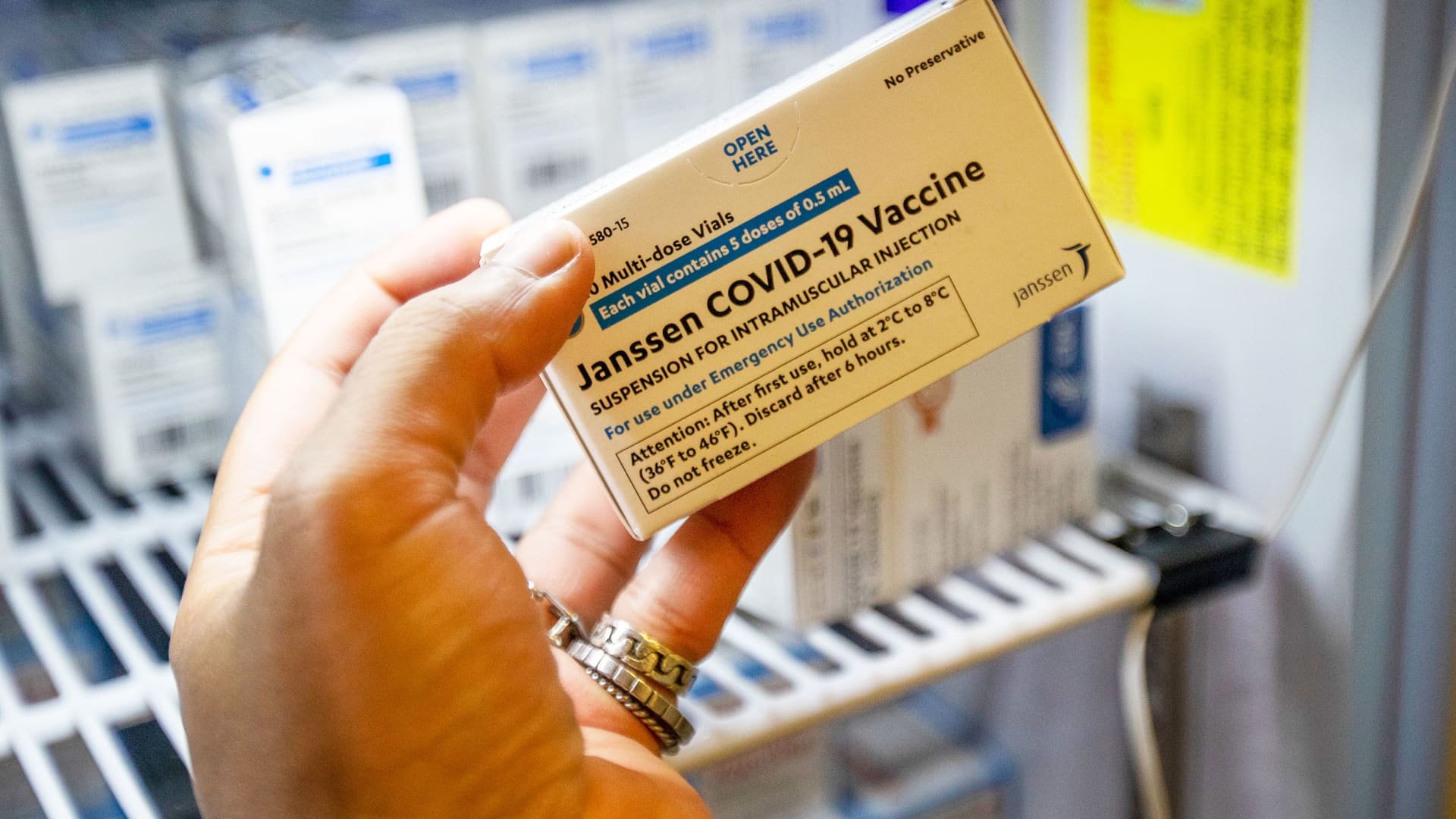

The Janssen Johnson & Johnson COVID-19 vaccine.

Allen J. Schaben | Los Angeles Times | Getty Images

International Covid vaccine sales helped spark Johnson & Johnson‘s revenue and earnings beat on Tuesday, but the company said it expects no sales from the shot moving forward.

“Regarding our Covid-19 vaccine, we do not anticipate material sales beyond that which were recorded in the first quarter as our contractual commitments are complete,” Joseph Wolk, the chief financial officer, said during a conference call Tuesday.

related investing news

Those commitments include external manufacturing exit costs and clinical-trial expenses, the consumer staples giant said in its first-quarter earnings release.

That marks the end of a rocky three years for J&J’s Covid vaccine despite being one of the first shots to enter the U.S. market during the pandemic. The vaccine, initially billed as a single-dose regimen, has long been overshadowed by the slightly more effective shots from Pfizer and Moderna due to a rare but serious risk of a blood-clotting disorder.

J&J’s unpopular shot appeared to bear its last fruit Tuesday, contributing $747 million in sales during the three-month period ended March 23. That drove strong growth in the company’s pharmaceutical business, which saw sales grow more than 4% over the same period last year.

Notably, all Covid vaccine revenue during the quarter came from outside of the U.S. It is unclear which countries contributed to the sales.

That revenue number trounced estimates of Wall Street analysts.

Bank of America analyst Geoff Meacham had expected the shot to bring in $150 million in sales during the quarter. A forecast by Wells Fargo analysts did “not assume any Covid sales in Q1,” but noted that some revenue from contract commitments could “pull through.”

After J&J reported earnings, SVB Securities analyst David Risinger also noted that sales of the vaccine beat a consensus estimate by more than $500 million. JP Morgan analyst Chris Schott added that J&J’s first-quarter beat was in part “driven by Covid vaccine upside.”

First-quarter sales of the Covid vaccine are also up from the $544 million it raked in during J&J’s last quarter, and the $457 million the company reported a year ago.

The last time J&J reported U.S. sales of the vaccine was during the second quarter of 2022, which ended weeks after a Food and Drug Administration decision that strictly limited who can receive the shot. The agency said the vaccine can only be given to adults who specifically request it or cannot receive a different shot, pointing to the risk of blood clots.

Earlier this year, the drugmaker also announced it scaled back production of the shot amid slumping demand.

While J&J’s vaccine fell out of favor in the U.S. and other wealthy countries, developing countries have continued to rely on it. As a single shot, the vaccine is less expensive and easier to distribute to hard-to-reach populations.