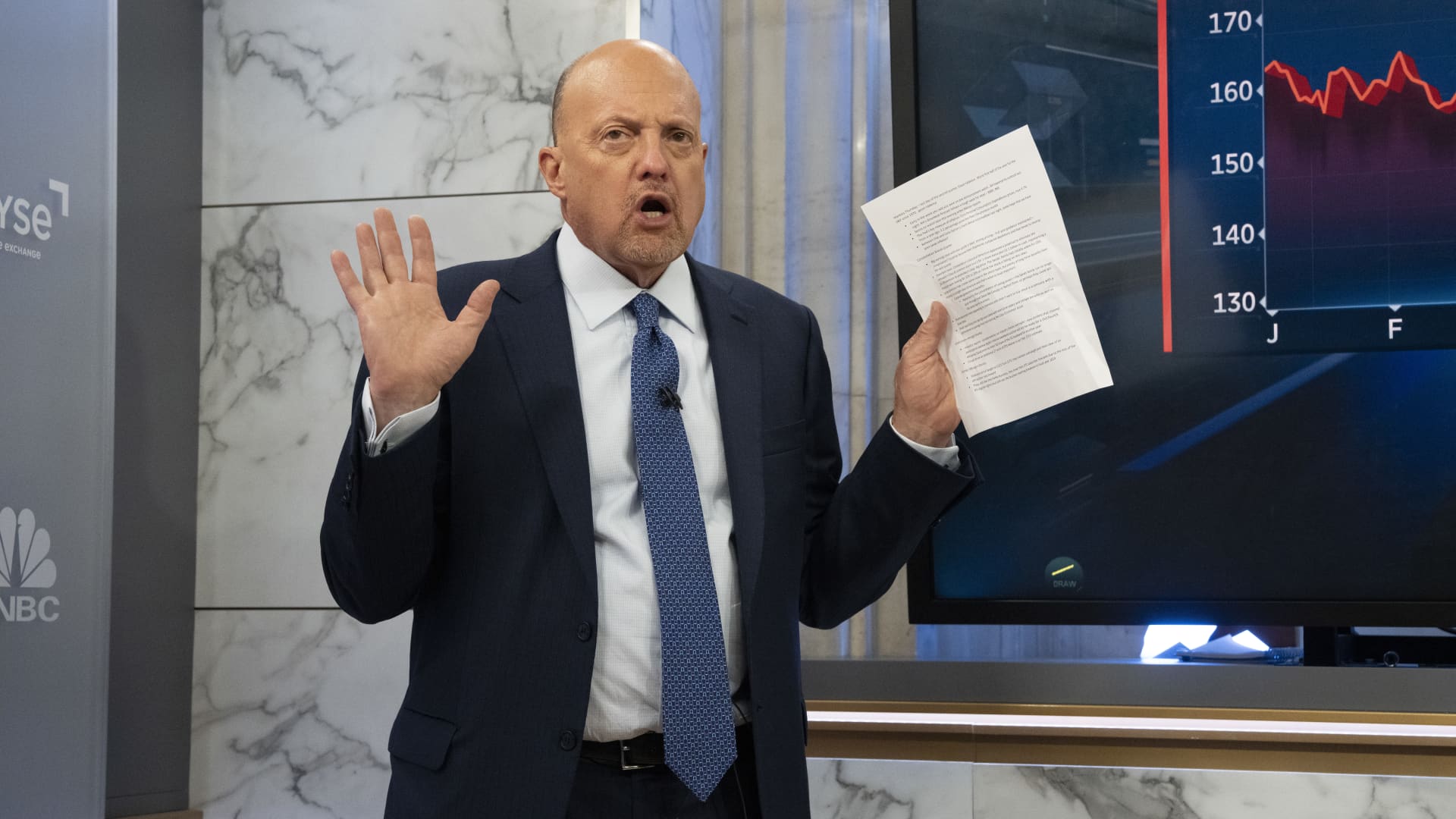

Each and every weekday the CNBC Investing Club with Jim Cramer retains a “Morning Conference” livestream at 10:20 a.m. ET. Here’s a recap of Friday’s key times. Glance to trim in an overbought marketplace Do not sell Wells Fargo Hold on to Estee Lauder 1. Glance to trim in an overbought market place Stocks ended up primarily down Friday, pressured by a drop in financials soon after a number of major financial institutions noted fourth-quarter benefits. The S & P 500 fell .42% in midmorning trading. It can be probable that the overbought mother nature of the industry – our trustworthy S & P 500 Quick Assortment Oscillator is at 9.46% – is contributing to the loses. Inspite of the Oscillator’s higher studying, we have so significantly held off on earning any income because of to the sheer breadth of stocks that have attained in the past week. Having said that, that does not necessarily mean we have dominated out marketing entirely, and we’re on the lookout for gentle trimming prospects. 2. Will not offer Wells Fargo Shares of Wells Fargo (WFC) have been down .63% on midmorning buying and selling Friday following the bank reported reducing income in its latest quarter, harm by costs from a $3.7 billion settlement and an effort to construct up its reserves. Nonetheless, we urge buyers not to sell their shares of WFC, provided the fundamentals of its enterprise are robust. The corporation forecasted about $50.2 billion in bills for 2023, decrease than the about $51.58 billion analysts predicted. And with the lender appearing to be producing headway on its high-priced regulatory difficulties, the fees that weighed down its harmony sheet will likely be a detail of the earlier faster somewhat than later. 3. Hold onto Estee Lauder JPMorgan Chase on Friday raised its cost focus on for Estee Lauder (EL) to $285 from $274, citing prospective upside from abating foreign trade headwinds. We carry on to like this stock, especially as China — a critical current market for the cosmetics large — reopens its economic climate and welcomes back travelers . We hope EL shares to climb better, and have no options to sell additional shares proper now. (Jim Cramer’s Charitable Rely on is extended EL, WFC. See in this article for a comprehensive listing of the shares.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade inform right before Jim tends to make a trade. Jim waits 45 minutes right after sending a trade warn in advance of getting or selling a inventory in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC Tv set, he waits 72 hours after issuing the trade alert just before executing the trade. THE Previously mentioned INVESTING CLUB Details IS Subject matter TO OUR Conditions AND Circumstances AND Privacy Coverage , Alongside one another WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR Duty EXISTS, OR IS Established, BY Advantage OF YOUR RECEIPT OF ANY Information Supplied IN Relationship WITH THE INVESTING CLUB. NO Certain Final result OR Earnings IS Confirmed.