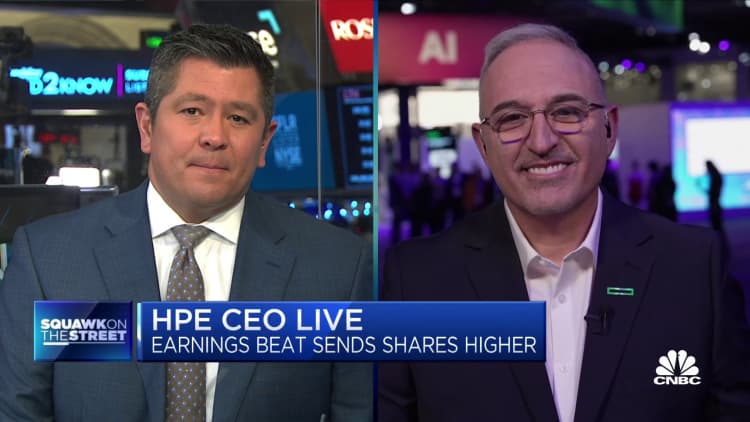

Antonio Neri

Anjali Sundaram | CNBC

Juniper Networks shares soared a lot more than 20% in prolonged buying and selling on Monday soon after the Wall Street Journal noted that Hewlett Packard Organization is in “innovative talks” to purchase the company for close to $13 billion.

A deal could be introduced as shortly as this 7 days, the Journal said, citing individuals familiar with the matter. Juniper and HPE associates did not right away respond to CNBC’s requests for remark.

Juniper, which has prolonged competed with Cisco in the networking machines industry, underperformed the tech industry last 12 months. The company’s stock value fell about 8% in 2023, although the Nasdaq Composite attained 43%. HPE rose approximately 10%.

Juniper’s revenue shrank 1% in the third quarter from a calendar year previously to $1.4 billion.

A deal could bolster HPE’s efforts to problem Cisco, the primary supplier of networking switches. In the most current quarter, HPE noted 2% profits growth from a yr earlier. Its fastest-developing segment in the quarter was Clever Edge, which contains knowledge center switching.

HPE held $4 billion in dollars and equivalents at the stop of Oct.

HPE was shaped in 2015, when Hewlett-Packard break up into two corporations. HP, the other spinout, makes PCs and printers.

Considering the fact that the split, HPE has mostly avoided creating splashy acquisitions. Its greatest offer was the $1.5 billion buy of supercomputer maker Cray in 2019.

In May possibly, HPE agreed to promote its stake in the Chinese joint enterprise H3C for $3.5 billion. An government explained at the firm’s analyst assembly in Oct that HPE will not program to keep excessive funds over the very long term.

Browse the entire Wall Road Journal report right here.

Enjoy: HPE CEO: AI interest is much increased than I ever anticipated, and we see an tremendous pipeline