Andrew Bialecki, CEO and co-founder of Klaviyo, poses for a portrait in Boston on Sep. 5, 2019.

Barry Chin | Boston World | Getty Images

Klaviyo is focusing on a absolutely diluted valuation of up to $9 billion in its initial community offering soon after it raised the proposed selling price assortment of its shares in a submitting on Monday.

The advertising automation firm believed in the submitting that its IPO price will fall in between $27 and $29, up from the $25 to $27 variety it earlier estimated. Klaviyo declared the start of its IPO past 7 days and ideas to checklist shares on the New York Inventory Trade underneath the ticker “KVYO.”

Klaviyo’s IPO arrives following a yearslong extend of quite several significant enterprise-backed tech choices. It follows Instacart’s IPO announcement and Arm’s debut, exhibiting an early signal that tech choices could be making a comeback. Relying on how Klaviyo, Instacart and Arm accomplish, their IPOs could motivate other tech businesses to observe.

E-commerce enterprise Shopify owns about 11% of Klaviyo shares, the advertising business disclosed, with about a few-quarters of its annualized recurring profits derived from customers who use Shopify, as of the conclusion of 2022.

— CNBC’s Annie Palmer contributed to this report.

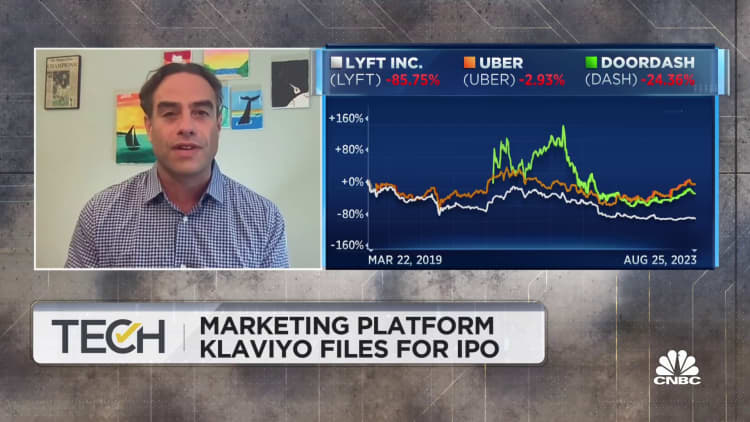

View: Tech agency Klaviyo information for IPO