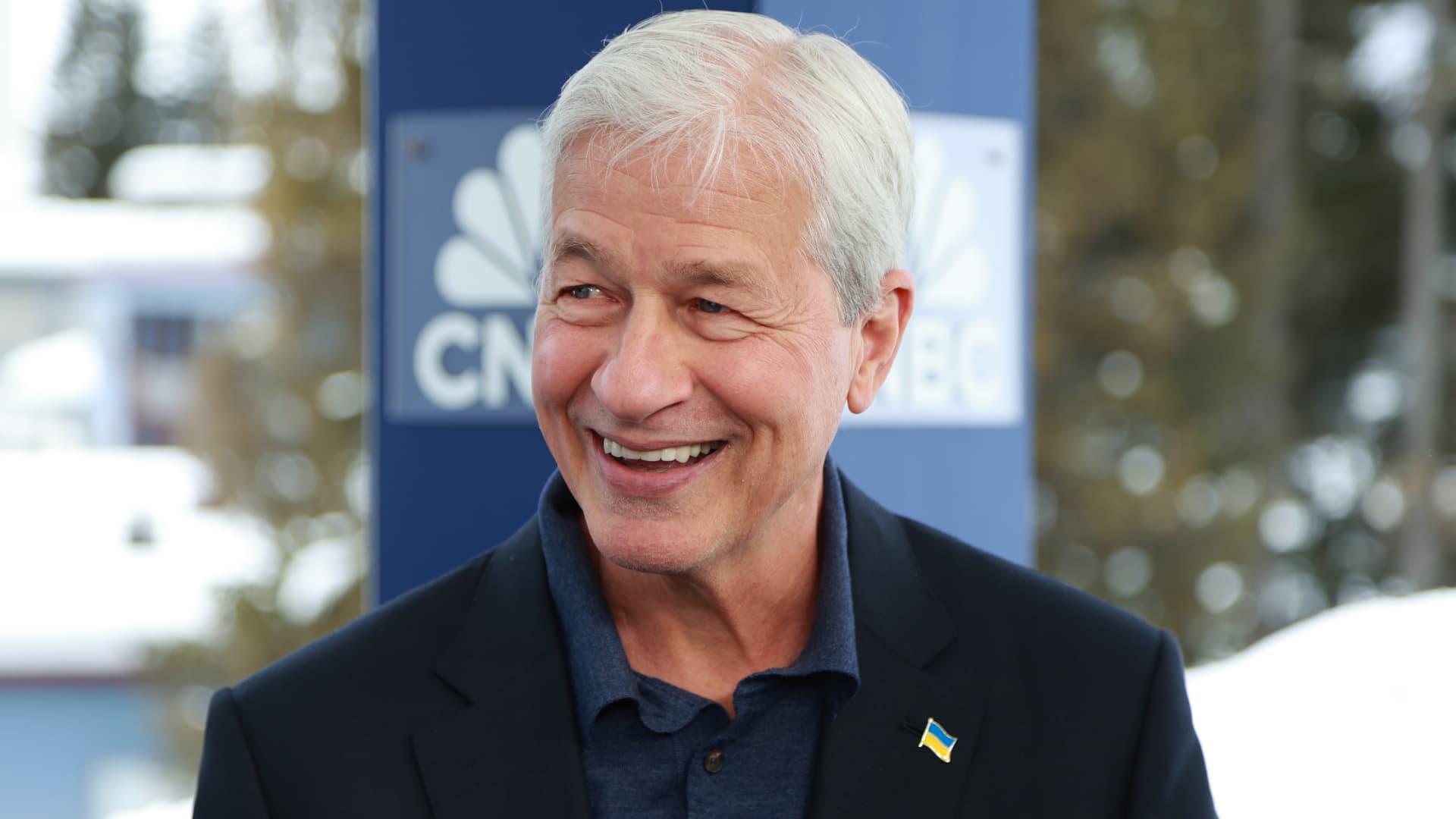

Jamie Dimon, President and CEO of JPMorgan Chase, speaking on CNBC’s “Squawk Box” at the World Economic Forum Annual Meeting in Davos, Switzerland, on Jan. 17, 2024.

Adam Galici | CNBC

JPMorgan Chase is scheduled to report first-quarter earnings before the opening bell Friday.

Here’s what Wall Street expects:

- Earnings: $4.11 a share, according to LSEG

- Revenue: $41.85 billion, according to LSEG

- Net interest income: $23.18 billion, according to StreetAccount

- Trading Revenue: Fixed income of $5.19 billion and equities of $2.57 billion, according to StreetAccount

JPMorgan will be watched closely for clues on how banks fared at the start of the year.

While the biggest U.S. bank by assets has navigated the rate environment well since the Federal Reserve began raising rates two years ago, smaller peers have seen their profits squeezed.

The industry has been forced to pay up for deposits as customers shift cash into higher-yielding instruments, squeezing margins. Concern is also mounting over rising losses from commercial loans, especially on office buildings and multifamily dwellings, and higher defaults on credit cards.

Still, large banks are expected to outperform smaller ones this quarter, and expectations for JPMorgan are high. Analysts believe the bank can boost guidance for 2024 net interest income as the Federal Reserve is forced to maintain interest rate levels amid stubborn inflation data.

Analysts will also want to hear what CEO Jamie Dimon has to say about the economy and the industry’s efforts to push back against efforts to cap credit card and overdraft fees.

Wall Street may provide some help this quarter, with investment banking fees for the industry up 11% from a year earlier, according to Dealogic.

Shares of JPMorgan have jumped 15% this year, outperforming the 3.9% gain of the KBW Bank Index.

Wells Fargo and Citigroup are scheduled to release results later Friday, while Goldman Sachs, Bank of America and Morgan Stanley report next week.

This story is developing. Please check back for updates.