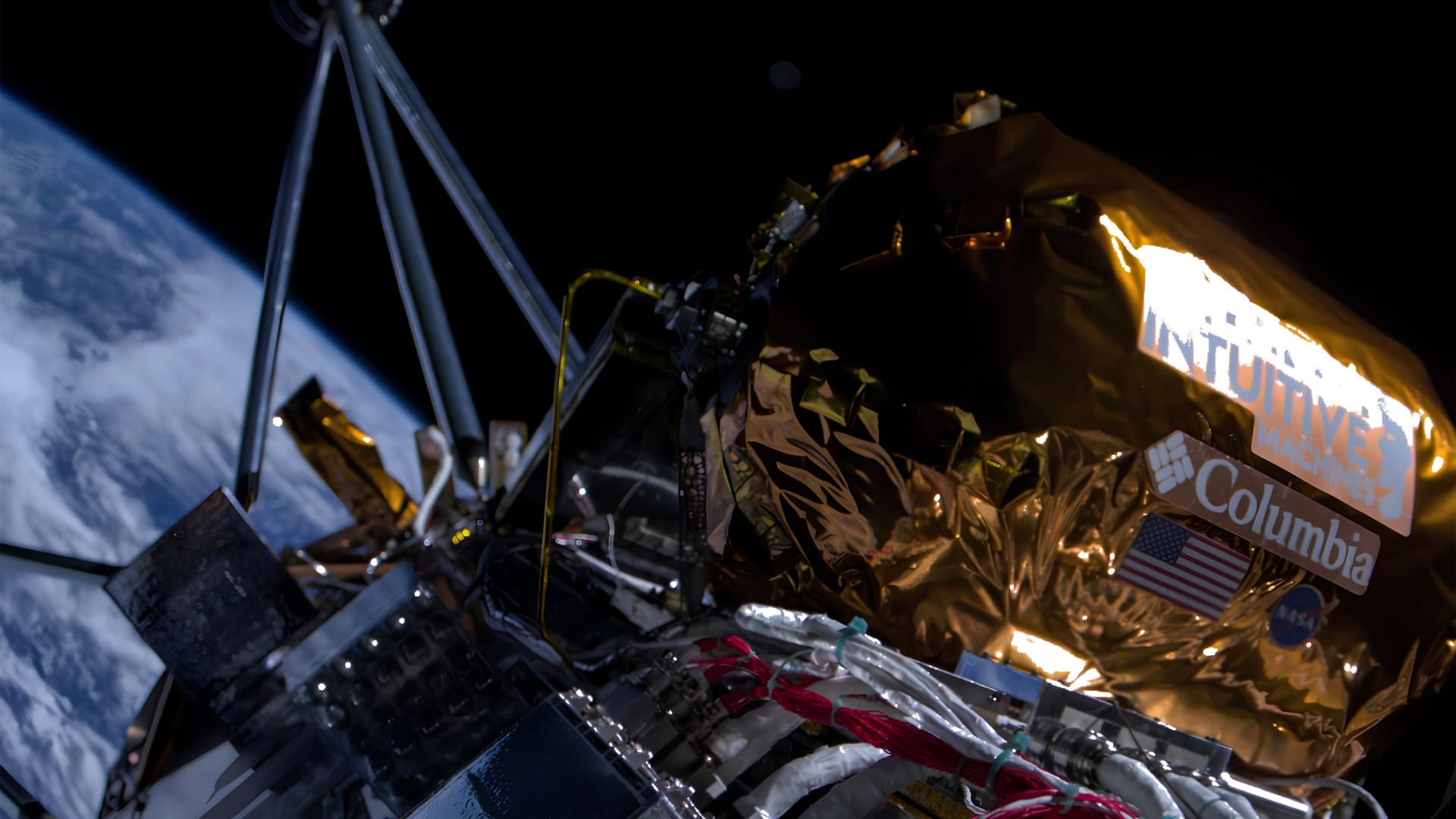

The company’s IM-1 mission lander shortly after launching on Feb. 15, 2024.

Intuitive Machines

Shares of Intuitive Machines jumped for a third consecutive trading session, surpassing their post-SPAC debut price, as the company’s first mission completed further milestones as it approached the moon.

Intuitive Machines’ stock surged as much as 65% in trading Tuesday to an intraday high of $12.05, north of the $10.03 a share price that shares traded at after the company completed its SPAC merger in February 2023.

As recently as last month, the stock was trading near $2 a share. Since its inaugural moon mission launched last week, the company’s share price has more than doubled.

The mission, known as IM-1, launched on a SpaceX rocket and has since completed several of the 16 milestones that Intuitive Machines identified as key to the mission’s success. One of the key milestones came when the lander, named “Odysseus,” successfully fired its engine for the first time. The lander has used the engine to adjust its trajectory and remain on target.

Sign up here to receive weekly editions of CNBC’s Investing in Space newsletter.

In a series of daily updates since Friday, the Texas-based lunar company said its cargo lander “continues to be in excellent health” and is preparing to enter the moon’s orbit on Wednesday. The company noted that entering lunar orbit, also known as “lunar orbit insertion,” will be the mission’s “largest challenge to date.”

The company is on track to make its moon landing attempt at 5:49 p.m. ET on Thursday, it said.

Intuitive Machines and NASA leaders showcase a mockup of the company’s Nova-C lunar lander during a presentation on May 31, 2019.

Aubrey Gemignani / NASA

The IM-1 lander is carrying 12 government and commercial payloads, six of which are for NASA under a $118 million contract.

Intuitive Machines’ mission represents the second under NASA’s Commercial Lunar Payload Services initiative, which aims to use low-cost private spacecraft to deliver science projects and cargo to the moon with increasing regularity in support of the agency’s Artemis crew program.

Governments and private companies alike have made more than 50 attempts to land on the moon with mixed success since the first attempts in the early 1960s, and the track record has remained shaky even in the modern era.

Last month, U.S. company Astrobotic got its first moon mission off the ground but encountered problems shortly after launch. The flight was cut short and failed to make a lunar landing attempt.

Don’t miss these stories from CNBC PRO: