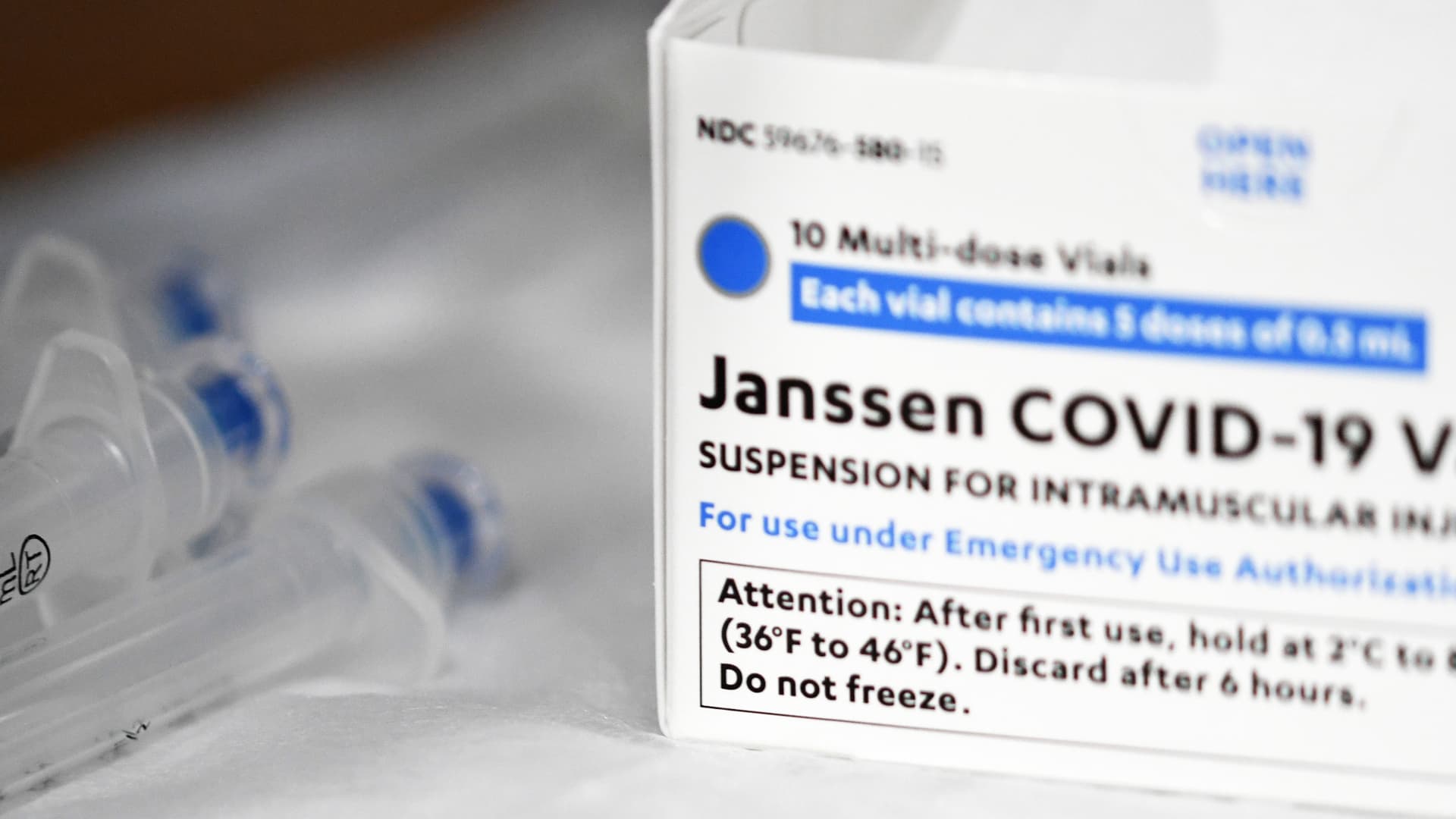

Syringes and a box of Johnson & Johnson vaccine.

Paul Hennessy | SOPA Images | LightRocket | Getty Images

Johnson & Johnson on Tuesday lowered its full-year sales and earnings outlook, and stopped providing Covid-19 vaccine revenue guidance due to a global supply surplus and demand uncertainty.

J&J is now forecasting 2022 sales of $94.8 billion to $95.8 billion, about one billion dollars lower than the guidance provided in January. The company lowered its full-year adjusted earnings per share by 25 cents to between $10.15 to $10.35, from a previous forecast of $10.40 to $10.60.

J&J reported first-quarter sales of $23.4 billion, slightly missing Wall Street expectations but growing 5% over the same quarter last year. The company posted earnings of $2.67 cents per share, beating expectations and growing 3.1% over the same period of 2021. J&J reported net income of $5.15 billion, a nearly 17% decrease over the first quarter of 2021.

Here’s how J&J performed compared with what Wall Street expected, based on analysts’ average estimates compiled by Refinitiv:

- Adjusted EPS: $2.67 per share, vs. $2.58 expected

- Revenue: $23.4 billion, vs. $23.6 billion expected

The company sold $457 million of its Covid vaccine globally. CFO Joe Wolk said developing nations have limited capacity in terms of refrigeration and getting shots in arms, which has created a backlog of the vaccines. When asked about no longer providing a sales outlook for the shots, Wolk said it was unusual to provide guidance for a specific product to begin with.

“We did it last year because we understood the Street had an expectation or at least an excitement around understanding how vaccine sales might play out but it was never material,” Wolk told CNBC’s Meg Tirrell, noting that the vaccine is not for profit and doesn’t impact the company’s bottom line. He said Covid vaccine sales met J&J’s internal expectations.

J&J reported $12.87 billion in pharmaceutical sales, an increase of 6.3% over the same quarter last year. The company’s medical devices business grew by 5.9% to $6.97 billion in sales compared to the first quarter of 2021. Sales at J&J’s consumer health business, which it is spinning off into a separate publicly traded company, declined 1.5% to $3.59 billion compared to the same period last year.

In pharmaceuticals, Wolk said new prescriptions slowed in early January when the omicron Covid variant was sweeping the U.S., but picked up in February and March. He said J&J’s medical devices business led the company’s growth with an uptick in general and advanced surgery as well as orthopedics. The company’s medical devices segment has previously struggled during Covid surges, when elective procedures are delayed because hospitals are overwhelmed with patients who are sick with the virus.

Wolk said consumer health was hit by supply constraints for some product ingredients and packaging materials, particularly in skin health and beauty. However, he said demand is strong for consumer health products, notably over-the-counter medicines such as Tylenol and Motrin, and J&J expects skin health and beauty to rebound later in the year.

J&J’s board has approved a 6.6% quarterly dividend increase to $1.13 per share due to the company’s strong 2021 performance, the company announced.