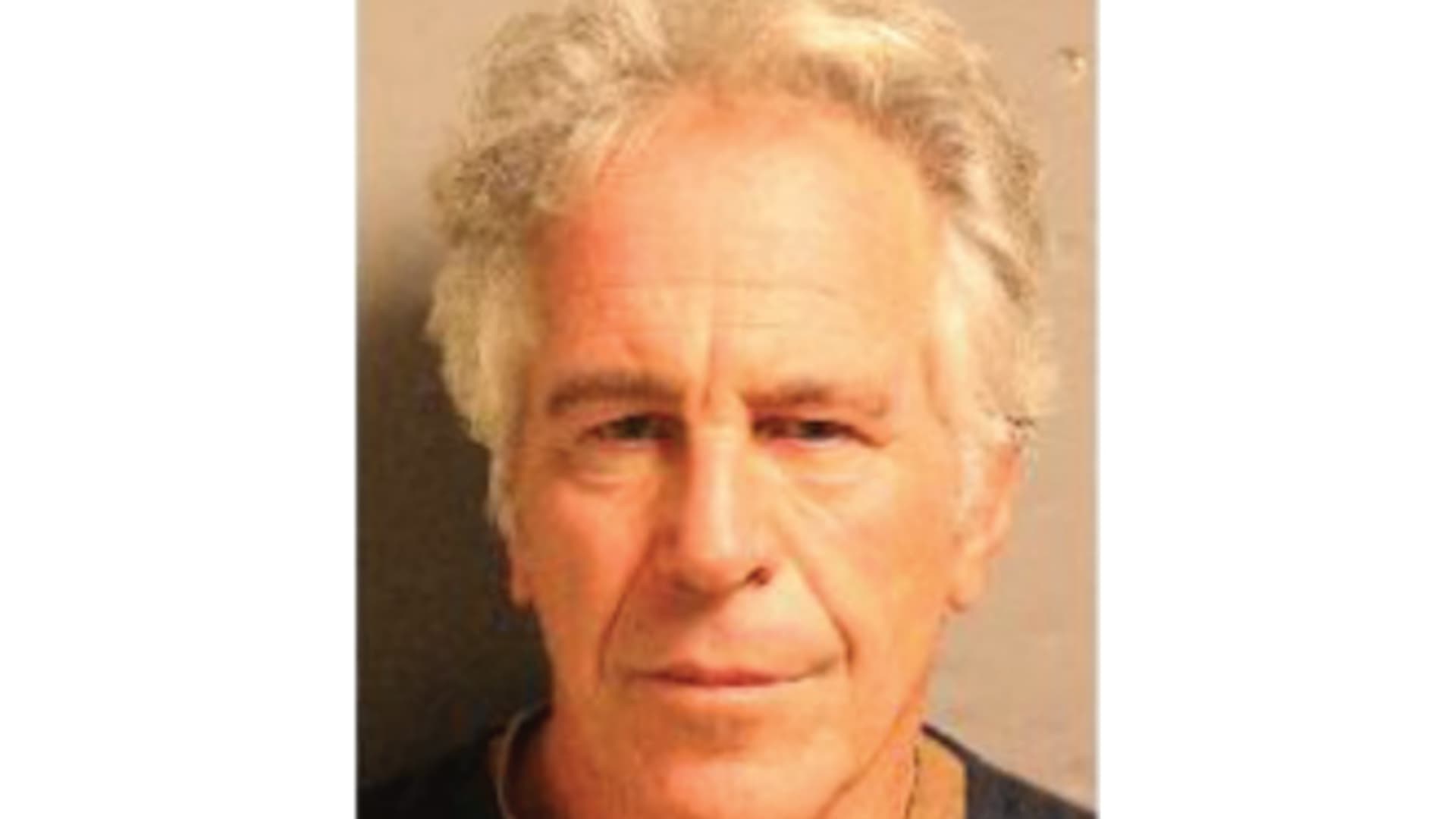

Michael Burns

Michael Newberg | CNBC

Lionsgate is leaning toward spinning off its studio division rather than its Starz cable and streaming unit, according to people familiar with the matter.

This would be a change in strategy for the media and entertainment company, which said in May it expected to finalize a spin or sale of Starz by the end of summer. In recent months, Lionsgate has held talks to sell a 20% stake in Starz to a number of potential buyers, including most recently Vivendi-owned Canal+, the people said, who asked not to be named because the discussions are private. Those talks haven’t ended, but no deal is imminent, said the people.

Lionsgate is engaged in talks with multiple potential partners about selling a stake in the studio business, said the people. Those talks are likely to more quickly reach a deal Lionsgate is comfortable with than for Starz since there’s more robust interest, the people said. The studio business produces films and TV series, and includes a library of more than 17,000 titles, such as “The Hunger Games,” “The Expendables,” and “Mad Men.”

Lionsgate is expected to make a formal announcement on its new plans as early as Wednesday. A Lionsgate spokesperson declined to comment.

Selling a stake in the studio to a private-equity firm or strategic company will set a valuation floor for the business to trade on its own. It would also bring an immediate jolt of capital to Lionsgate, whose shares have plummeted in recent years. Lionsgate’s market valuation is about $1.8 billion, down from nearly $7 billion in early 2018.

Longer term, Lionsgate is interested in selling both the studio and Starz, said the people. The company competes against much larger entities – including Netflix, Disney, Amazon, Apple and Comcast’s NBCUniversal – in TV and movie production. Lionsgate executives hope a spin off of the studio and separation of Starz would be first steps toward facilitating a sale of both units to maximize value for shareholders, said the people.

“We’re not going to make a dumb deal on one or both sides of the business,” Lionsgate vice chairman Michael Burns said during a Bank of America media and entertainment conference last month. “I think our shareholders will be very happy with the outcome.”

Starzplay rebrand

Lionsgate also plans to rebrand its international streaming service, Starzplay, to Lionsgate+, said the people. The rebrand will take place in 35 countries in Europe, Latin America and Asia Pacific, including the U.K., France, Germany, Australia and Japan, one of the people said.

Starz’s streaming service will keep the Starz brand in the U.S. and Canada, the person said. Starz is in 63 countries and ended last quarter with 26.3 million global streaming subscribers.

Rebranding Starz to Lionsgate+ also keeps a link between Lionsgate and Starz even as the businesses separate.

Disclosure: Comcast’s NBCUniversal is the parent company of CNBC.