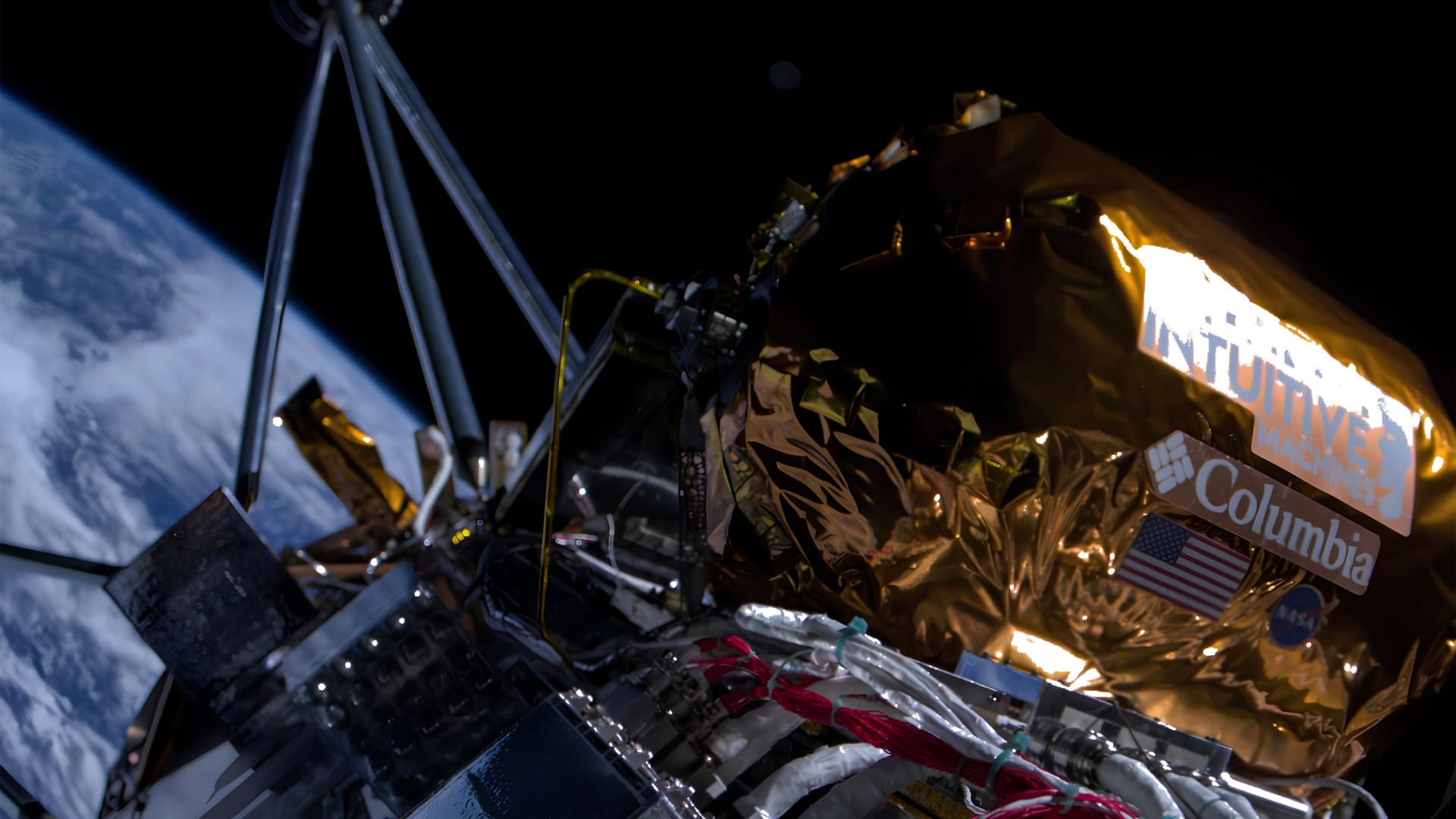

The company’s IM-1 mission lander shortly after launching on Feb. 15, 2024.

Intuitive Machines

Intuitive Machines‘ stock jumped in early trading Wednesday after NASA awarded the lunar-focused company a major contract to build moon data satellites.

“This contract marks an inflection point in Intuitive Machines’ leadership in space communications and navigation,” Intuitive Machines CEO Steve Altemus said in a statement.

NASA said the company was the sole awardee to build “lunar relay systems” for the agency’s Near Space Network, a system that communicates with government and commercial missions that are up to 1 million miles from Earth. The contract will see Intuitive Machines build and deploy a constellation of lunar satellites to provide communications and navigation services, especially for NASA’s Artemis program.

The five-year contract, which has a maximum total value of $4.82 billion, will incrementally issue awards as work progresses. Intuitive Machines’ initial NSN award is worth $150 million.

Intuitive Machines shares surged more than 50% in early trading from its previous close at $5.40 a share.

Cantor Fitzgerald analyst Andres Sheppard, whose firm has a buy-equivalent rating and a $10 price target on the stock, called the NSN contract a boon for the company.

“We see the win today as a significant catalyst and validation towards LUNR’s outlook and the company’s ability to continue to win contracts,” Sheppard wrote in a note to clients.

The stock has more than doubled year-to-date as Intuitive Machines has steadily racked up NASA contracts.

Intuitive Machines made history in February as the first U.S. company to soft-land a cargo mission on the moon’s surface. Since then, IM became one of three companies awarded contracts under NASA’s $4.6 billion crew lunar rover contract and also added its fourth cargo delivery contract with a $117 million award last month.

Benchmark’s Josh Sullivan, who also has a buy rating and $10 price target, said he believes the latest award shows that NASA views Intuitive Machines’ experience “as elite.”

“LUNR’s path to becoming the preeminent lunar infrastructure player took a big step forward with NSN,” Sullivan wrote.

The company is preparing to launch its next cargo mission to the moon, IM-2, in the first quarter. Analysts expect the company’s first NSN lunar satellite will launch on the IM-3 mission that’s scheduled for late 2025.