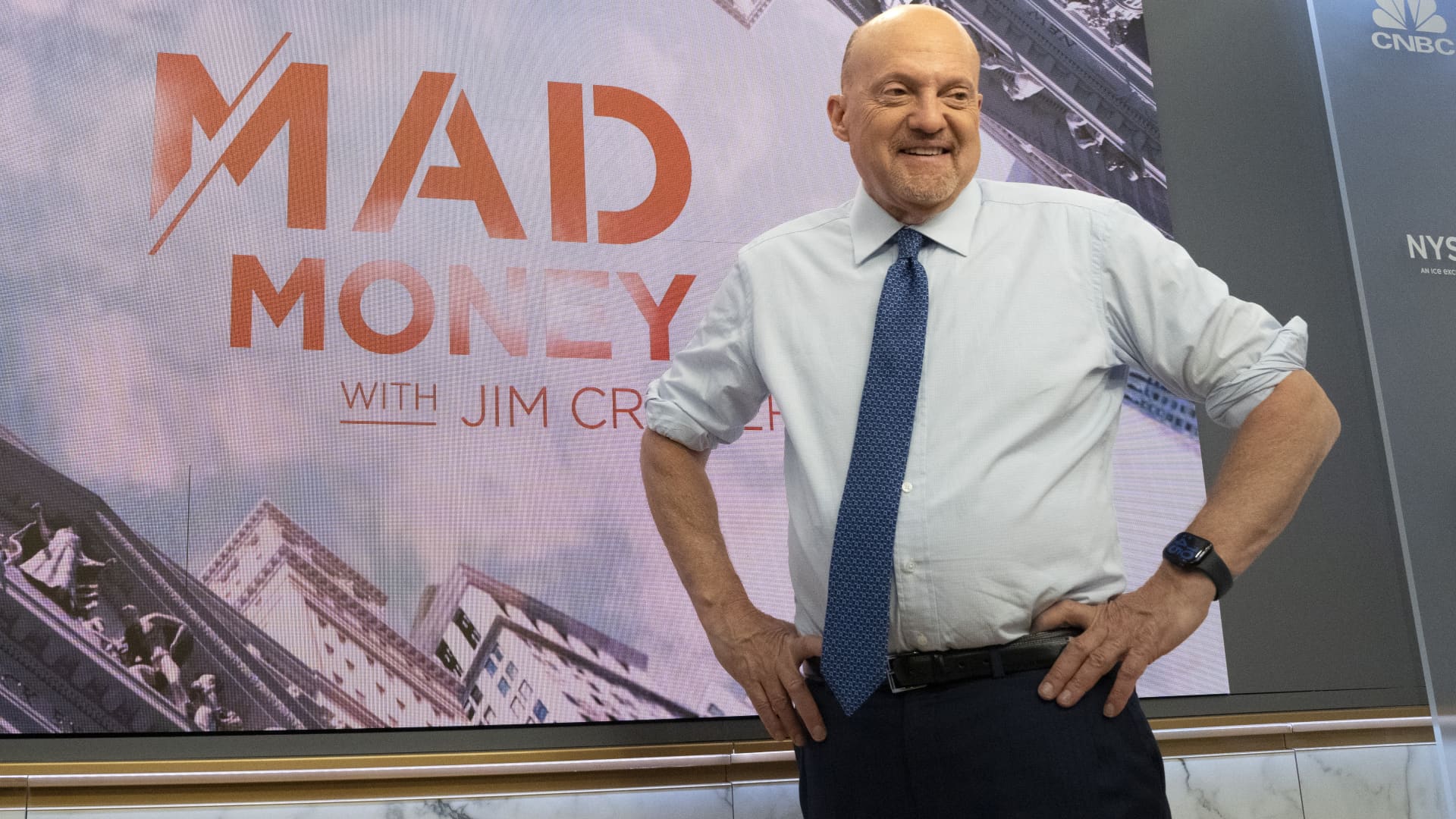

CNBC’s Jim Cramer on Monday told investors that the Federal Reserve’s actions this week could lead to a bull market.

