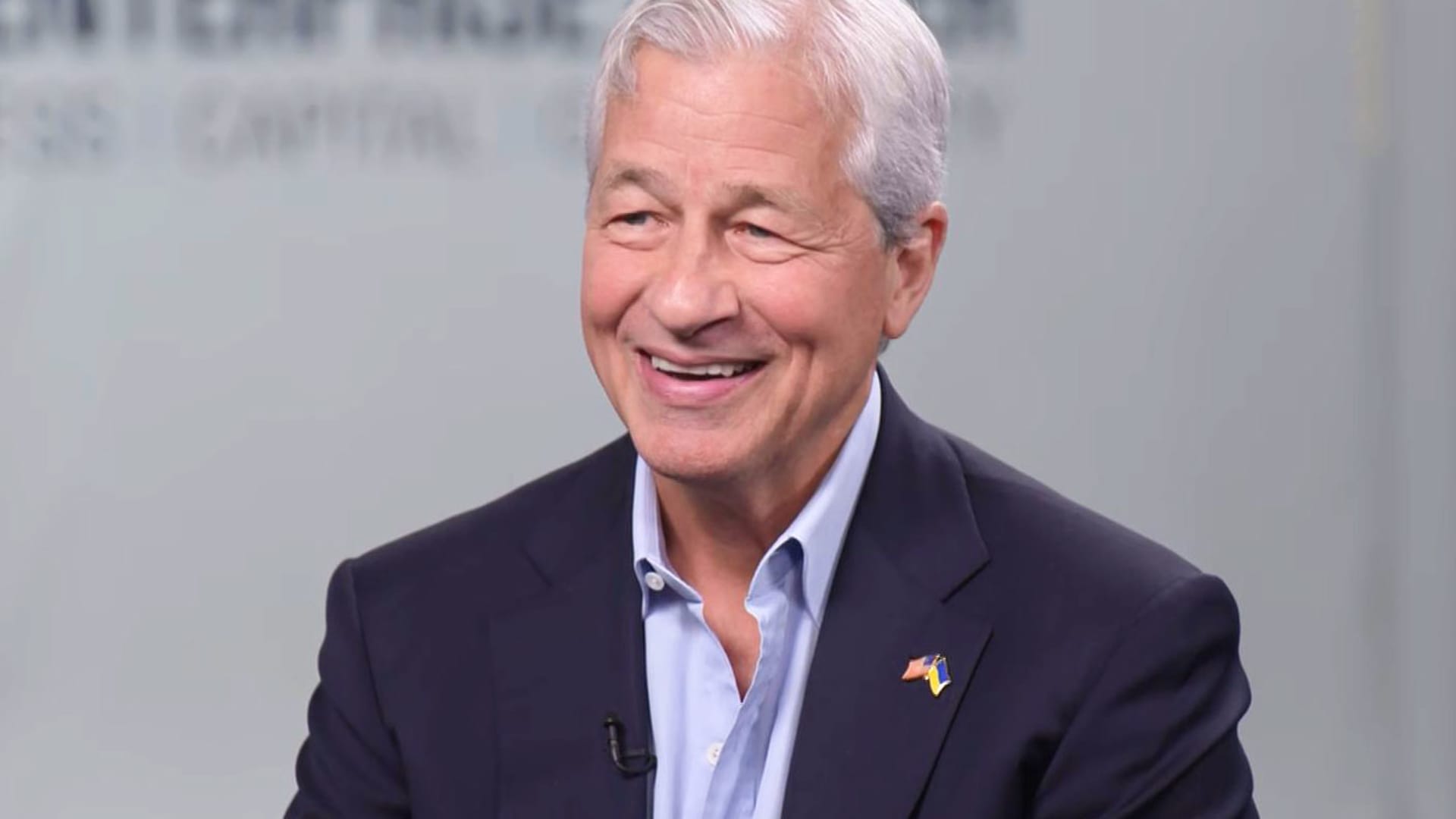

- U.S financial institutions including JPMorgan Chase, Wells Fargo and Morgan Stanley explained Friday they prepare to elevate their quarterly dividends after clearing the Federal Reserve’s yearly tension test.

- JPMorgan options to increase its payout to $1.05 a share from $1 a share starting off in the 3rd quarter, the New York-based financial institution explained in a statement.

- Goldman Sachs declared the premier for every share strengthen among the major banking companies, even though Citigroup announced the smallest.