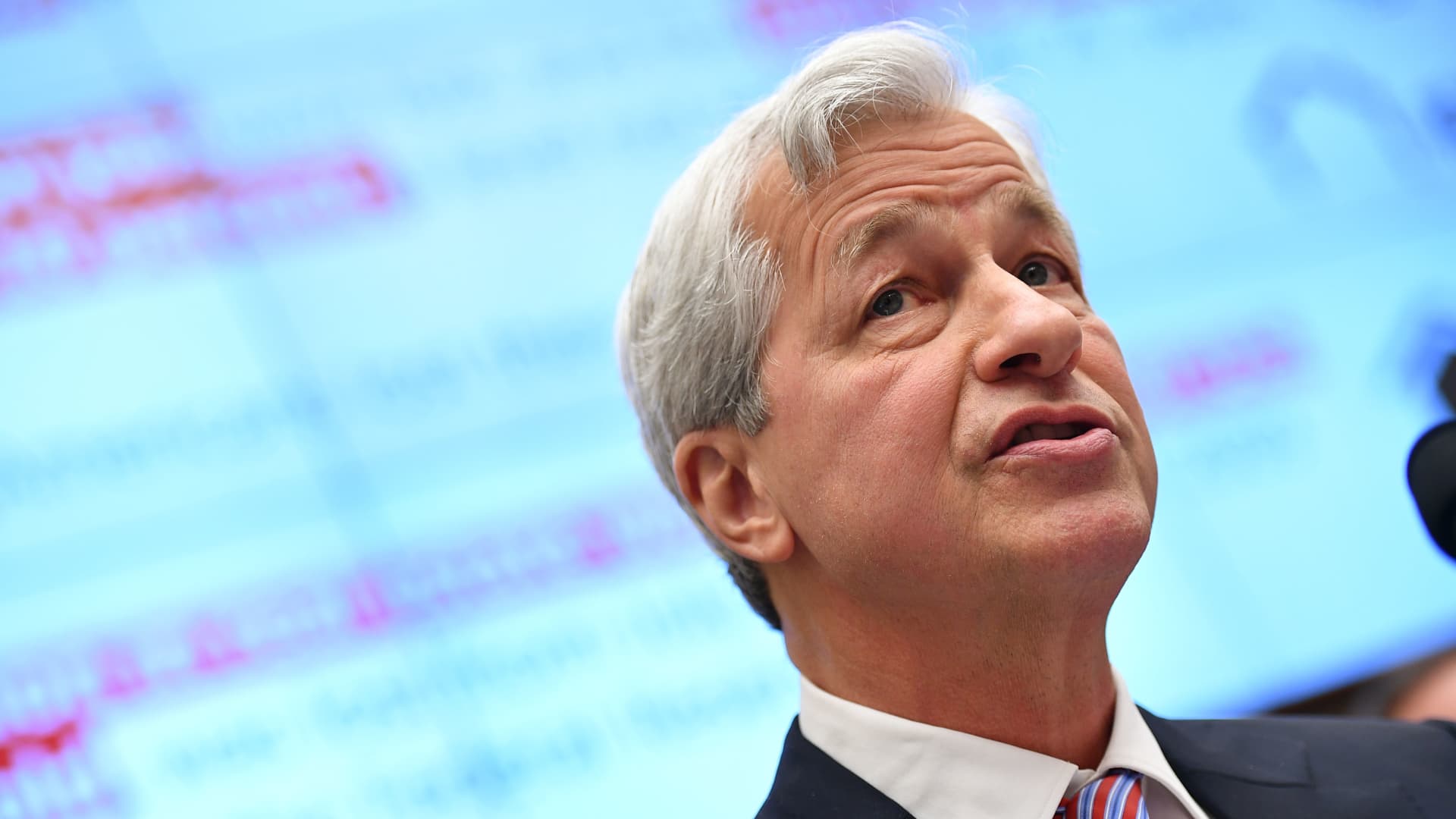

JP Morgan Chase & Co. Chairman & Chief Executive Officer Jamie Dimon testifies before the House Financial Services Committee on accountability for megabanks in the Rayburn House Office Building on Capitol Hill in Washington, DC on April 10, 2019.

Mandel Ngan | AFP | Getty Images

JPMorgan Chase CEO Jamie Dimon was handed a rare rebuke on Tuesday after shareholders rejected a massive retention bonus announced by the bank last year.

Just 31% of investors participating in the New York-based bank’s annual shareholder meeting supported the $52.6 million award that was part of Dimon’s 2021 compensation package.

The bonus, in the form of 1.5 million options that Dimon can exercise in 2026, was designed to keep the CEO and chairman at the helm of JPMorgan for another five years. Its estimated value, pegged last year, fluctuates and is dependent on the bank’s share price appreciation, according to bank spokesman Joe Evangelisti.

“The special award was extremely rare – the first in more than a decade for Mr. Dimon – and it reflected exemplary leadership and additional incentive for a successful leadership transition,” Evangelisti said.

While the results of the so-called “say on pay” vote are nonbinding, JPMorgan’s board said it takes investor feedback “seriously” and intended Dimon’s bonus to be a one-time event, he added.

The disapproval was the first time JPMorgan’s board suffered a downvote on compensation since the measures were introduced more than a decade ago. Dimon, 66, has led JPMorgan since 2006, helping guide it through several crises and building it into the biggest U.S. bank by assets.

Earlier this month, proxy advisory firms including Glass, Lewis & Co recommended that shareholders reject the pay package of Dimon and his top lieutenant. Including the retention bonus, Dimon’s pay last year was valued at $84.4 million.

“Excessive one-off grants to the CEO and COO amid tepid relative performance worsen long-standing concerns regarding the company’s executive-pay program,” Glass Lewis said in its report.

Dimon and his other directors received support otherwise from investors, which is more typical of a shareholder vote at a large company.

Glass Lewis had also advised that shareholders reject the compensation of rival CEO David Solomon, who leads Goldman Sachs and was awarded a $30 million retention bonus in October. In that case, however, about 82% of Goldman’s shareholders voted in favor of management.