“If [Fed Chair] Jerome Powell says, ‘we’re getting a 75 basis point rate hike and then we’ll see what happens’ … then you might get a rip-snorting rally,” the “Mad Money” host said.

“On the other hand, if he says we’re doing the triple-rate hike and then we’re willing to keep tightening no matter what, including a possible inter-meeting hike if the CPI stays hot, then we are definitely going lower,” he added, referring to June’s hotter-than expected 9.1% inflation reading.

The Federal Reserve will conclude its two-day meeting on Wednesday, and many analysts expect a 75 basis point rate hike.

Cramer also previewed this week’s slate of earnings. All earnings and revenue estimates are courtesy of FactSet.

Tuesday: General Electric, Alphabet, Microsoft

General Electric

- Q2 2022 earnings release at 6:30 a.m. ET; conference call at 8 a.m. ET

- Projected EPS: 37 cents

- Projected revenue: $17.36 billion

Cramer said he’s not bullish on GE – yet.

Alphabet

- Q2 2022 earnings release at 4 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $1.27

- Projected revenue: $69.87 billion

Microsoft

- Q4 2022 earnings release at 4:05 p.m. ET; conference call at 5:30 p.m. ET

- Projected EPS: $2.29

- Projected revenue: $52.39 billion

Cramer said he believes both Alphabet and Microsoft could have standout quarters.

Wednesday: Boeing, Meta, Ford, ServiceNow

Boeing

- Q2 2022 earnings release at 7:30 a.m. ET; conference call at 10:30 a.m. ET

- Projected loss: loss of 13 cents per share

- Projected revenue: $17.57 billion

He said he’s doubtful that Boeing will report a solid quarter given the ongoing worker strikes and no federal go-ahead for its 787 Dreamliner commercial jets.

Meta

- Q2 2022 earnings release at 4:05 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $2.55

- Projected revenue: $28.92 billion

Meta will likely report an earnings beat and forecast cut, Cramer predicted. “Once the expectations get low enough, though, for the metaverse, then the stock becomes a solid buy,” he said.

Ford

- Q2 2022 earnings release at 4:05 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: 45 cents

- Projected revenue: $37.20 billion

Cramer believes the carmaker will report that it’s sold out of many models.

ServiceNow

- Q2 2022 earnings release at 4:10 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $1.55

- Projected revenue: $1.76 billion

“We had CEO Bill McDermott on last month and he talked about tougher times in Europe. His stock got hit hard in response — now we’ll find out if that was an overreaction,” he said.

Thursday: Apple, Amazon

Apple

- Q3 2022 earnings release at 4:30 p.m. ET; conference call at 5 p.m. ET

- Projected EPS: $1.16

- Projected revenue: $82.73 billion

“Own it, don’t trade it,” Cramer said.

Amazon

- Q2 2022 earnings release at 4 p.m. ET; conference call at 5:30 p.m. ET

- Projected EPS: 12 cents

- Projected revenue: $118.98 billion

Cramer said Amazon’s stock price could open “very low” at Tuesday’s market open after Walmart cut its profit outlook Monday, dragging the e-commerce giant’s stock down after-hours.

Friday: Chevron, Procter & Gamble

Chevron

- Q2 2022 earnings release at tbd time; conference call at 11 a.m. ET

- Projected EPS: $5.08

- Projected revenue; $58.66 billion

Cramer said he believes Chevron will deliver great results in its latest quarter, even if analysts are growing increasingly skeptical of the company’s ability to perform.

Procter & Gamble

- Q4 2022 earnings release at 6:55 a.m. ET; conference call at 9 a.m. ET

- Projected EPS: $1.22

- Projected revenue: $19.41 billion

“If Procter comes in, I’d treat that as a buying opportunity – after it reports though,” Cramer said.

Disclosure: Cramer’s Charitable Trust owns shares of Apple, Alphabet, Amazon, Chevron, Ford, Meta, Microsoft and Procter & Gamble.