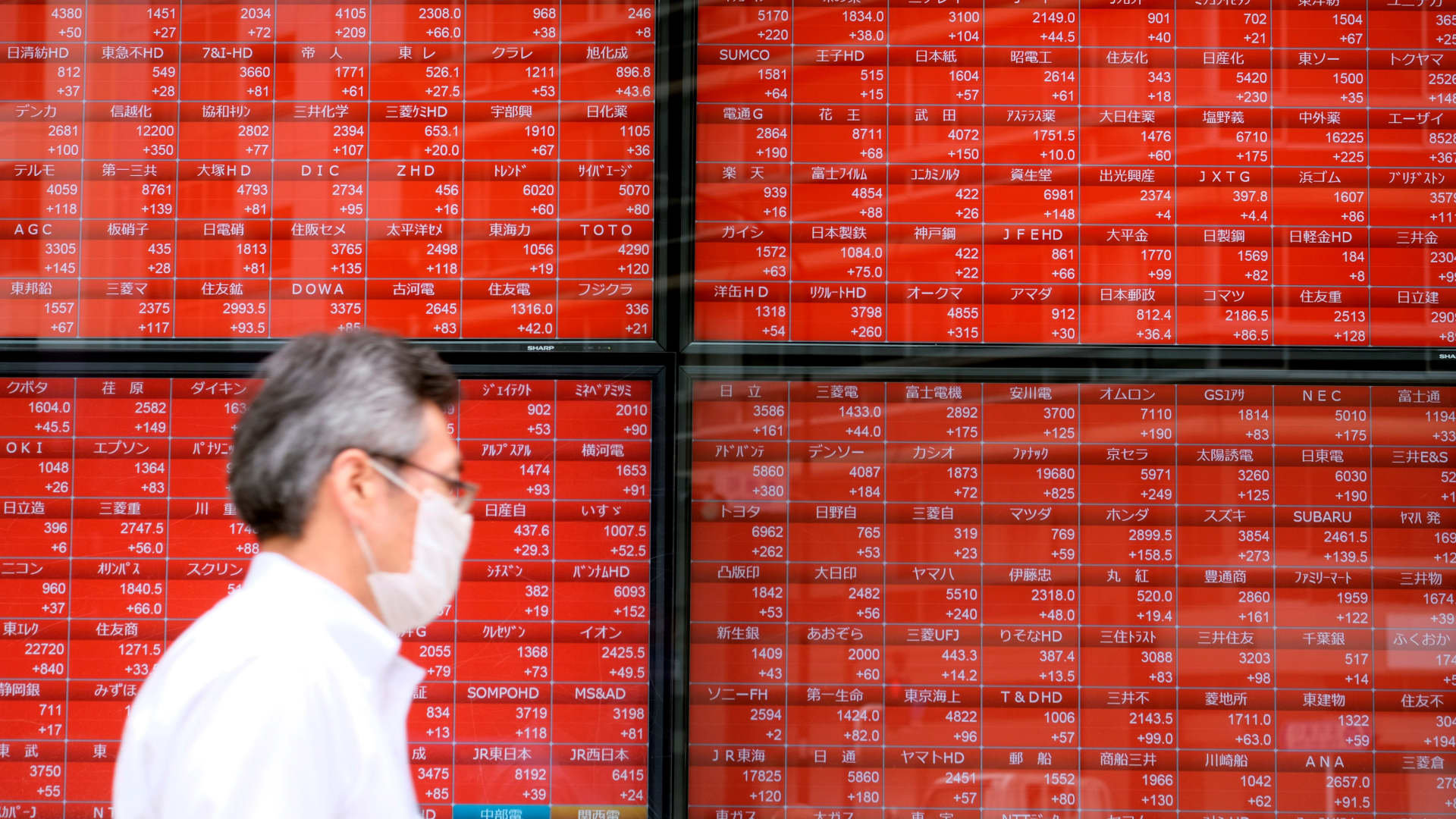

A pedestrian walks past an digital quotation board exhibiting share costs of the Tokyo Inventory Exchange in Tokyo on June 16, 2020.

Kazuhiro Nogi | AFP | Getty Pictures

Shares in the Asia-Pacific dropped sharply on Wednesday after indexes on Wall Road plunged pursuing a bigger-than-predicted U.S. customer price tag index report for August.

Japan’s Nikkei 225 dropped 2.7%, and the Topix index fell 2%. The Japanese yen traded at 143.75 for each greenback soon after hovering all around its weakest ranges considering that September 1998.

The Hold Seng index in Hong Kong dipped 2.55%, and the Hold Seng Tech index fell 2.96%. In Australia, the S&P/ASX 200 lose 2.48%.

The Kospi in South Korea missing 1.34% and the Kosdaq declined 1.67%. The South Korean received passed the 1,390-mark versus the dollar and was very last trading at 1,391.98 in opposition to the greenback, all around the weakest stages considering the fact that March 2009.

Mainland China’s Shanghai Composite lost 1.02% and the Shenzhen Ingredient fell 1.496%.

MSCI’s broadest index of Asia-Pacific shares outside the house Japan fell 2.28%.

The U.S. 2-12 months Treasury generate also reached 3.79%, the best stage considering the fact that 2007. The Dow Jones Industrial Regular misplaced 1,276.37 details, or 3.94%, to near at 31,104.97. The S&P 500 shed 4.32% to 3,932.69, and the Nasdaq Composite dropped 5.16% to end the session at 11,633.57.

“What is potentially most disconcerting in all this is that the strength in core inflation is quite considerably provider sector-led classes,” reported Ray Attrill, National Australia Bank’s head of Forex technique, wrote in a observe, adding the sector is mostly wage inflation-pushed.

— CNBC’s Jeff Cox, Jesse Pound and Carmen Reinicke contributed to this report.