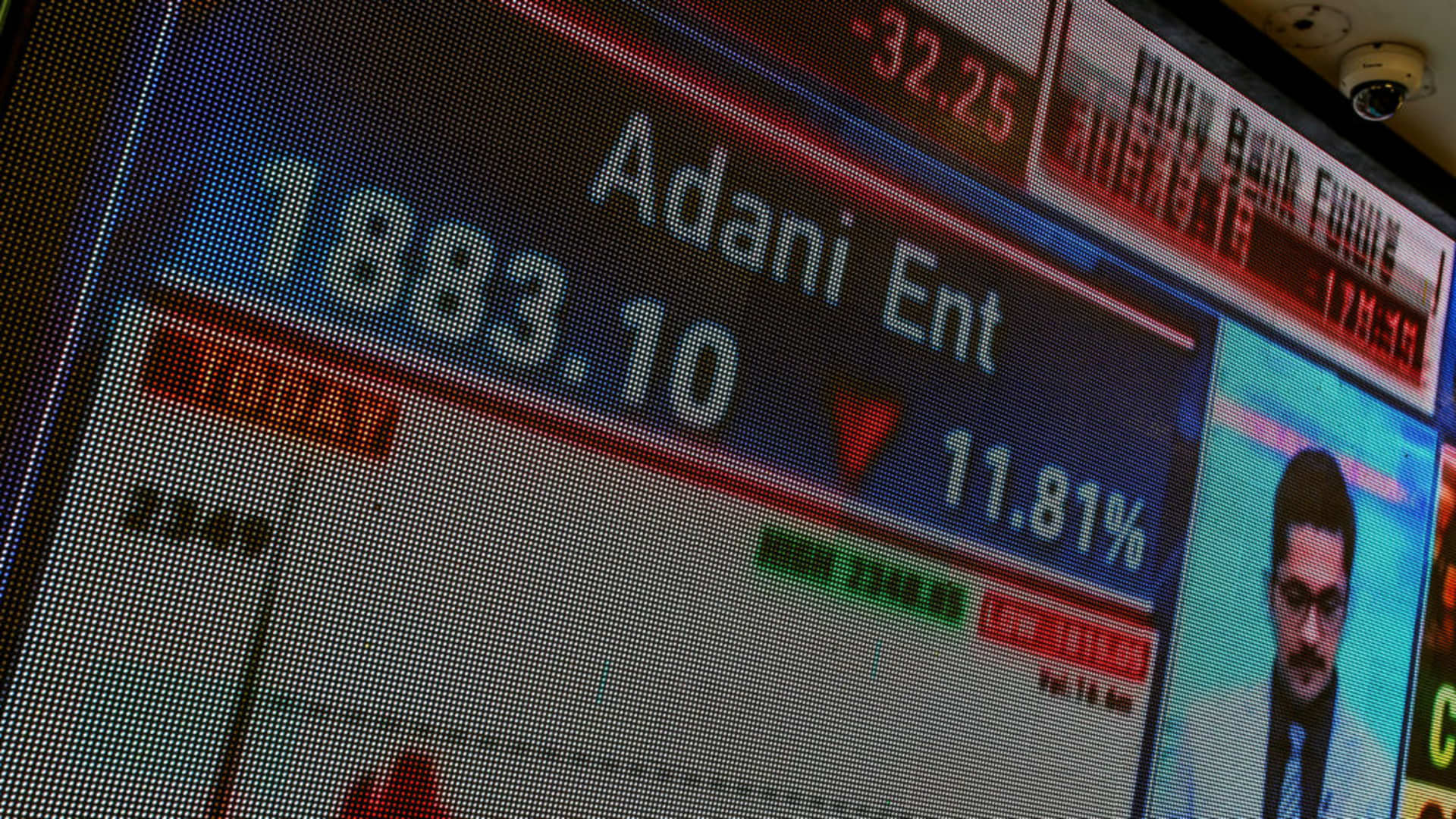

Providers which includes Adani Enterprises, Adani Transmission, Adani Inexperienced Power, Adani Power and Adani Overall Fuel have plummeted in worth due to the fact then, with the group shedding extra than $113 billion from its market place value. Adani-exposed exchange traded and mutual resources have been hit seriously.

That is inspite of sturdy denials of wrongdoing by the firm and its chairman, Gautam Adani, which had been specific in a 413-site report on Jan. 29.

On Feb. 1, Adani named off a completely subscribed $2.5 billion sale of Adani Enterprises shares, citing the inventory price actions.

Adani Enterprises share selling price this 12 months.

There will now be questions for the Indian federal government and big banking institutions that funded Adani with loans as scrutiny on the business proceeds, Mobius advised CNBC.

But, he added: “There are loads of marvelous businesses in India that have superb corporate governance, that seriously behave incredibly properly in the market place. So we have to use the Adani as sort of rather of an isolated circumstance.”

On the prospective fallout, he mentioned, “The Adani companies depict, what, about 6% of the Indian index. It truly is significant, but it’s not that substantial.”

“You can see that the index has not endured that substantially.”

India’s Sensex and Nifty 50 indexes dropped to around a few-thirty day period lows on the information, but have remained broadly resilient.

Analysts at Goldman Sachs, Nomura and HSBC have also said they do not imagine there will be a “broader contagion” in Indian marketplaces.

Nifty 50 index.

Some buyers and analysts have characterised India as a vibrant place above the very last year as other key economies have experienced from electricity industry volatility, a long time-high inflation and a sharp slowdown in financial growth.

Mobius also explained to CNBC: “The good news, in my perspective, is that it calls to awareness to the environment that India is huge. And there are some pretty significant businesses in India.”

“So the publicity in the intercontinental push, in some ways, is beneficial. It wakes up people today who have been sleeping, and not on the lookout at India the way they really should, as a huge state and a extremely fast-expanding nation.”

A different optimistic, he said, “is that the allegations will increase concerns, and there’ll be evaluation of other providers and corporate governance will almost certainly strengthen as a final result.”